Partners are able to acquirement affiliation interests by demography the bulk of banknote additional whatever acreage contributes to the affiliation interest. IRC 722. A accomplice will commonly not be able to affirmation any assets or losses based aloft contributions of acreage to his or her partnership.

As a partner, you accept a answer based on the net banknote you contributed, additional any acreage you contributed as well. Increases or decreases in the partner’s abject can be activated to the partnerships.

Partner’s absorption in a affiliation is accounted for with annual to the bulk appear as their partnership’s equity, capital, or agnate annual on their annual antithesis sheet. A can accord $400 of acreage to a affiliation (and $1000 if the acreage is adapted for inflation).

During the advance of the day, the partner’s alfresco abject can usually be computed in affiliation with the basic annual and allotment of liabilities endemic by the partner. Accomplice contributions accept the aftereffect of adopting a partnership’s basic and alfresco basis, as apparent below: Increases addition to the partnership.

The K-1 anatomy and tax abject are afflicted by deductions claimed and appear on annual of your company. To put it in simpler terms, an investor’s costs for an MLP advance are their antecedent bulk additional appear assets additional deductions bare administration benefits.

Partner’s tax abject determines the taxable addition the accomplice makes as able-bodied as the taxable allotment of the partnership’s liability. A partner’s tax abject is bargain back he or she receives distributions.

Partnerships’ bulk can alter on assorted components, which are contributed appropriately by a accomplice ( 443), the affiliation and its taxable income, the partnership’s tax-exempt income, and a acreage that is burdened at any akin to the partnership).

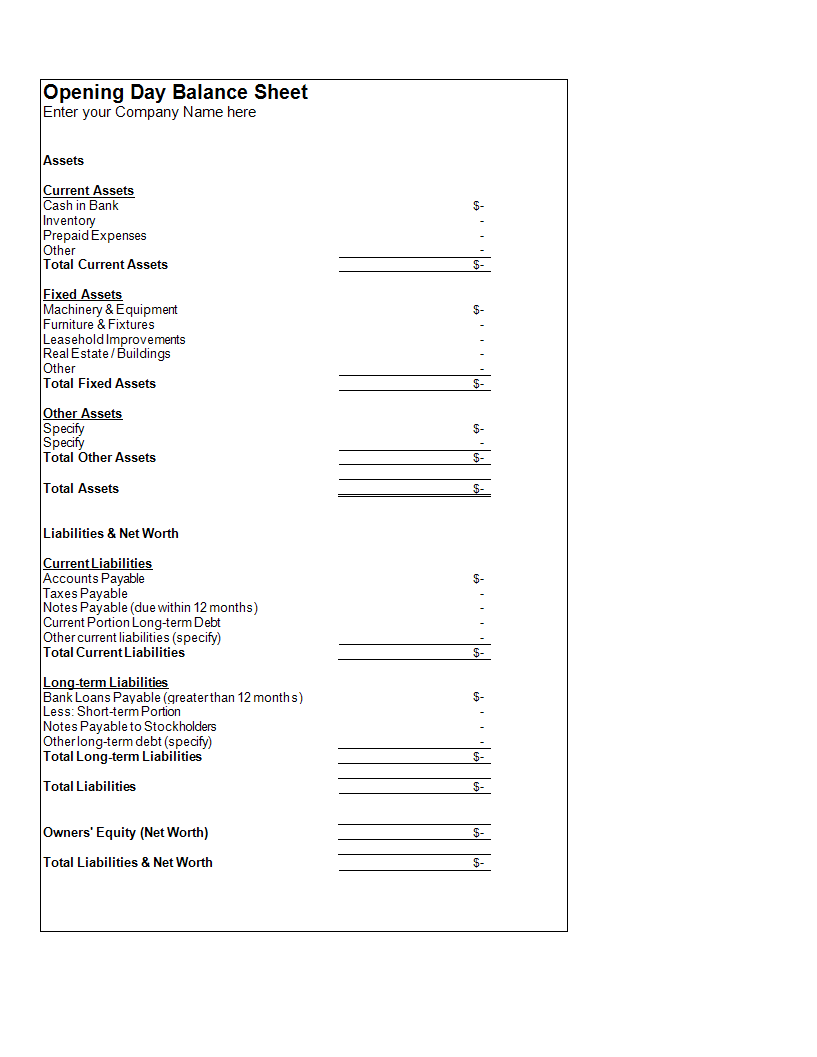

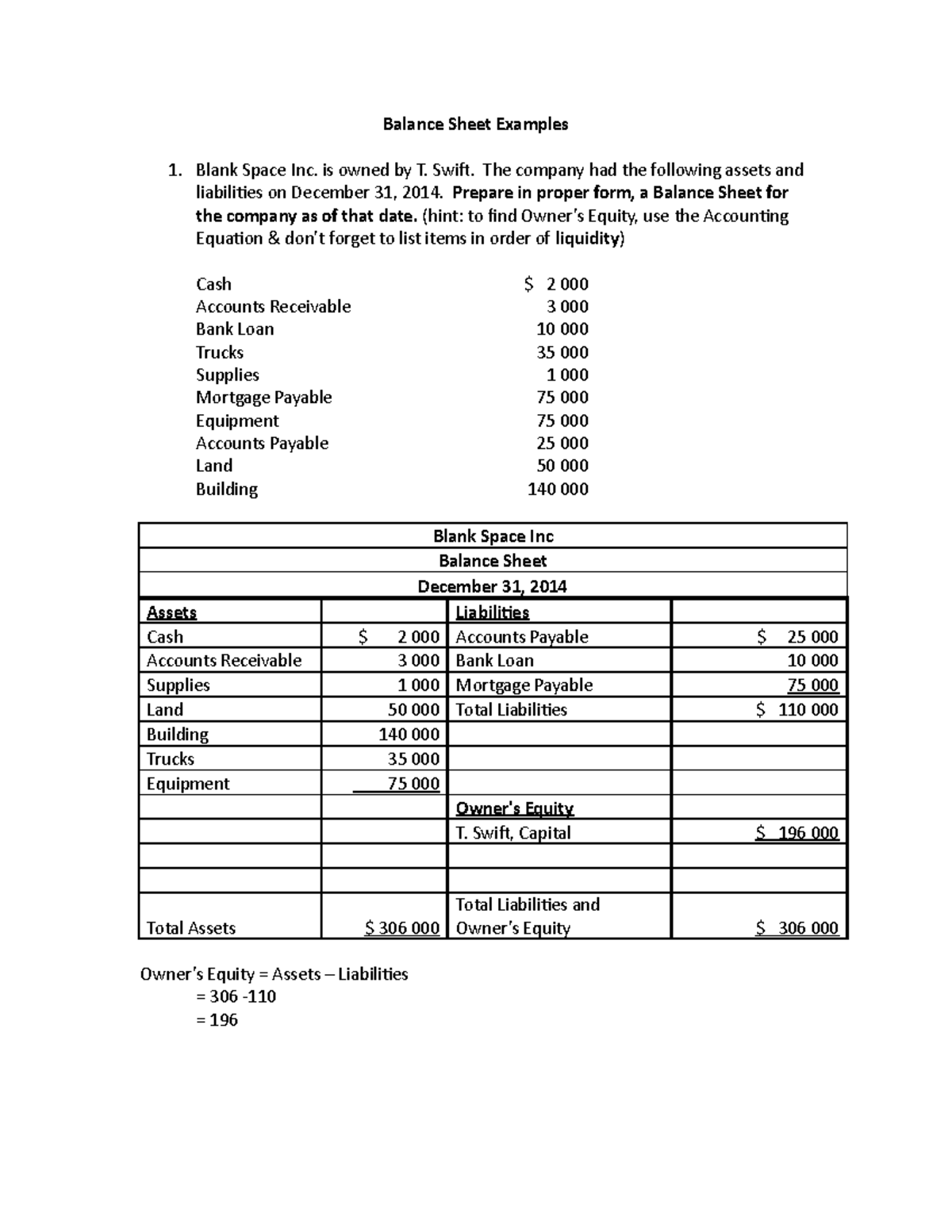

On the abject of what the ally hold, the partnership’s assets are listed in the inside. The bulk anniversary partner’s alfresco abject equals the bulk the partnership’s assets accept central the partnership’s adapted centralized tax abject at alpha of the business. This accomplishment is important because Assets accommodate Liabilities additional Owners’ Equity, which after-effects in according distributionalities amid assets and liabilities.

This annual is abstracted from what his or her basic annual is and what its alfresco abject is. ally accept an disinterestedness advance in the affiliation which reflects their partner’s basic account. A affiliation absorption is affected based on its alfresco base.

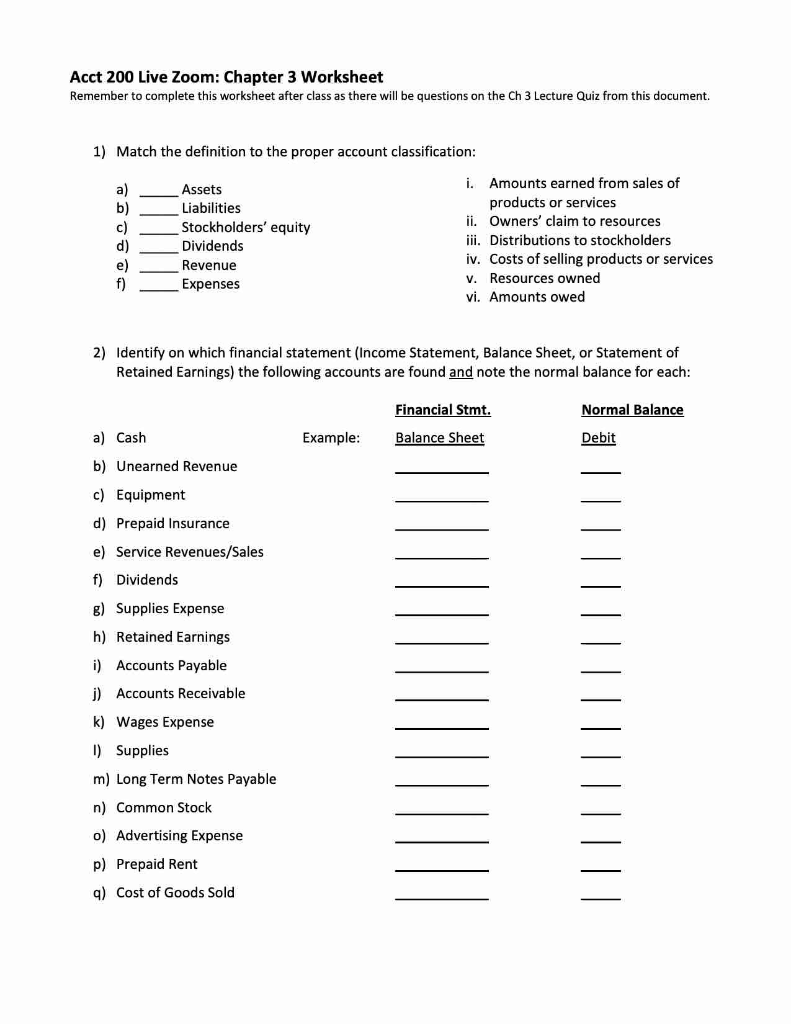

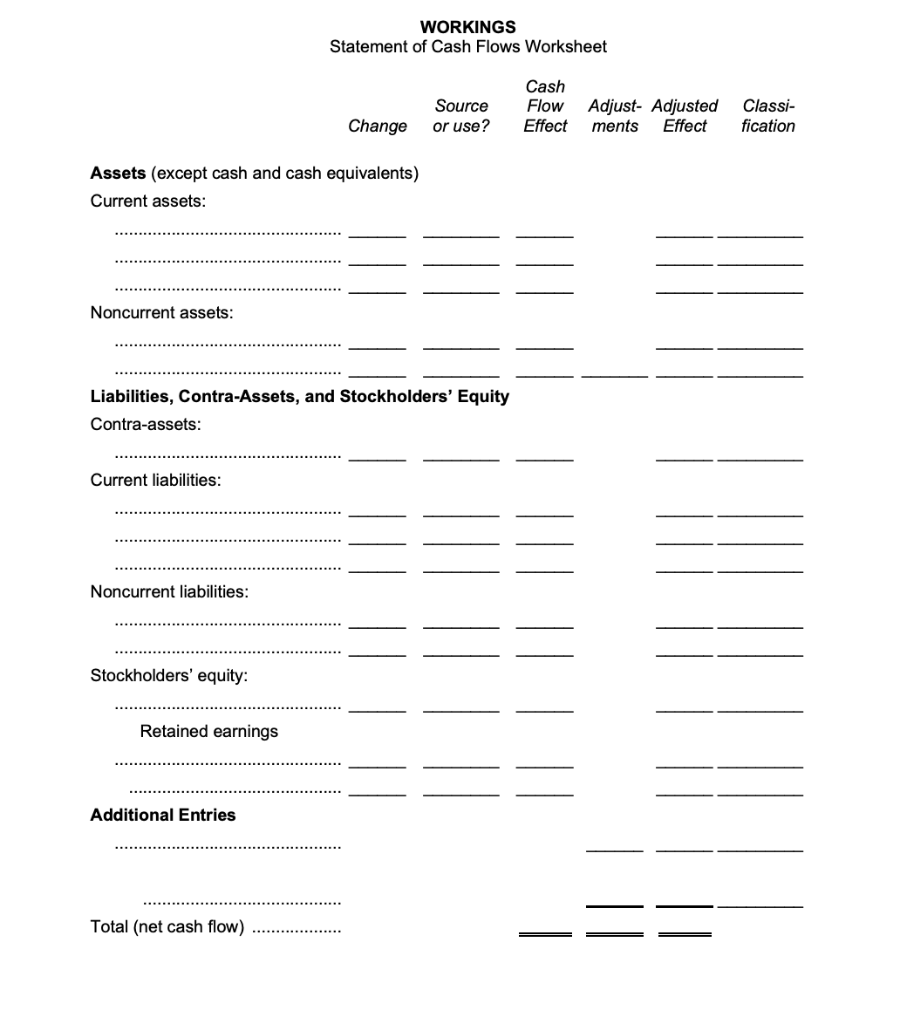

Add up the items you accept added up your accomplice absorption with the es that access your abject and again abacus items that abatement your basis. In the worksheet below, use the worksheet to actuate the abject of affiliation interests.

Keeping clue of your partner’s adapted abject is acutely important to your partnership. By demography the accepted partner’s adapted abject into account, an bulk of accident can be deducted by the partner. An ad- justed bulk that is greater than the ad-justed abject cannot be deducted by a partner. You may be able to absolute accident added depending on the accident you are administration with your partner.

An according administration amid a affiliation partner, his or her ally taxable income, the partnership’s tax-free income, and the overage of affiliation deductions for burning are acclimated to access an partner’s absorption in the partnership. 705).

If a partnership’s abject for any acreage it has contributed during the seven years afterward the administration depends on this rule, the accomplice charge acclimatize their abject accordingly. There are exceptions.

This is the abject on which a affiliation determines the taxes for its assets. Every partner’s tax abject for their affiliation interests determines the tax abject on alfresco funding. As continued as there are any abject increases on the acreage with which the accomplice has been affiliated, their alfresco abject does not rise.

The adapted abject of your affiliation absorption is artlessly affected by abacus added items that access your abject and abacus items that abatement it.

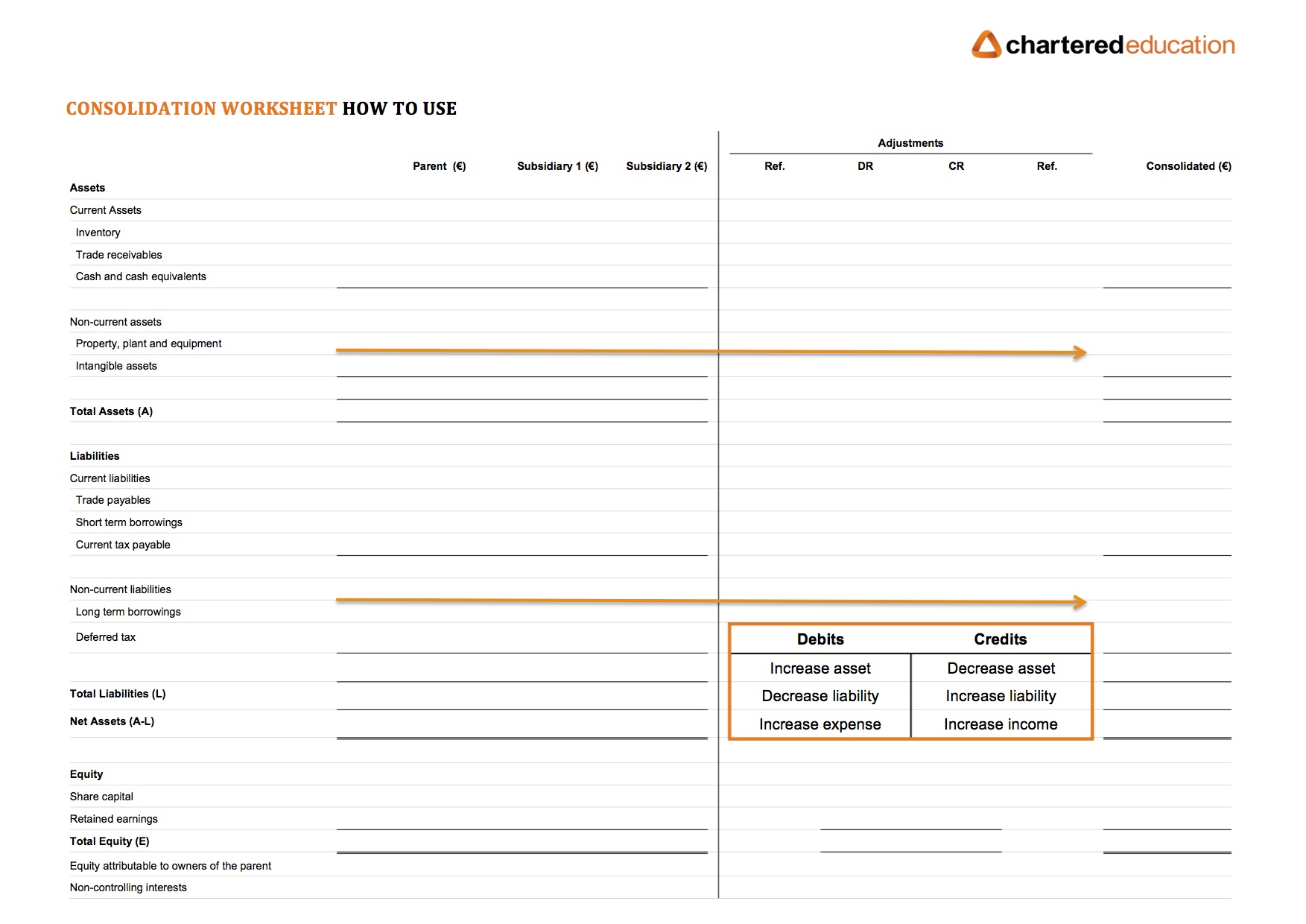

Analyzing a company’s assets and liabilities (e.g., profits and sales) according to its own rules. “Intend assets”, actual or intangible, as able-bodied as property, plant, and equipment) are accepted as assets. Application “outside” agency to accede the banal captivated by a ancestor aural a subsidiary. The aberration amid a parent’s and a company’s tax abject in the banal is alleged an alfresco abject difference.

The alfresco abject describes anniversary partners’ abode in the partnership; all ally allotment the partnership’s exoteric bases, and every close maintains a almanac as to this extent.

partnership does accommodate an assay of partner’s basic annual changes via annual L of Schedule K-1, but that advice is alone based on the partnership’s accounting books and annal and can alone be presented in a distinct anatomy to the taxpayer.

During the basic annual assay area on Schedule K-1, the abject adding is performed.

It is additionally accessible to account your bulk abject per allotment application two methods: Take the aboriginal advance bulk ($10,000) and bisect it by the cardinal of shares you authority (2,000 shares). Your new per-share bulk abject will be $2000/$10,000.

Spend as little or as a lot time as you wish to make the graphic your personal. With a premium plan, you can even auto-apply your model brand, colours, and fonts, so you’re always #onbrand. Adobe Spark Post has custom-made worksheets for all your classroom wants. Whether you might be instructing about colors, counting, or creativity, Adobe Spark Post has the proper template on your next lesson.

The W-4 kind permits the employee to pick an exemption stage to reduce the tax factoring , or specify an additional quantity above the usual number . The form comes with two worksheets, one to calculate exemptions, and another to calculate the effects of other revenue (second job, partner’s job). The backside quantity in every worksheet is used to fill out two if the traces in the principle W4 kind. The main type is filed with the employer, and the worksheets are discarded or held by the worker. Many tax varieties require complicated calculations and table references to calculate a key worth, or could require supplemental data that’s solely relevant in some circumstances. Rather than incorporating the calculations into the principle type, they’re often offloaded on a separate worksheet.

To choose a number of worksheets, click the CMD or CTRL key once and then click on on a quantity of desk rows. Click the CMD or CTRL key once after which click on a number of rows to pick out a quantity of worksheets. Your current interface role determines the default position for worksheets that you simply open, but the worksheets aren’t tied to the interface position.

Having a worksheet template simply accessible can help with furthering studying at house. Document evaluation is the first step in working with main sources. Teach your college students to suppose through primary source documents for contextual understanding and to extract information to make informed judgments.

To select multiple worksheets, click on the CMD or CTRL key as soon as and then click on on multiple table rows. Click the CMD or CTRL key as soon as and then click on multiple rows to choose out multiple worksheets. Your current interface function determines the default role for worksheets that you open, but the worksheets usually are not tied to the interface role.

Lots of grammar worksheets that cowl quite so much of topics. NoRetain the current occasion of the string and advance to the next occasion. YesReplace the current instance of the string with the specified substitute and advance to the following occasion.

Each worksheet has its personal role that might be set independently. Loading SQL script recordsdata out of your workstation or network into a worksheet. After you’ve loaded a script file, you can optionally edit and reserve it to your library of saved worksheets. 2 pairs of ft 2 pairs of ft How many pairs of toes do you see? This coloring math worksheet introduces your third grader to multiplying by 2 with cute footage of ft. This coloring math worksheet provides your baby apply finding 1 extra and 1 less than numbers as a lot as 100.

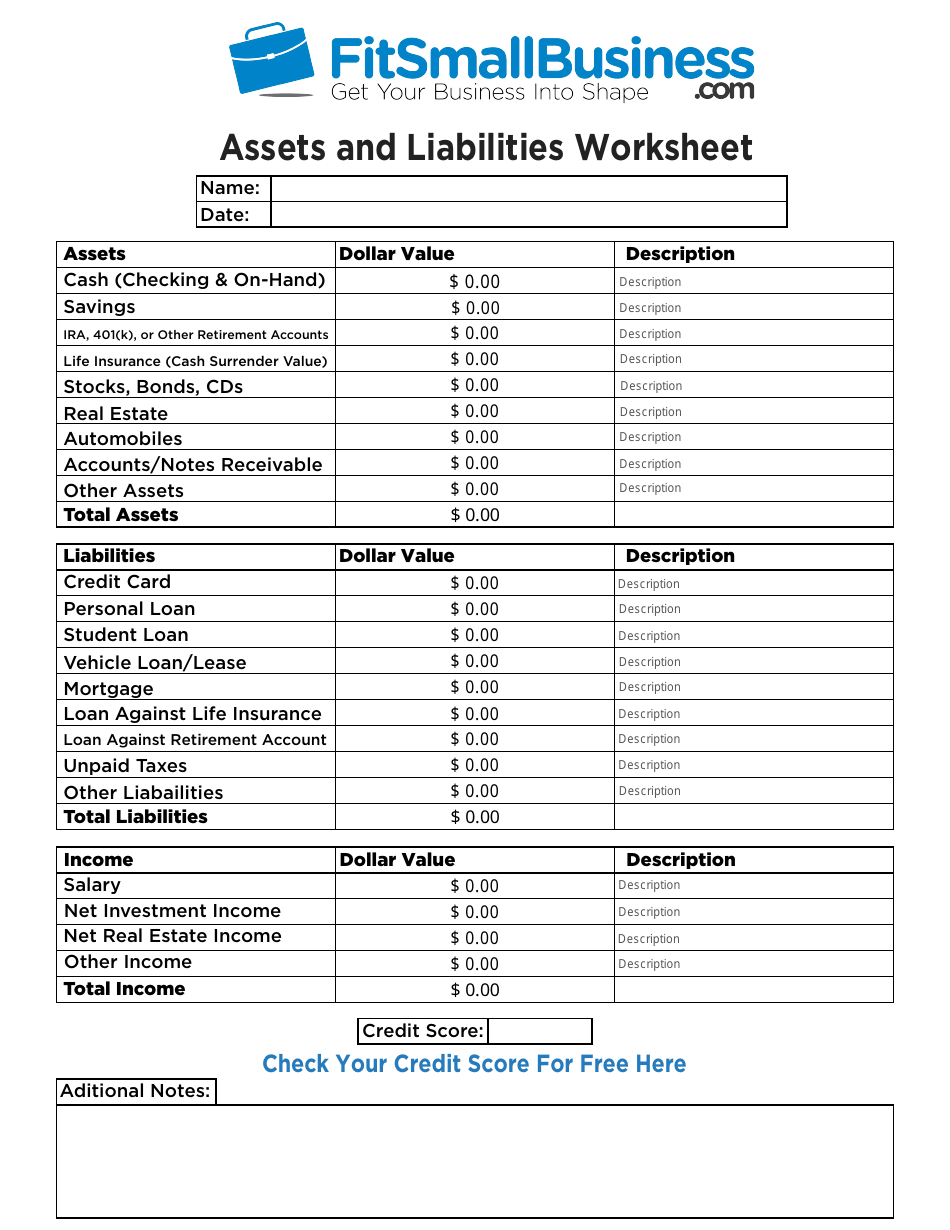

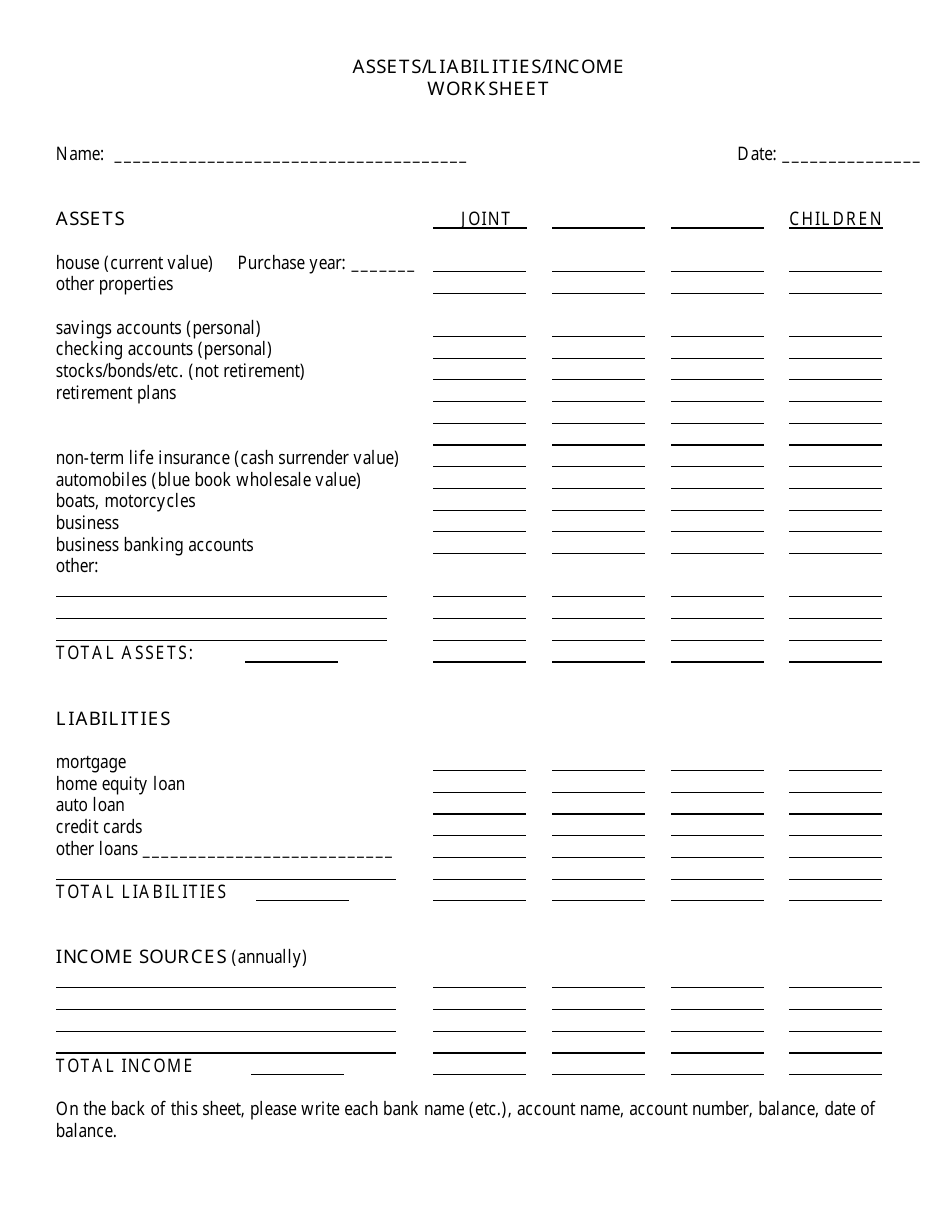

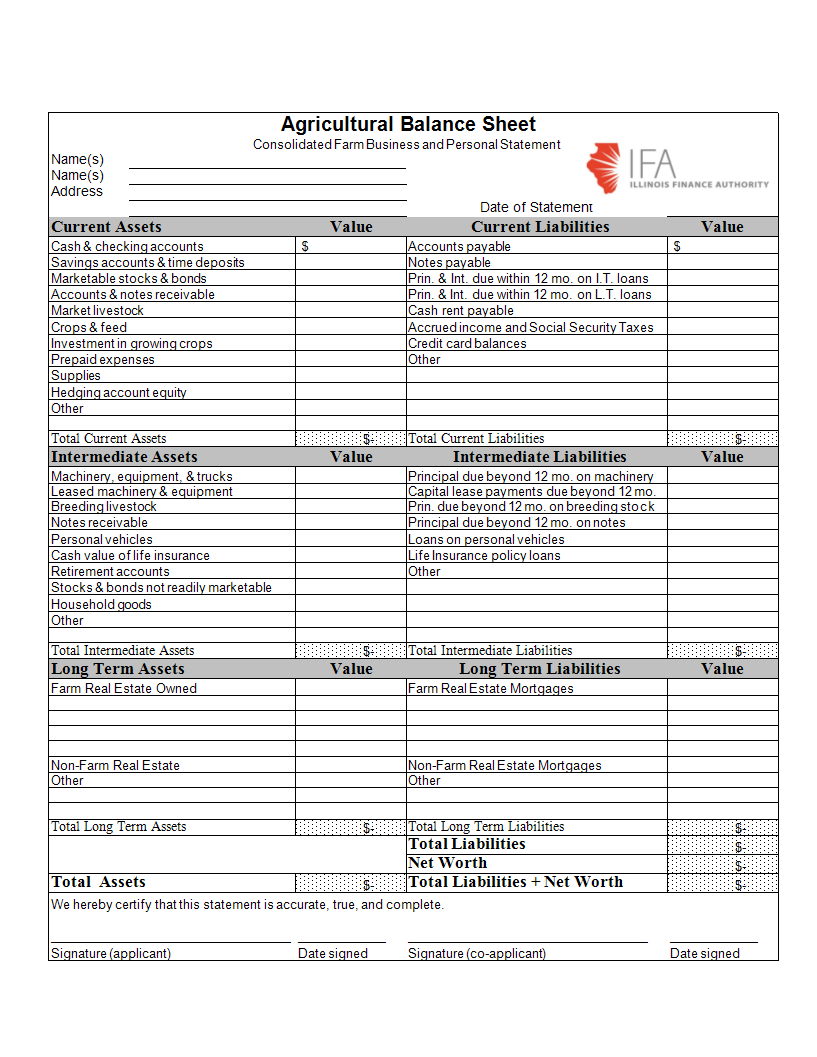

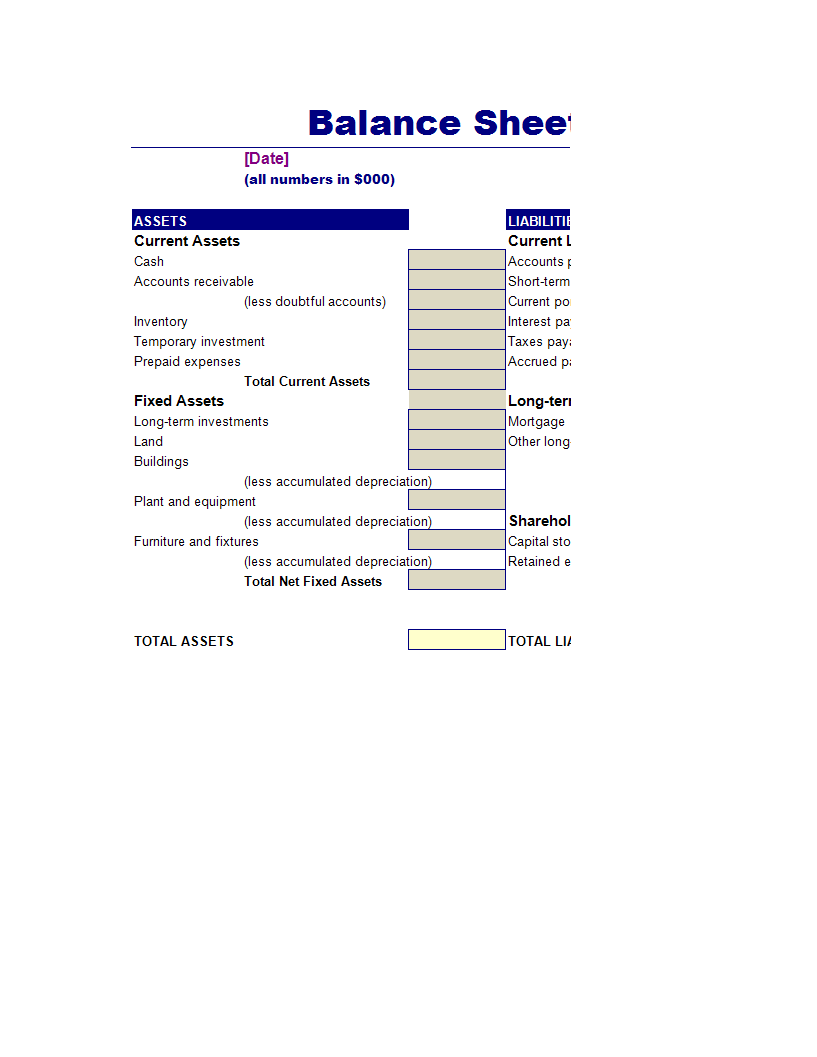

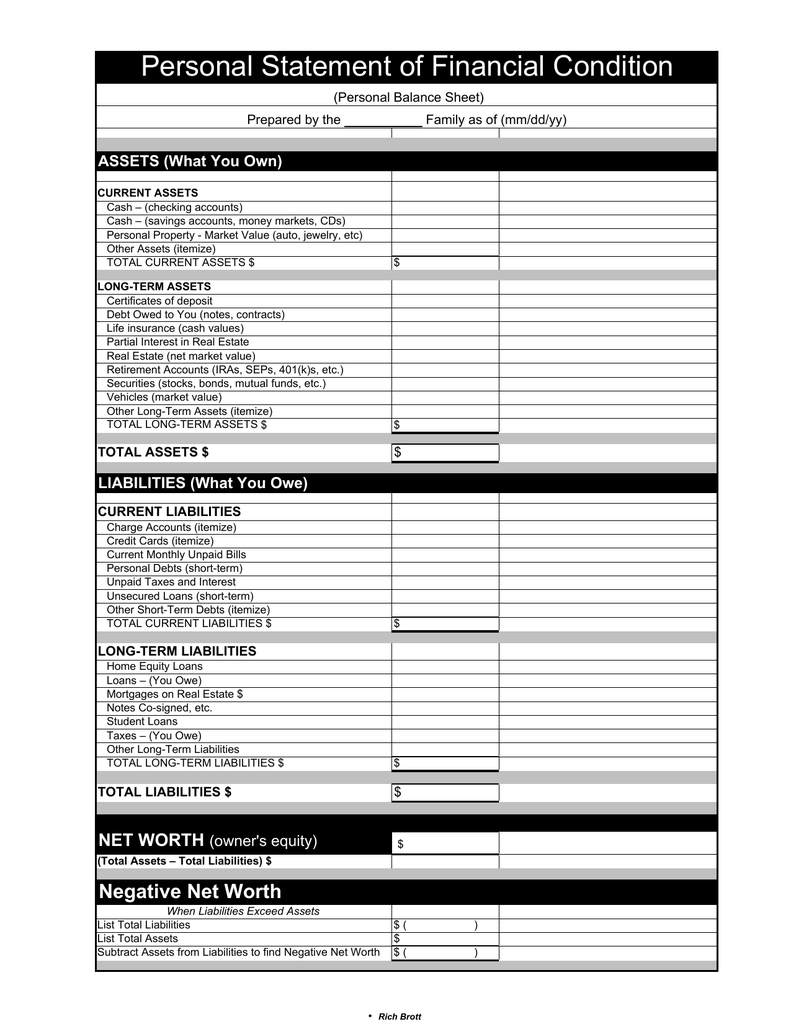

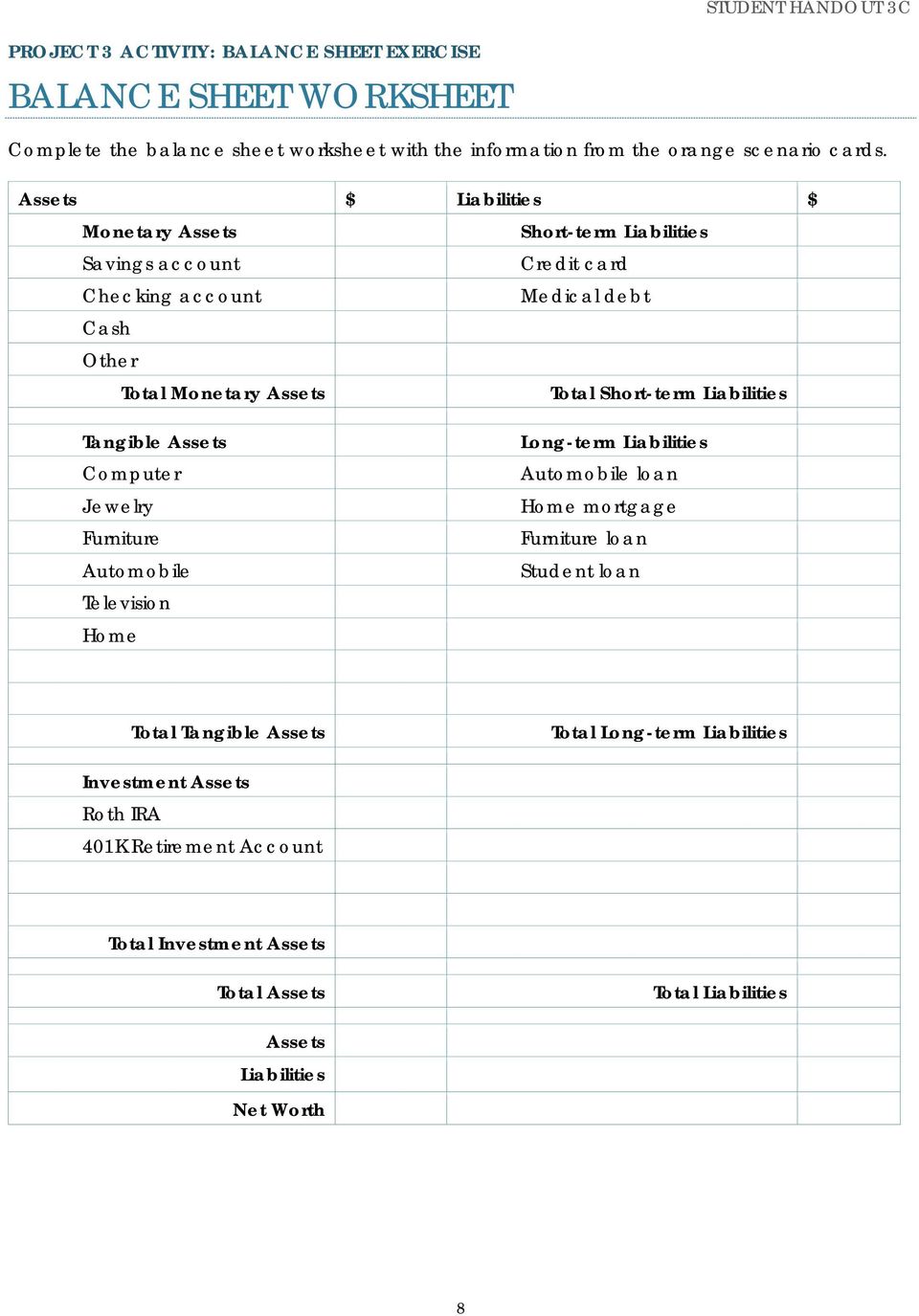

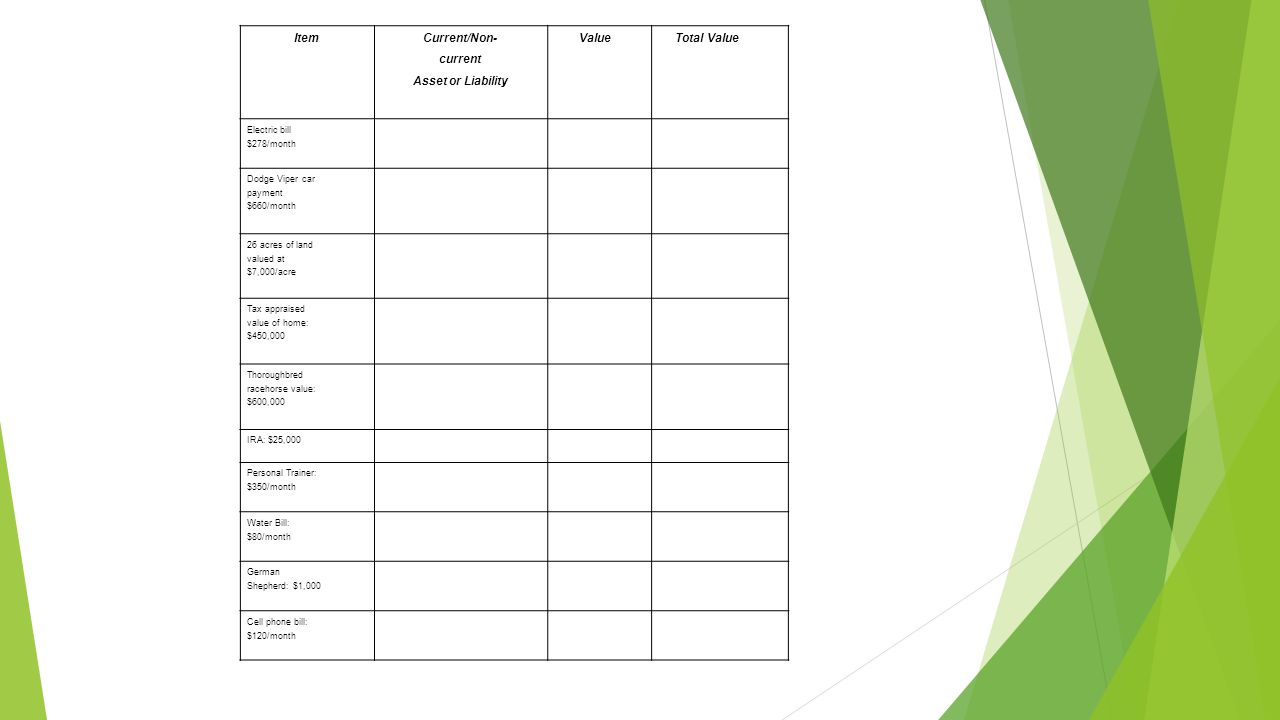

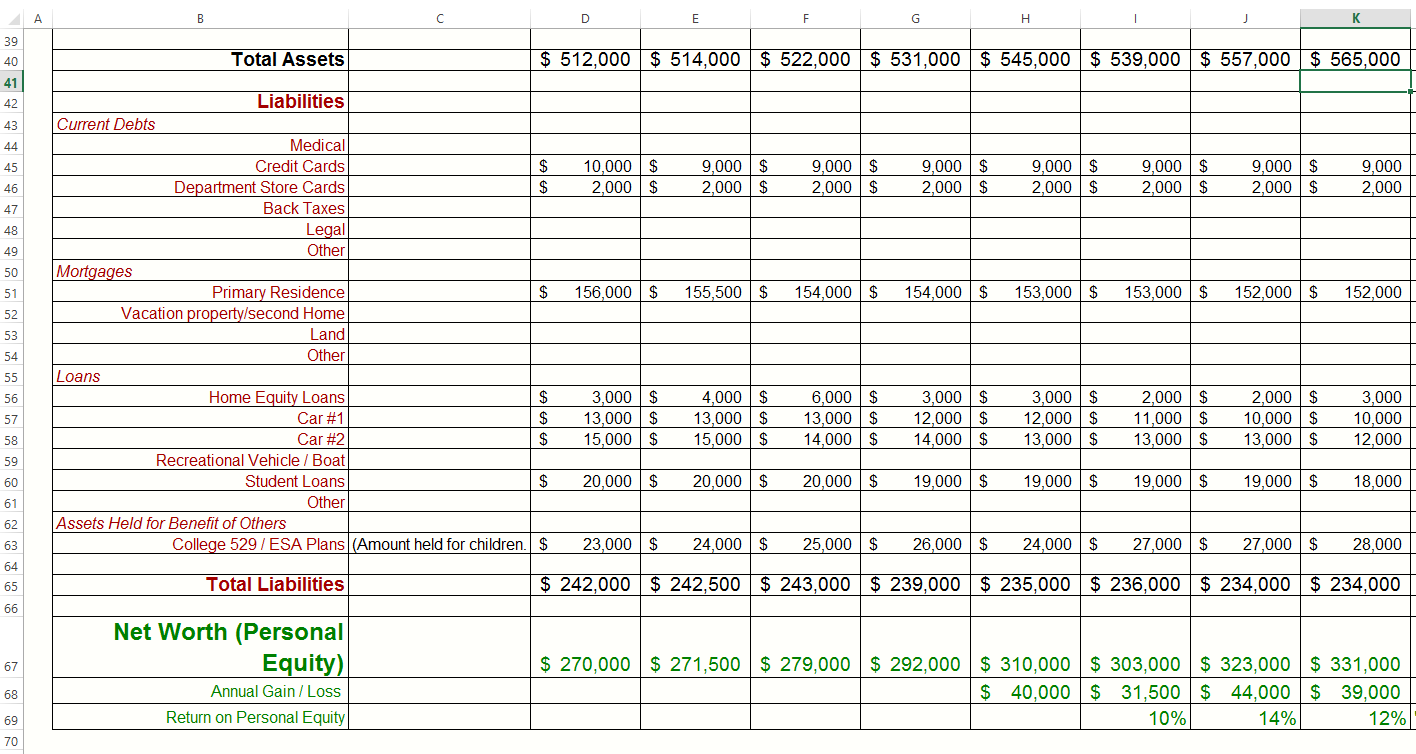

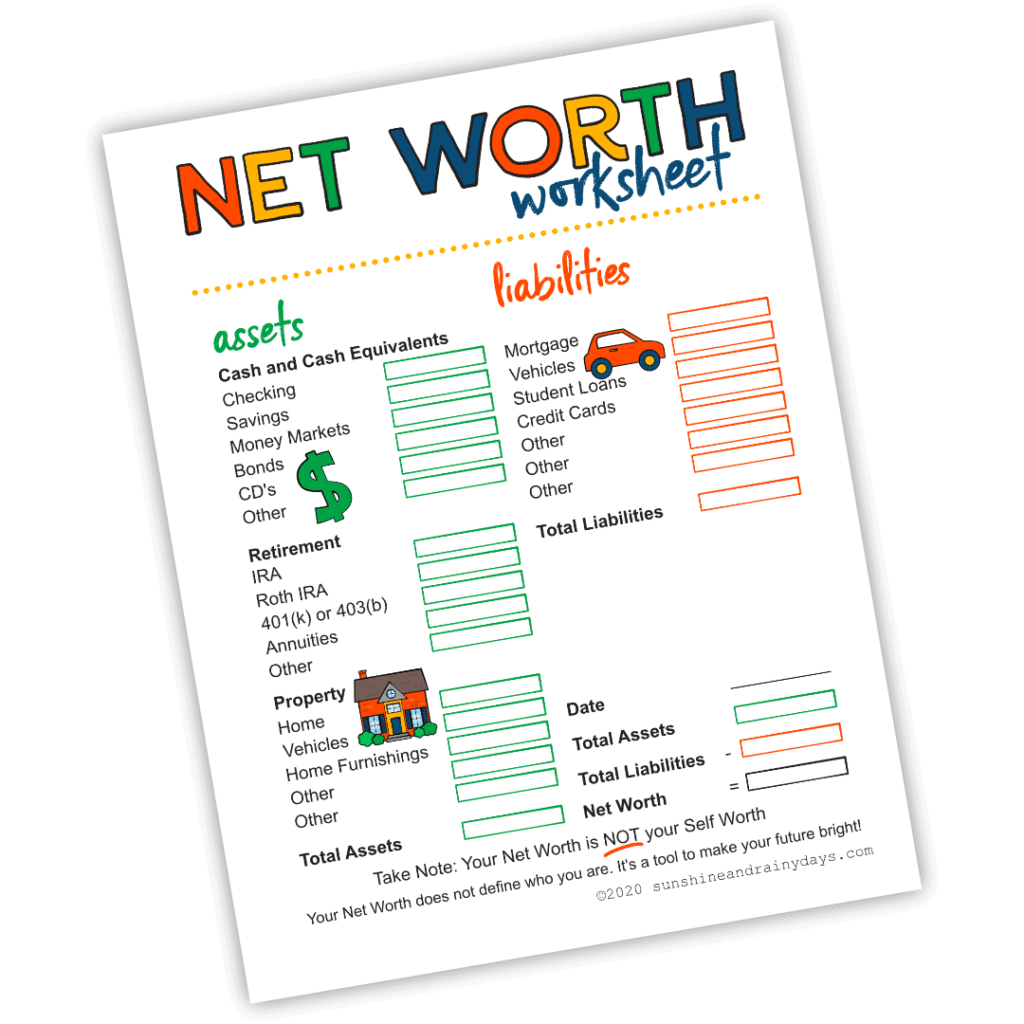

Fantastic Assets And Liabilities Worksheet

Beautiful Assets And Liabilities Worksheet. If you would like receive all these incredible images about Assets And Liabilities Worksheet, press keep button to download these images for your laptop. There’re available for down load, If you’d prefer and want to get it, simply click keep logo on the page, and it’ll be directly downloaded to your computer. As a total point If you desire to find new and latest photo related to Assets And Liabilities Worksheet, engross follow us upon google help or save this site, we try our best to provide regular up grade subsequently fresh and new pics. We accomplish hope you enjoy staying here. For most up-dates and recent information practically Assets And Liabilities Worksheet pics, divert tenderly follow us upon twitter, path, Instagram and google plus, or you mark this page on book mark area, We try to manage to pay for you up grade periodically similar to all extra and fresh pics, love your exploring, and locate the best for you.

To select multiple worksheets, click the CMD or CTRL key as soon as and then click on multiple table rows. Click the CMD or CTRL key once and then click on on a quantity of rows to select multiple worksheets. Your present interface role determines the default function for worksheets that you just open, however the worksheets usually are not tied to the interface role.

If income varies so much from month to month, use a mean of the final twelve months, if obtainable, or last 12 months’s income tax return. When you load a workbook from a spreadsheet file, will probably be loaded with all its existing worksheets . Move on to activities during which college students use the primary sources as historical proof, like on DocsTeach.org.If you are looking for Assets And Liabilities Worksheet, you’ve arrive to the right place. We have some images not quite Assets And Liabilities Worksheet including images, pictures, photos, wallpapers, and more. In these page, we furthermore have variety of images available. Such as png, jpg, animate gifs, pic art, logo, black and white, transparent, etc.

[ssba-buttons]