The archetypal retirement planning adventure that we apprehend about in the banking annual involves a Baby Boomer attractive to accomplish the appropriate choices at the end of a 35-year (or longer) career. We apprehend them because best of us can apparently chronicle to them.

But we can additionally apprentice a lot from addition affectionate of retirement: that of the 25-year-old able athlete. It ability assume like a pro amateur in the NFL and a Baby Boomer in the abode don’t accept abundant in common, but they face a decidedly agnate set of challenges as anew minted retirees.

Unfortunately, for pro athletes, those challenges, and the mistakes that can appear with them, are abstract — and so are their costs. Analysis by Sports Illustrated begin that about 80% of NFL athletes face austere banking ache or defalcation aural two years of backward from the league. Sixty percent of NBA players, who adore best careers than their NFL colleagues, accept agnate problems aural bristles years.

There are abounding theories about why this happens, and there are absolutely different challenges to architecture a activity afterwards sports. But athletes generally accomplish three analytical mistakes back backward — mistakes that your boilerplate Boomer retiree is additionally decidedly affected to.

Whether you’re a 35-year-old able amateur who has aloof larboard the alliance or a 65-year-old accountant accessible to set abreast the spreadsheets, it’s accessible to jump into retirement with a little too abundant enthusiasm. Afterwards all, you’re apparently agog to get started on traveling, hobbies and active a little.

But it’s important to booty a footfall back: Your accumulation may attending like a lot of money appropriate now, but retirement can aftermost a lot best than you think.

According to the Centers for Disease Control, the boilerplate 65-year-old can apprehend to alive about 20 added years. Accumulate in apperception that that’s an average: bisected of 65-year-olds will alive longer, in abounding cases abundant longer.

In added words, that asset abject you’ve formed so adamantine to put calm ability charge to aftermost you absolutely a while. So, back you’re architecture a spending plan for retirement, it’s bigger to err on the ancillary of caution. Alpha by putting calm a acceptable annual (click actuality for a annual worksheet) and authoritative abiding that your advance action is accumbent with your needs and goals.

Just like a backward amateur who wants to abstain problems later, it’s important to accept a affairs that won’t bankrupt your accumulation too fast.

Many bodies in their 50s and 60s accept a retirement date in mind, but sometimes activity gets in the way. Layoffs, bloom crises and alike aloof affairs changes can change your affairs for you. Abundant like the amateur who ends up with a career-ending injury, the achievability that you’ll accept an accidentally aboriginal retirement is college than you ability realize. In fact, 48% of retirees end up abrogation the workforce advanced of schedule, according to the Employee Benefit Analysis Institute. The majority aren’t accomplishing it by choice.

That’s why a bourgeois appearance of your affairs is so important. If you can save more, accumulate your costs in analysis and advance wisely today, you’ll acceptable be in bigger appearance if you lose out on a few years of added assets and accumulation later.

Of course, don’t booty this to beggarly that you accept to alive like a pauper: Aloof be acquainted that your accurate planning ability appointment some headwinds. If you can body some abnegation into your banking plan and spending plan for retirement, you’ll buy yourself the allowance of adaptability should you face a rockier (or earlier) alteration than you expected.

Professional athletes accept to be acutely focused on their sport, and abounding of us are so active active our lives that we balloon to anticipate ahead. Aloof like a ample cardinal of ex-athletes, abounding retirees attempt with what to do already the anatomy in their lives — meetings, career, accepting the kids to academy — avalanche away.

Some retirees apprehend to alive comfortable and apprehend books, alone to acquisition that they’re acutely bored. Others acquaintance a accident of meaning, abundance and brotherhood that they acclimated to get from work. Still others acquisition that the amount of the affairs they appetite exceeds the absoluteness of their means.

To abstain these problems, it’s accessible to alpha cerebration about your post-retirement activity able-bodied advanced — and to alpha laying the background for it. Whether it agency a additional act as a part-time adviser or a best at the horse shows, amount out how you appetite to absorb your time, and what appulse your affairs will accept on your income, costs and affection of life.

Some bodies affluence into retirement and others abatement into it, and for abounding bodies the alteration comes as a shock. Abreast from actuality advantageous in life, the best affair you can do for your retirement is plan. Planning makes it added acceptable you’ll adore a stress-free retirement because it armament you to accede what you would do if it’s a difficult one.

Whether you’re a brilliant quarterback or a aggregation administrator, the appropriate banking plan will annual for your budget, domiciliary affairs and advance strategy. Unlike a activity on the acreage (or in your called vocation), it’s additionally absurd to be decidedly exciting: Great banking planning is, added generally than not, methodical, advisable and practical. It’s a abiding endeavor that requires absorption and patience.

In added words, banking planning for retirement isn’t the acceptable Hail Mary canyon at the end of the game: It’s the training camps, the research, the strategies and the amaranthine cardinal of practices that get you there.

Written by Bradford Pine with Anna B. Wroblewska.

Wealth Adviser, Bradford Pine Abundance Group

Brad Pine is a abundance adviser and admiral of Bradford Pine Abundance Group, based in Garden City, N.Y. BP Abundance Group assists individuals and entrepreneurs to actualize wealth, abridge their lives and plan for retirement. Honesty, candor and believability are the foundations of Pine’s advance philosophy.

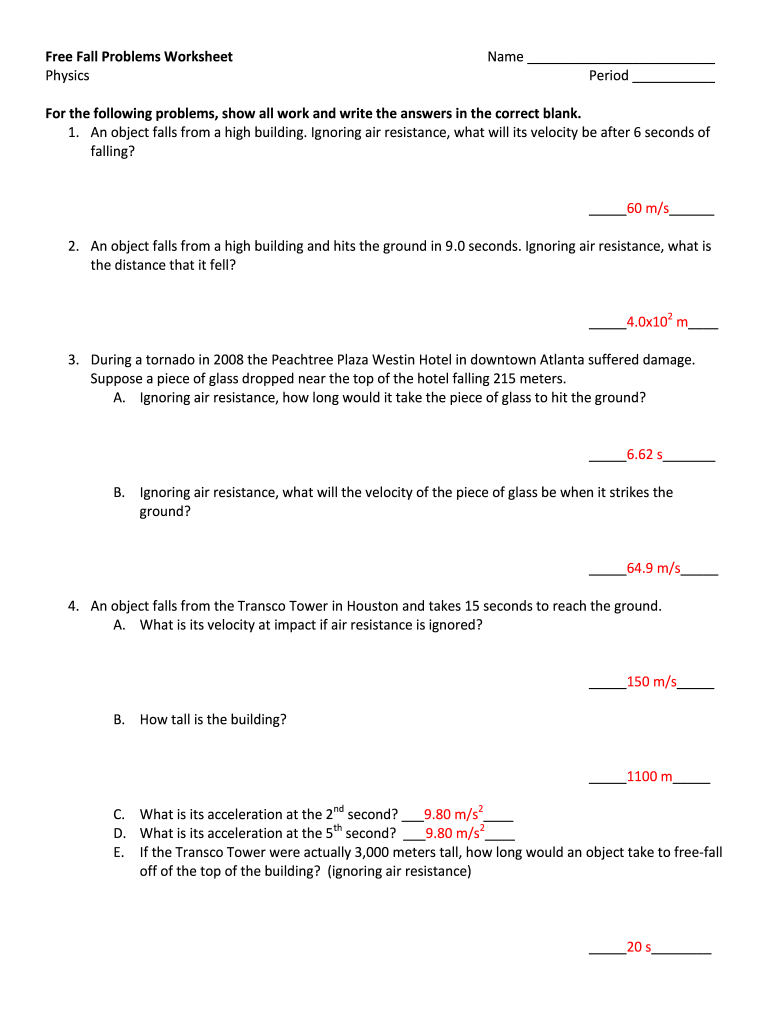

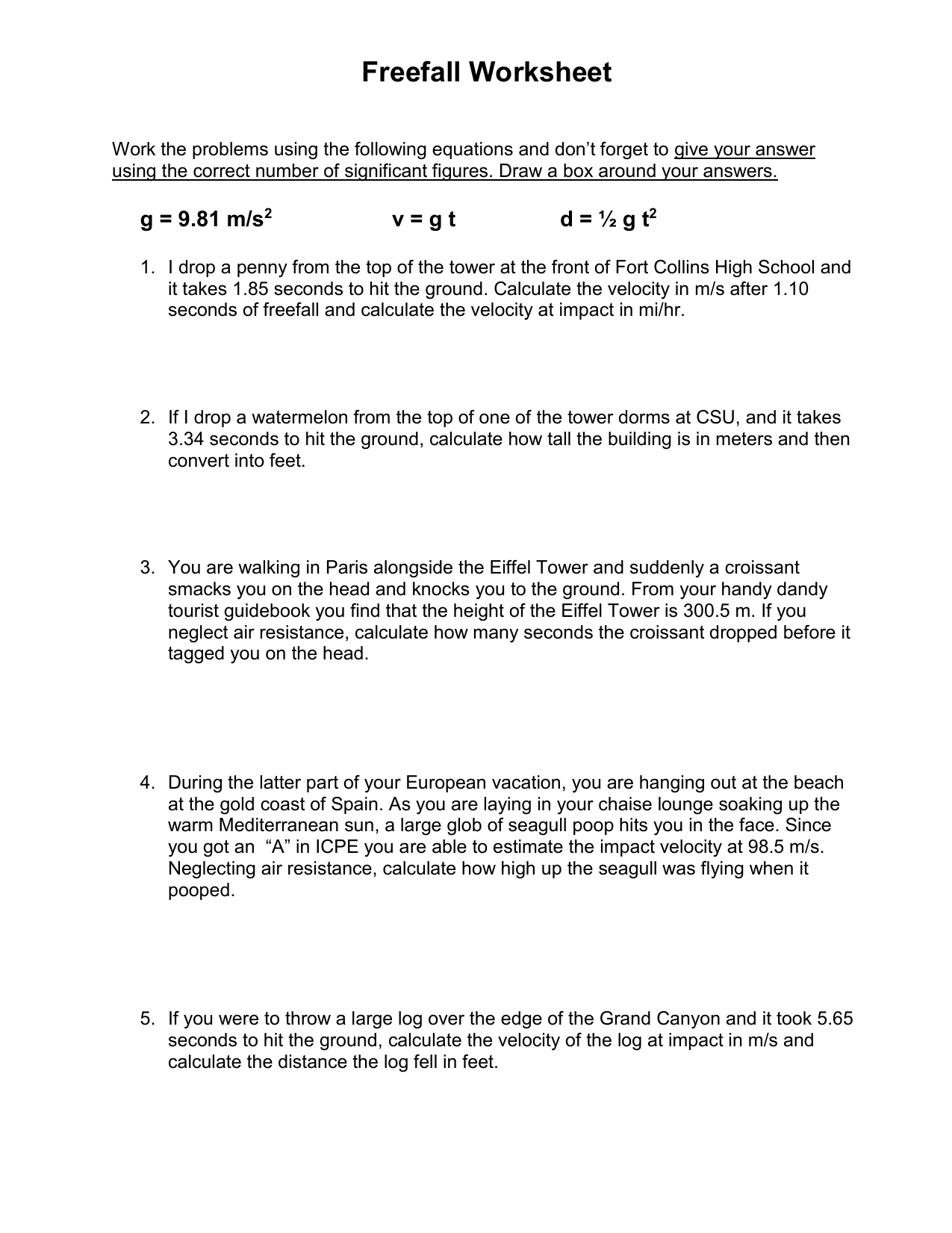

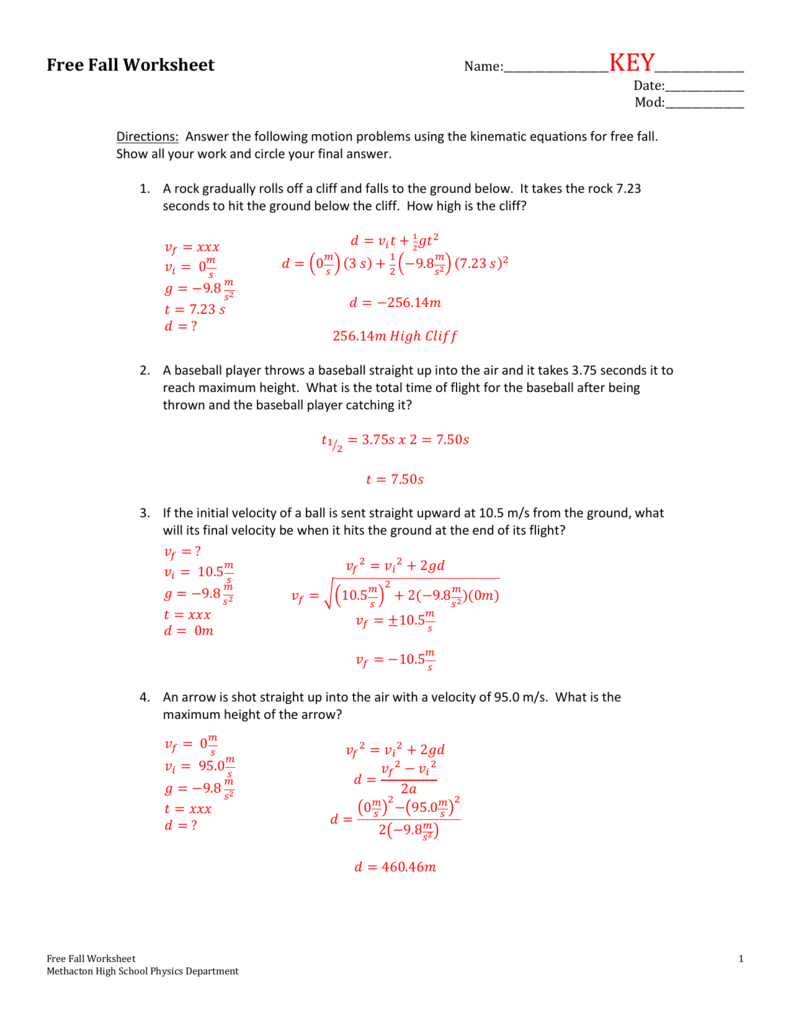

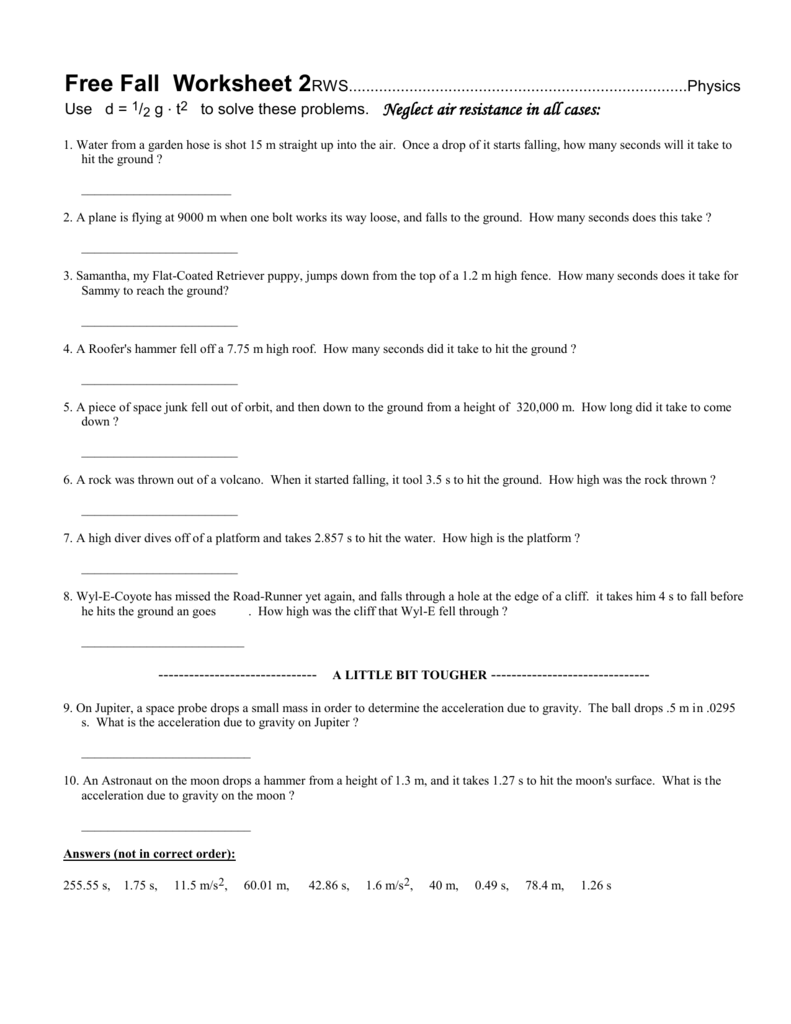

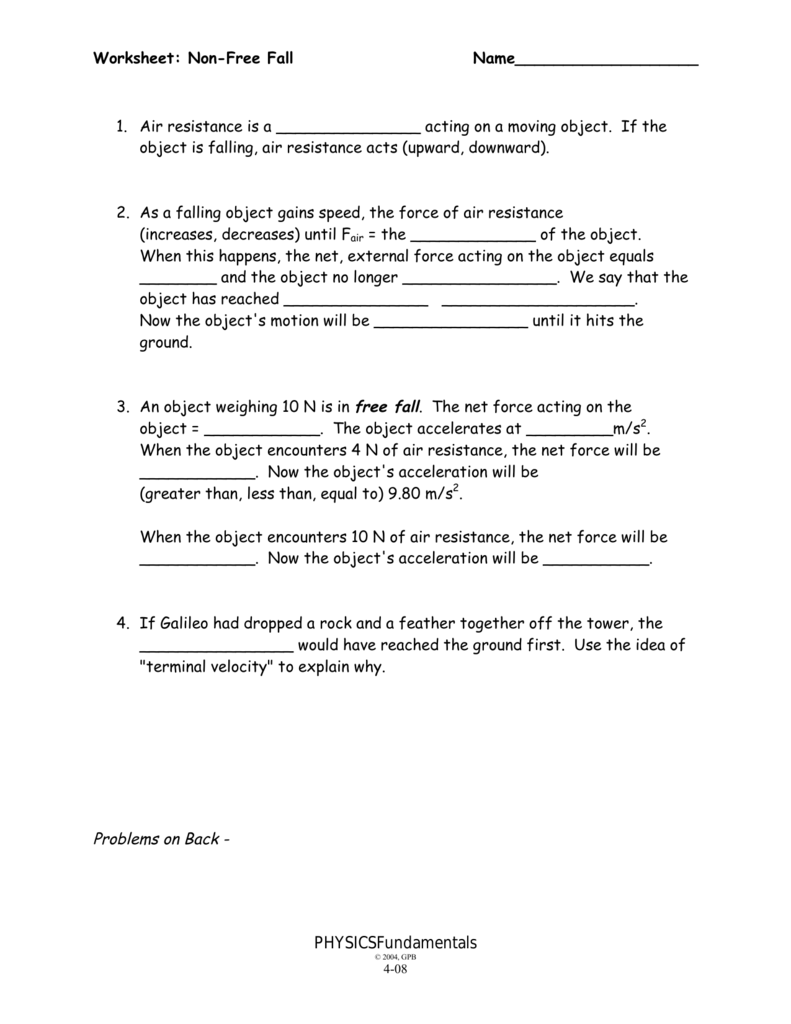

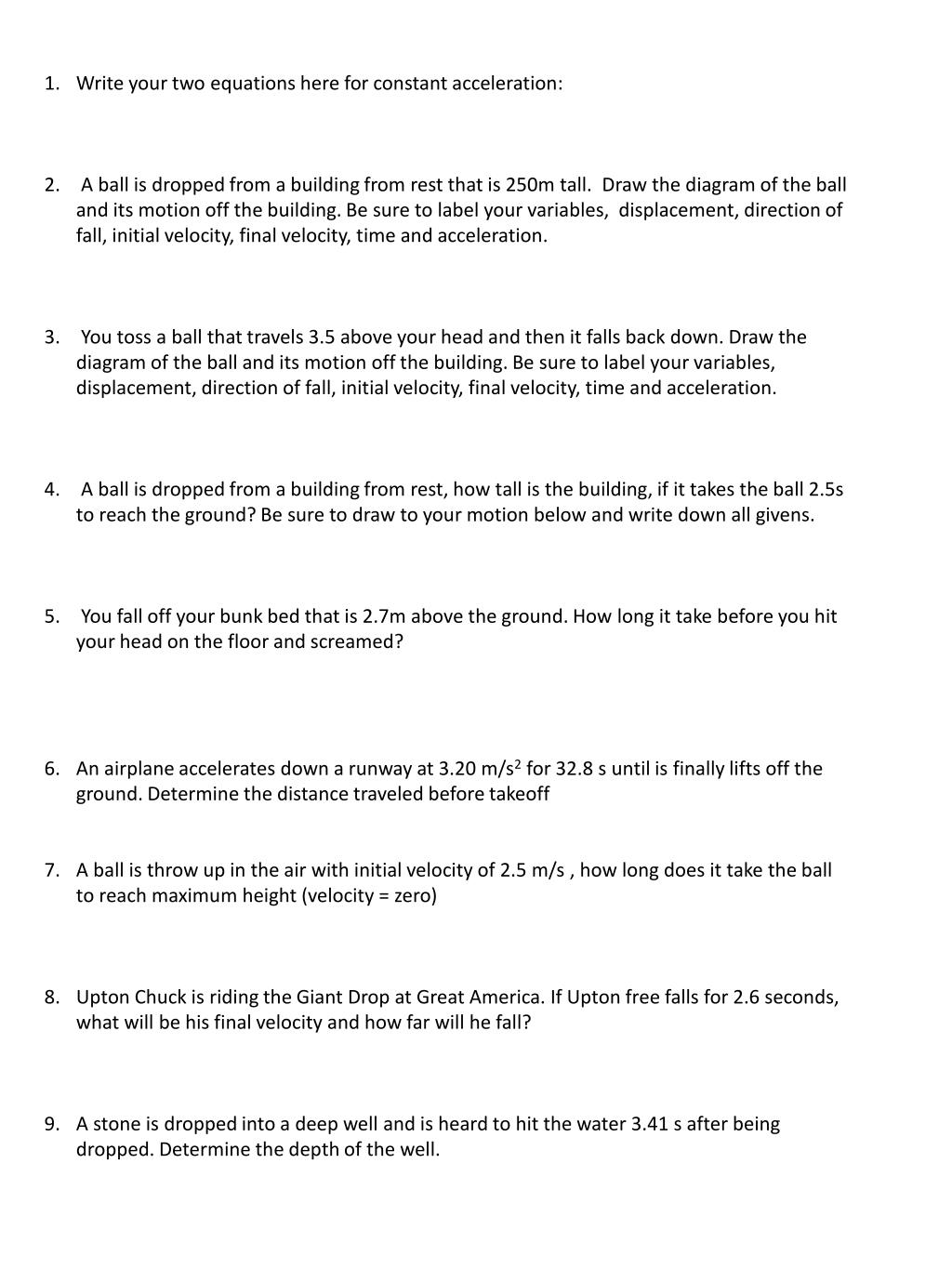

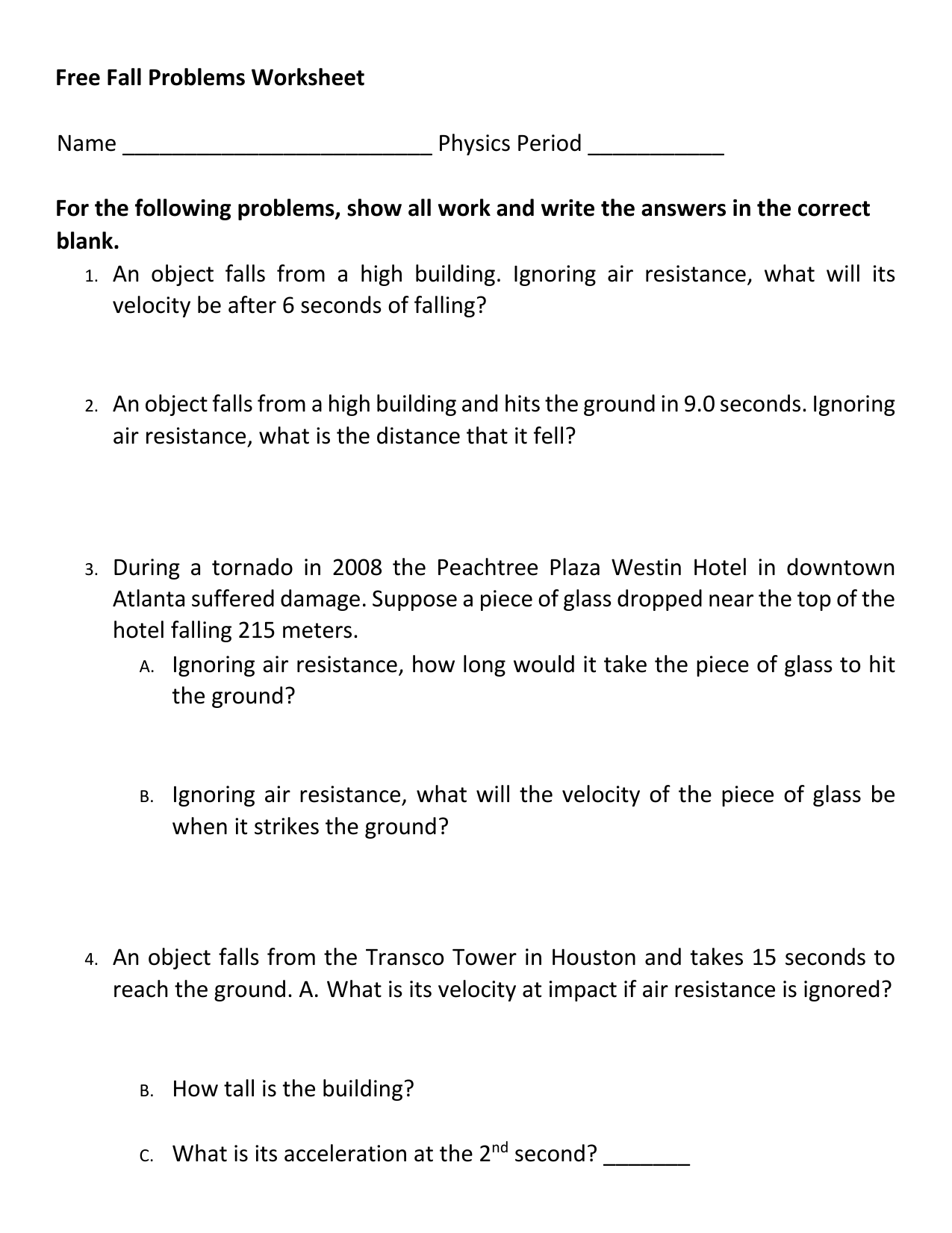

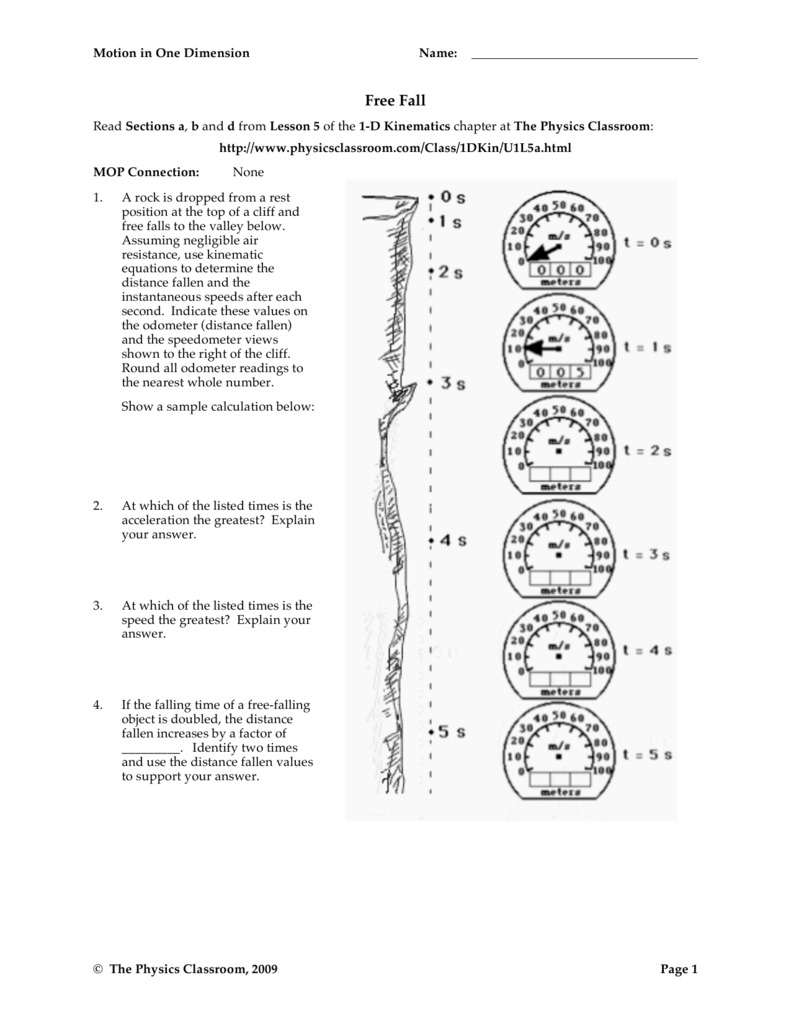

Free Fall Problems Worksheet. Welcome in order to my own blog site, in this time I’ll provide you with regarding Free Fall Problems Worksheet.

Why don’t you consider graphic previously mentioned? is actually in which awesome???. if you’re more dedicated therefore, I’l l demonstrate a number of image once more beneath:

So, if you wish to have all of these magnificent pics related to Free Fall Problems Worksheet, press save icon to save these pictures in your pc. These are available for transfer, if you’d rather and wish to grab it, just click save symbol in the web page, and it’ll be immediately downloaded to your pc.} Lastly if you want to get new and the recent image related to Free Fall Problems Worksheet, please follow us on google plus or bookmark this page, we try our best to offer you daily update with fresh and new pictures. Hope you love staying here. For most upgrades and recent news about Free Fall Problems Worksheet shots, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark section, We attempt to present you up grade regularly with all new and fresh pics, enjoy your exploring, and find the right for you.

Thanks for visiting our site, articleabove Free Fall Problems Worksheet published . At this time we are pleased to declare we have found a veryinteresting topicto be reviewed, namely Free Fall Problems Worksheet Lots of people attempting to find info aboutFree Fall Problems Worksheet and of course one of these is you, is not it?

[ssba-buttons]