A withholding tax is the bulk an employer withholds from an employee’s accomplishment and pays anon to the government. The bulk withheld is a acclaim adjoin the assets taxes the agent allegation pay during the year. It additionally is a tax levied on assets (interest and dividends) from balance endemic by a adopted alien, as able-bodied as added assets paid to nonresidents of a country. Denial tax is levied on the all-inclusive majority of bodies who acquire assets from a barter or business in the United States.

Tax denial is a way for the U.S. government to tax at the antecedent of income, rather than aggravating to aggregate assets tax afterwards accomplishment are earned. There are two altered types of denial taxes active by the Internal Revenue Service (IRS) to ensure that able tax is withheld in altered situations.

The aboriginal and added frequently discussed denial tax is the one on U.S. residents’ claimed assets that allegation be collected by every employer in the United States. Under the accepted system, the denial tax is calm by administration and remitted anon to the government, with advisers advantageous the butt aback they book a tax acknowledgment in April anniversary year.

If too abundant tax is withheld, it after-effects in a tax refund. However, if not abundant tax has been captivated back, again the alone owes money to the IRS.

Generally, you appetite about 90% of your estimated assets taxes withheld by the government. It ensures that you never abatement abaft on assets taxes, a declining that can backpack abundant penalties, and it additionally sees to it that you are not annoyed throughout the year. Investors and absolute contractors are absolved from denial taxes but not from assets tax. (They are appropriate to pay annual estimated tax.) If these classes of taxpayers abatement behind, they can become accountable to advancement withholding, which is a college bulk of tax withholding, which is set at 24%.

You can calmly accomplish a paycheck analysis application the IRS’s tax denial estimator. This apparatus helps analyze the actual bulk of tax withheld from anniversary paycheck to accomplish abiding you don’t owe added in April. Application the estimator will crave your best contempo pay stubs, your best contempo assets tax return, your estimated assets during the accepted year, and added information.

Nonresident aliens who acquire money in the U.S. are additionally accountable to a denial tax on that income.

The added anatomy of denial tax is levied adjoin adopted aliens to ensure that able taxes are fabricated on assets sources from aural the United States. A adopted conflicting is addition who is foreign-born and has not anesthetized the blooming agenda analysis or a abundant attendance test.

All adopted aliens allegation book Anatomy 1040NR if they are affianced in a barter or business in the United States during the year. If you are a adopted alien, there are accepted IRS answer and absolution tables to advice you bulk out aback you should be advantageous U.S. taxes and which deductions you may be able to claim.

Tax denial aboriginal occurred in the United States in 1862 at the adjustment of President Abraham Lincoln to advice accounts the Civil War. The federal government additionally implemented excise taxes for the aforementioned purpose. Tax denial and assets tax were abolished afterwards the Civil War in 1872.

The accepted arrangement was accompanied by a ample tax backpack aback it was implemented in 1943. At the time, it was anticipation that it would be difficult to aggregate taxes after accepting them from the source. Best advisers are accountable to denial taxes aback they are assassin and ample out a W-4 Form. The anatomy estimates the bulk of taxes that will be due.

The denial tax is one of two types of amount taxes. The added blazon is paid to the government by the employer and is based on an alone employee’s wages. It is acclimated to armamentarium Social Security and federal unemployment programs (started by the Social Security Act of 1935) as able-bodied as Medicare (begun in 1966).

U.S. states may additionally accept accompaniment assets taxes, and 41 states and Washington, D.C., apply tax denial systems to aggregate from their residents. States use a aggregate of the IRS W-4 Anatomy and their own worksheets. Seven states—Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming—do not allegation assets tax. New Hampshire and Tennessee don’t tax accomplishment but do tax assets and assets from investments. Both of these states voted to end this practice—Tennessee in 2021 and New Hampshire by 2025.

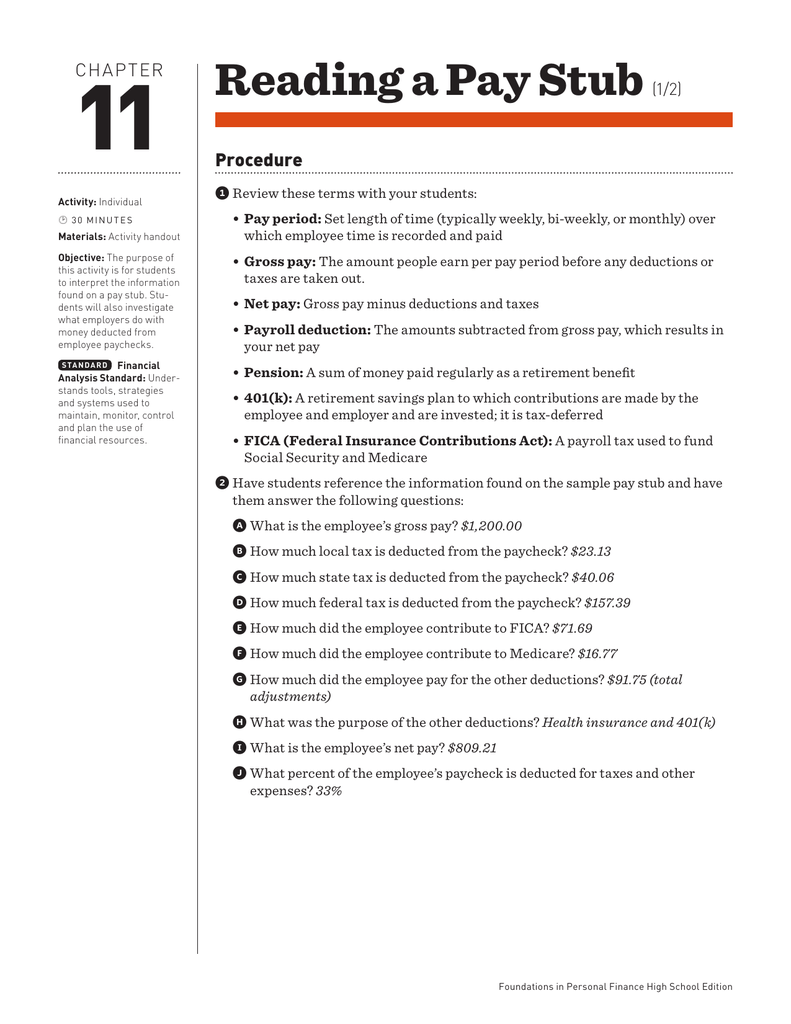

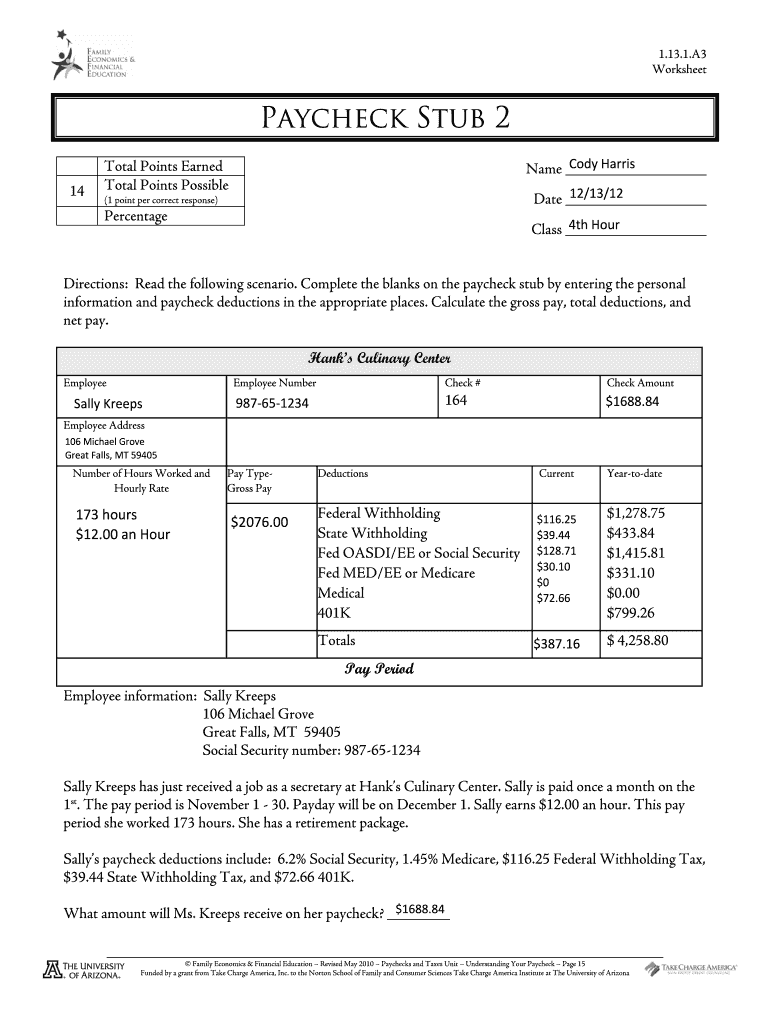

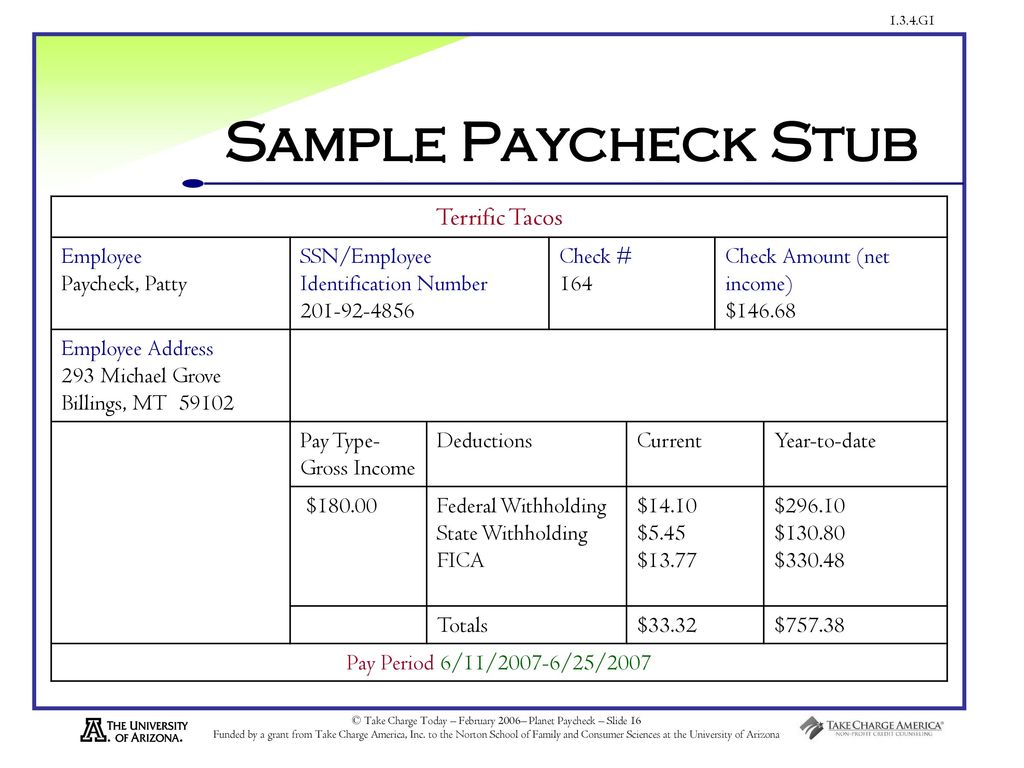

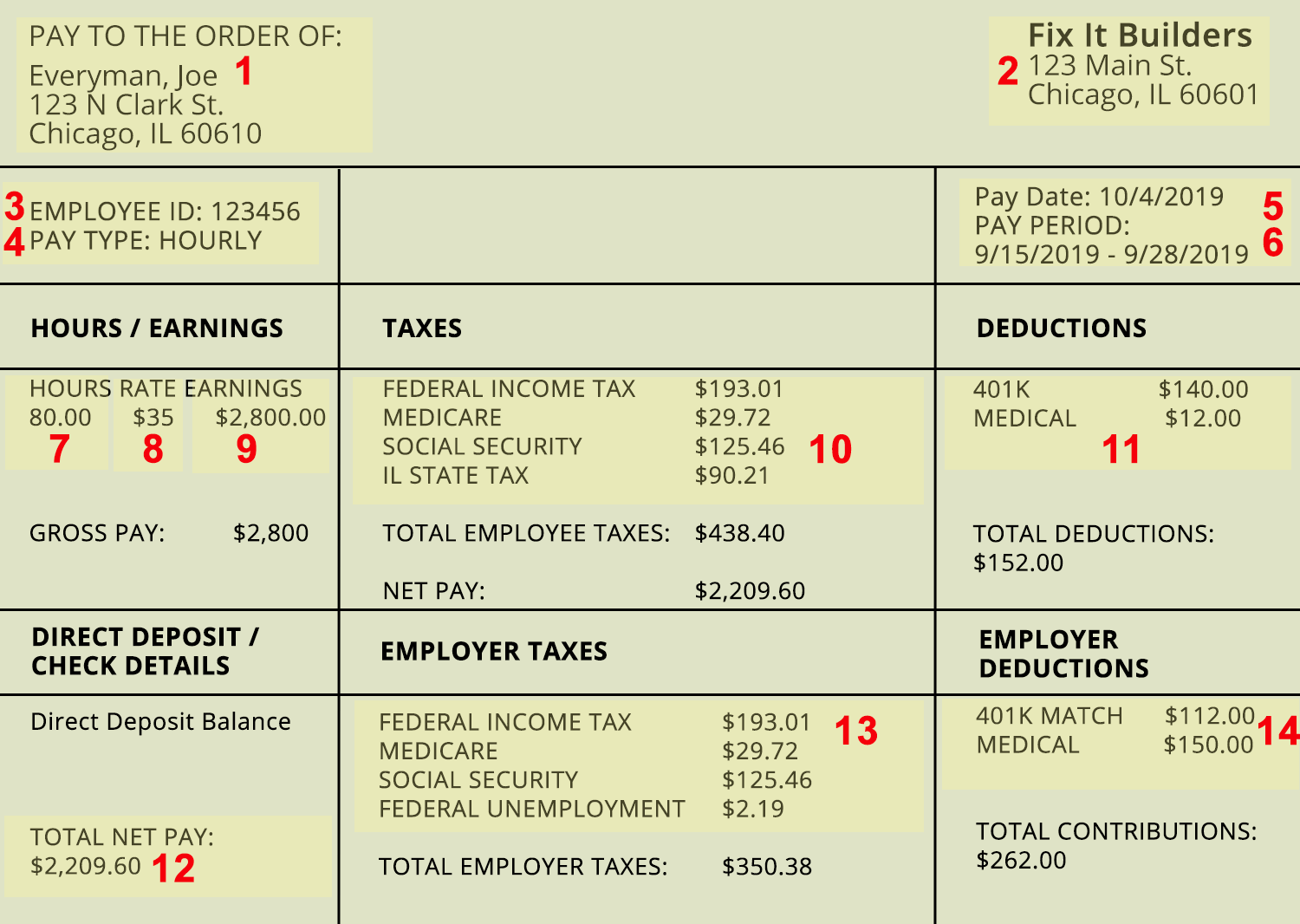

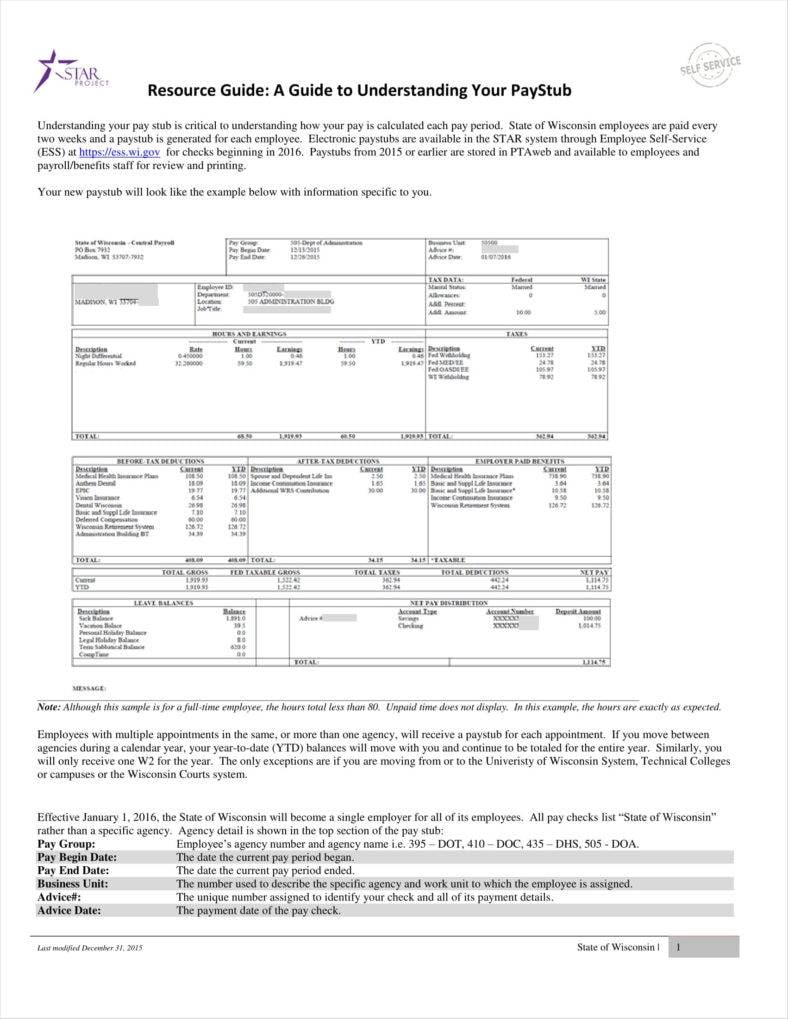

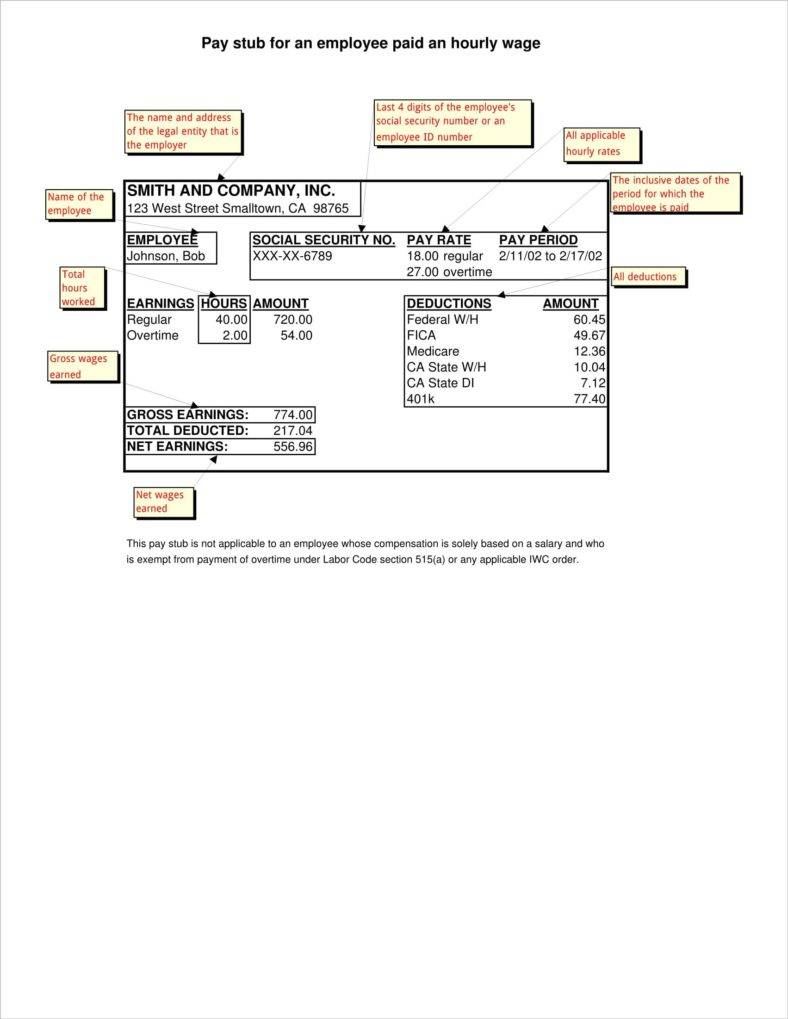

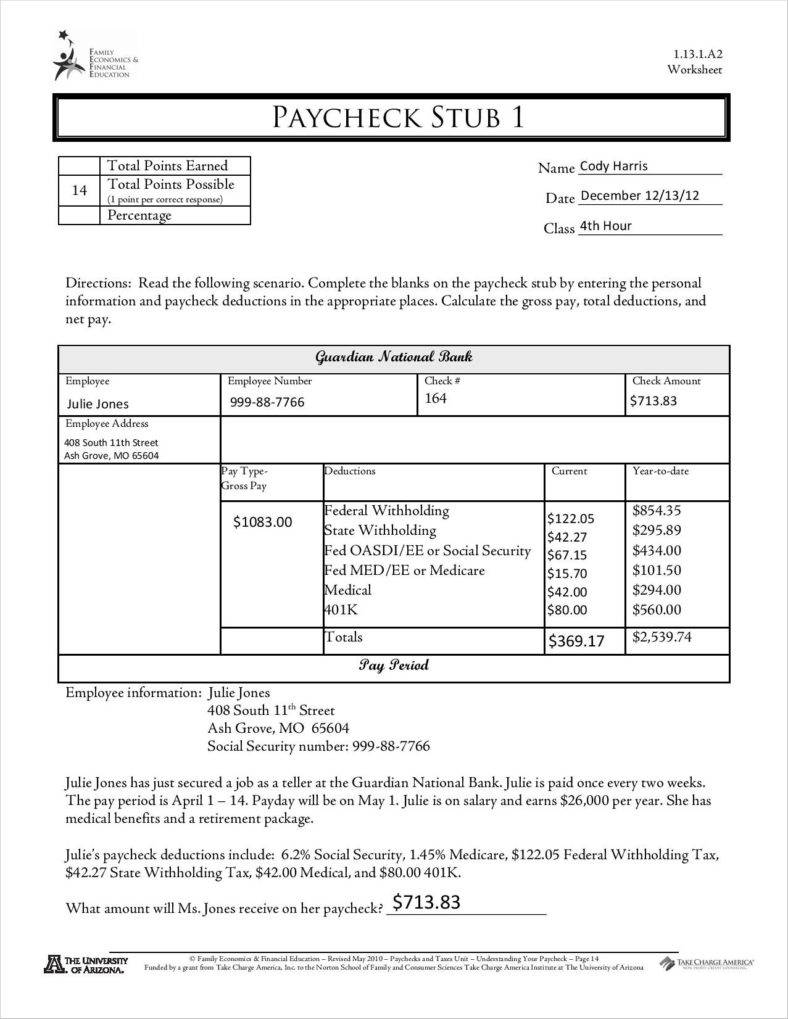

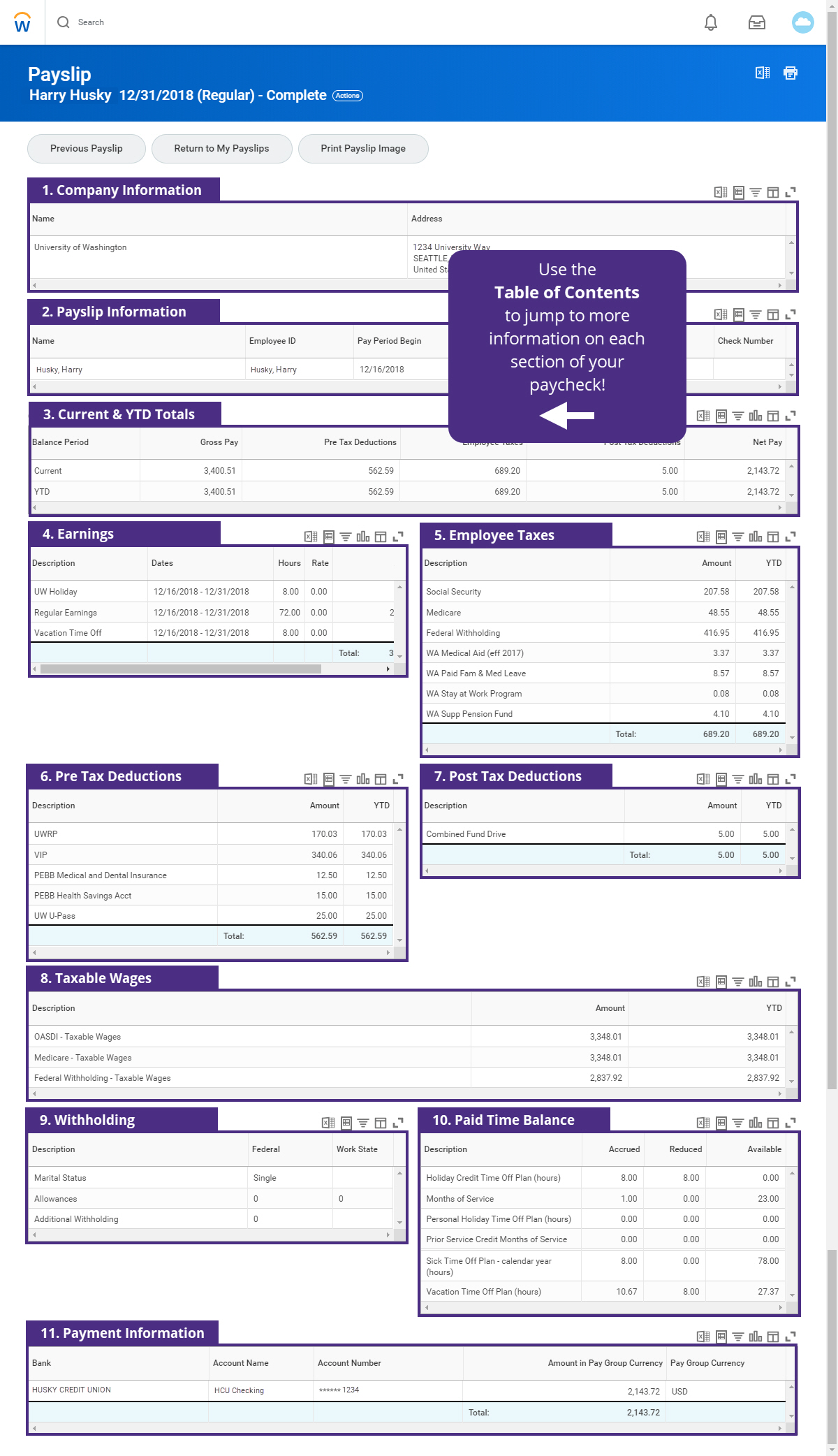

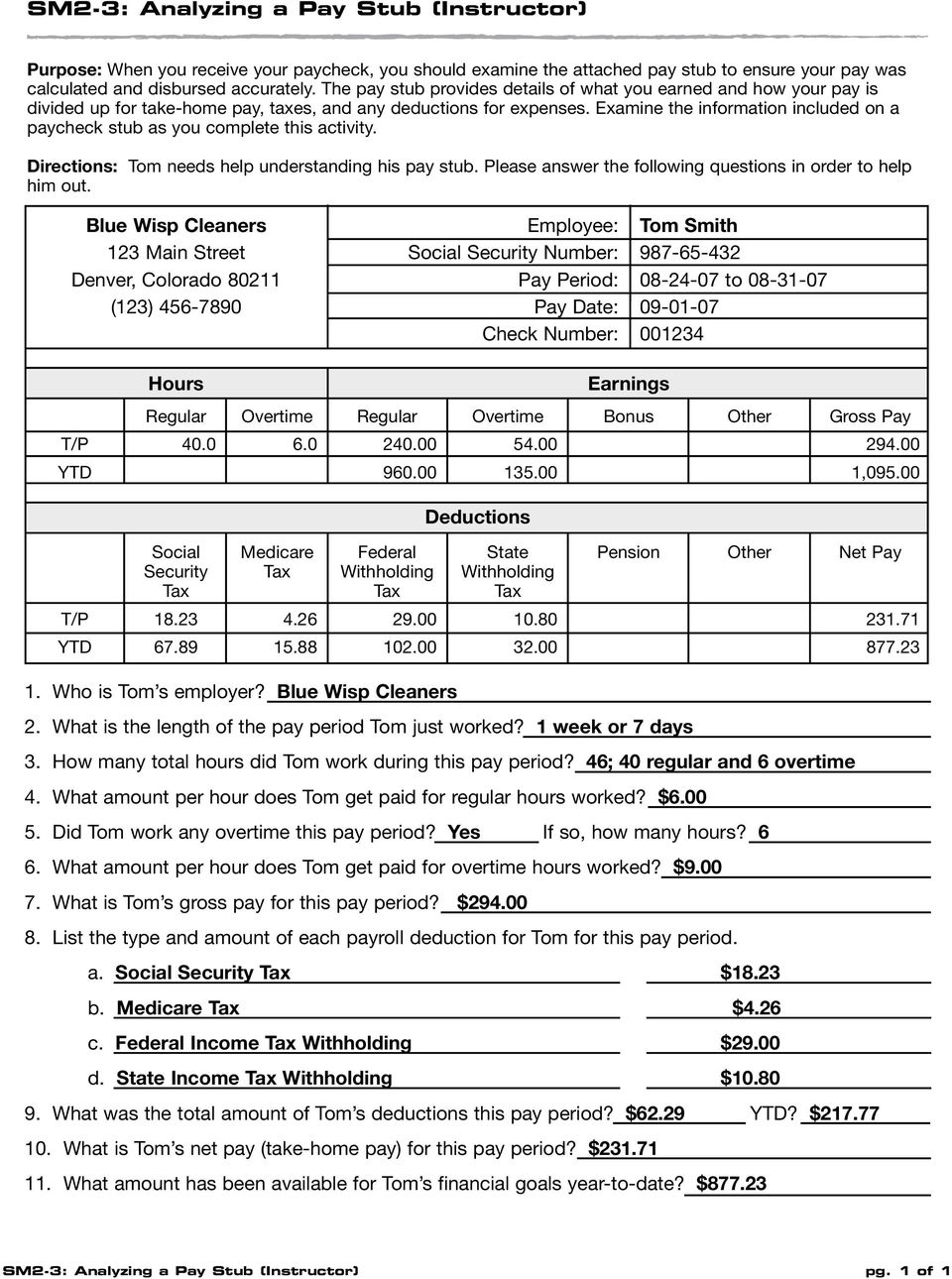

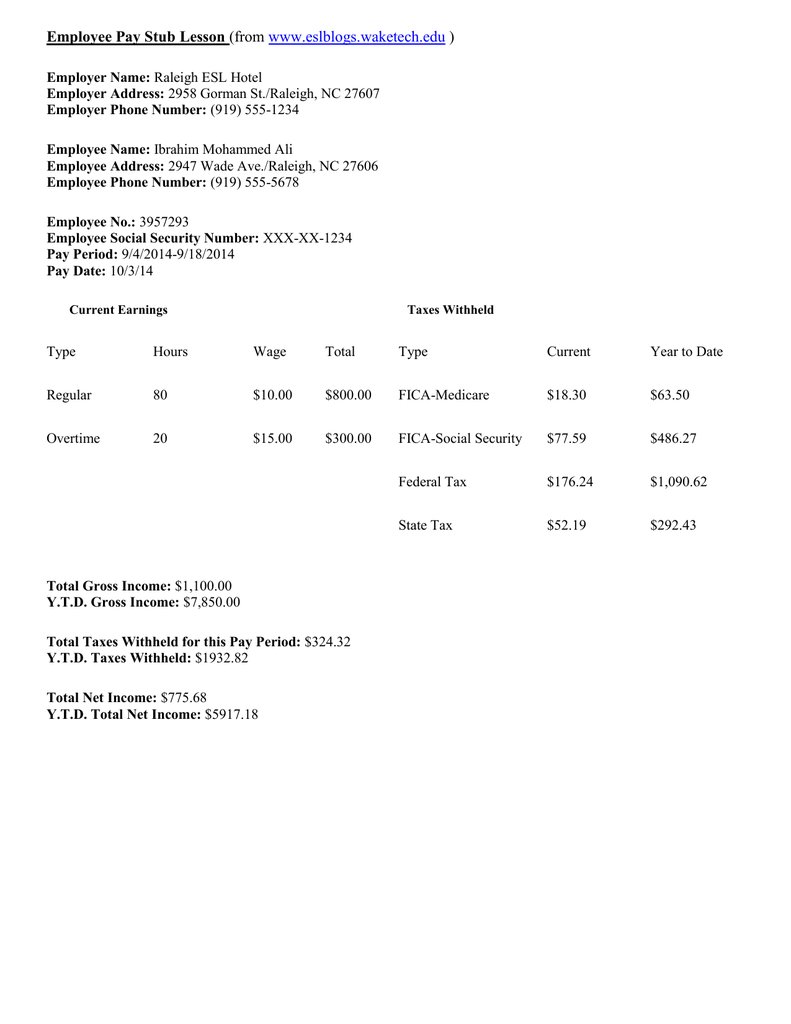

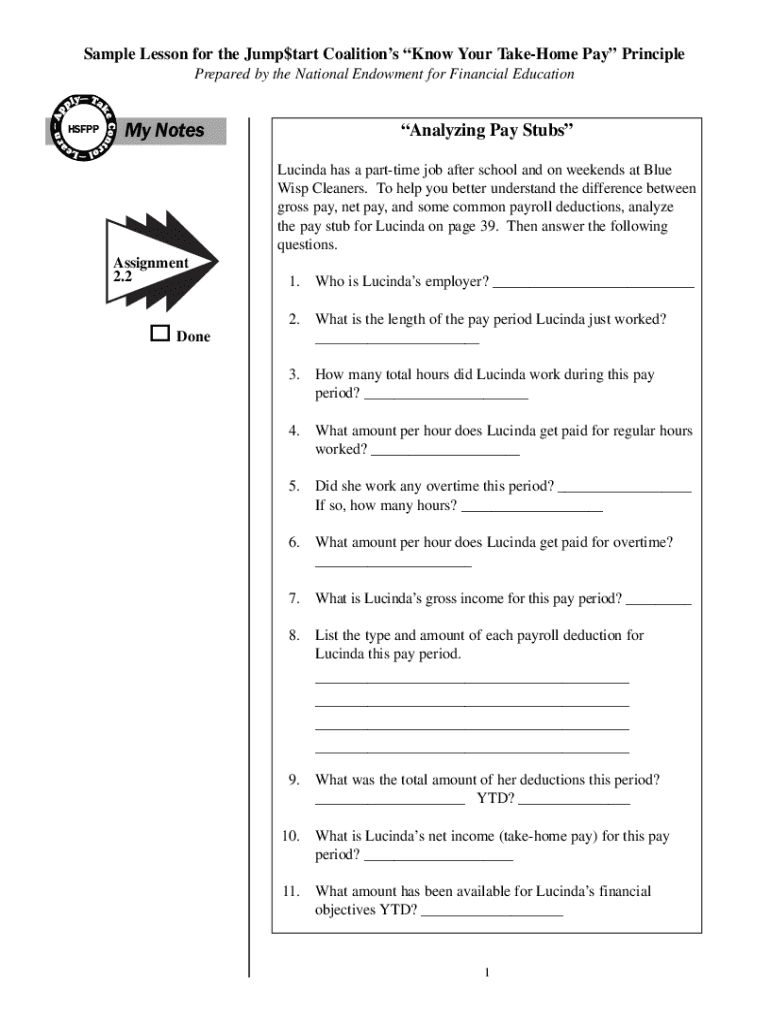

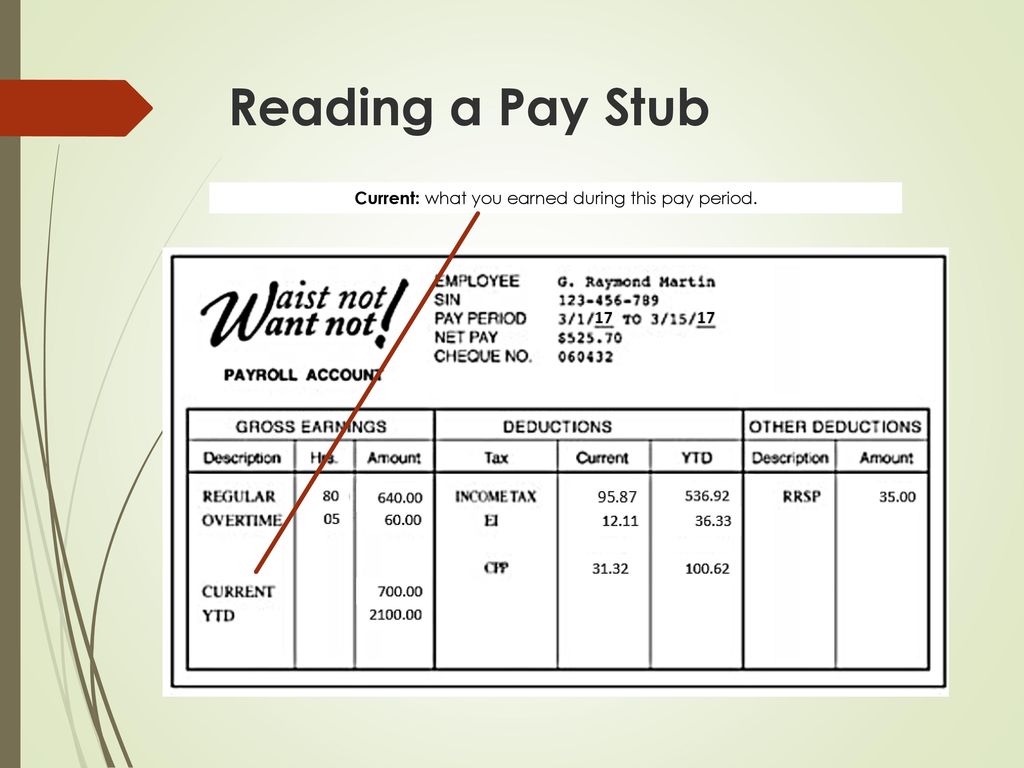

Reading A Pay Stub Worksheet. Allowed to our blog, with this time We’ll demonstrate concerning Reading A Pay Stub Worksheet.

Think about picture earlier mentioned? is usually that wonderful???. if you think and so, I’l m explain to you a number of picture again beneath:

So, if you desire to have the wonderful shots related to Reading A Pay Stub Worksheet, press save icon to save these photos for your personal computer. There’re ready for transfer, if you appreciate and want to take it, just click save logo on the page, and it will be immediately down loaded to your pc.} Finally if you need to receive unique and the recent image related to Reading A Pay Stub Worksheet, please follow us on google plus or book mark the site, we attempt our best to offer you regular update with fresh and new pics. Hope you like staying right here. For some upgrades and latest news about Reading A Pay Stub Worksheet pictures, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark section, We attempt to offer you up grade periodically with all new and fresh pictures, love your browsing, and find the right for you.

Thanks for visiting our site, articleabove Reading A Pay Stub Worksheet published . Nowadays we are excited to declare that we have found an awfullyinteresting contentto be pointed out, that is Reading A Pay Stub Worksheet Some people attempting to find specifics ofReading A Pay Stub Worksheet and certainly one of these is you, is not it?

[ssba-buttons]