Reconciling A Bank Statement Worksheet. Use the Bank Reconciliation characteristic to reconcile your financial institution statements and common ledger closing balances for all financial institution accounts each month. If it goes instantly into your submitting cupboard, you’re missing an necessary step within the bookkeeping course of – reconciling. Select this check box to point the transaction is to be matched or unmatched. If you are adding a model new interest, cost, billing receipt, direct examine or vouchered fee, this subject can only be modified within the bank line.

Check field is not selected), the earliest financial institution statement for the chosen bank group that has not been reconciled shows. This could happen when a verify has a Posting Date of the previous month in Escapia, but was not on the earlier month’s bank assertion, and therefore has not been reconciled. This is like writing a verify and that recipient doesn’t money it till the following month.

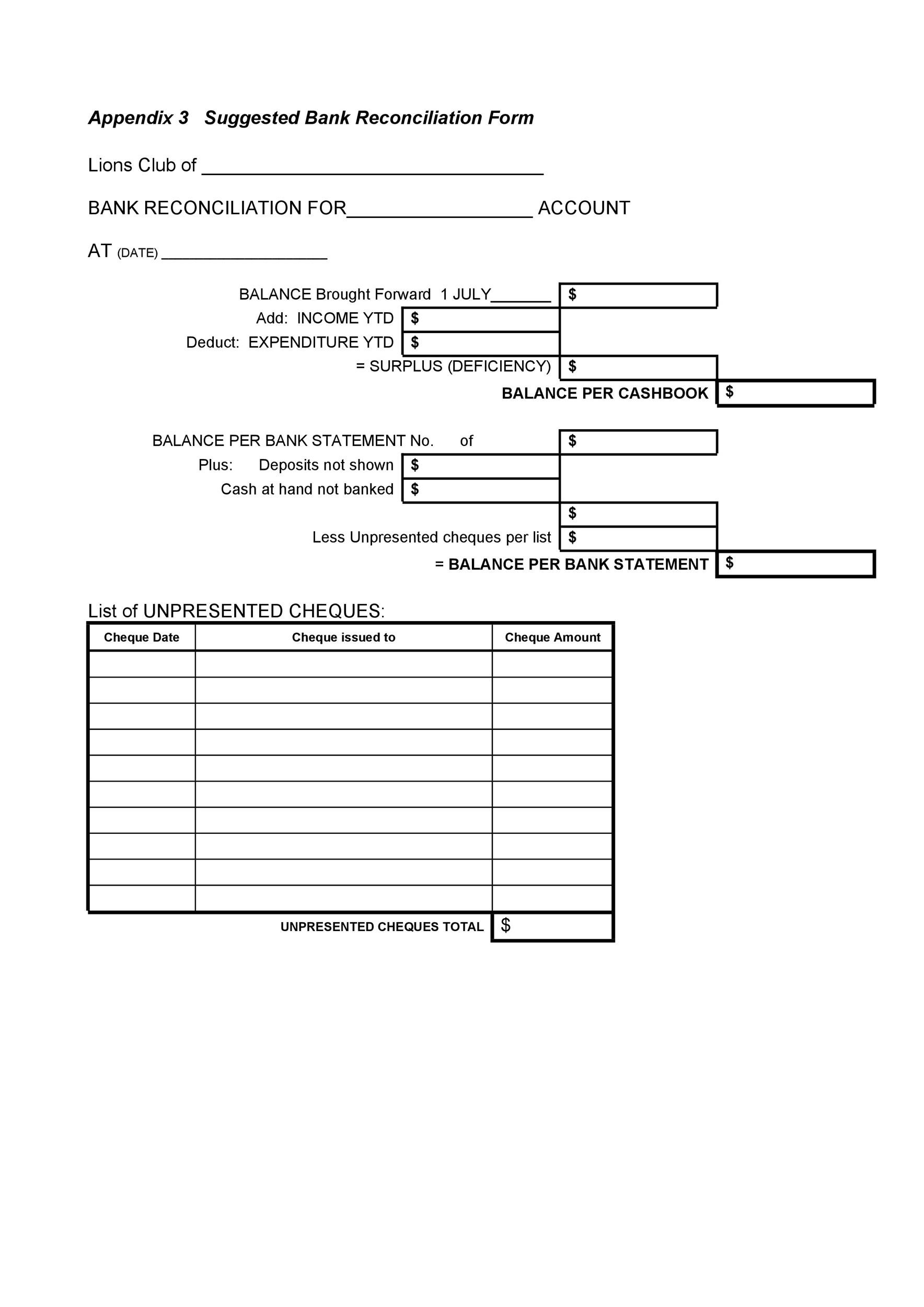

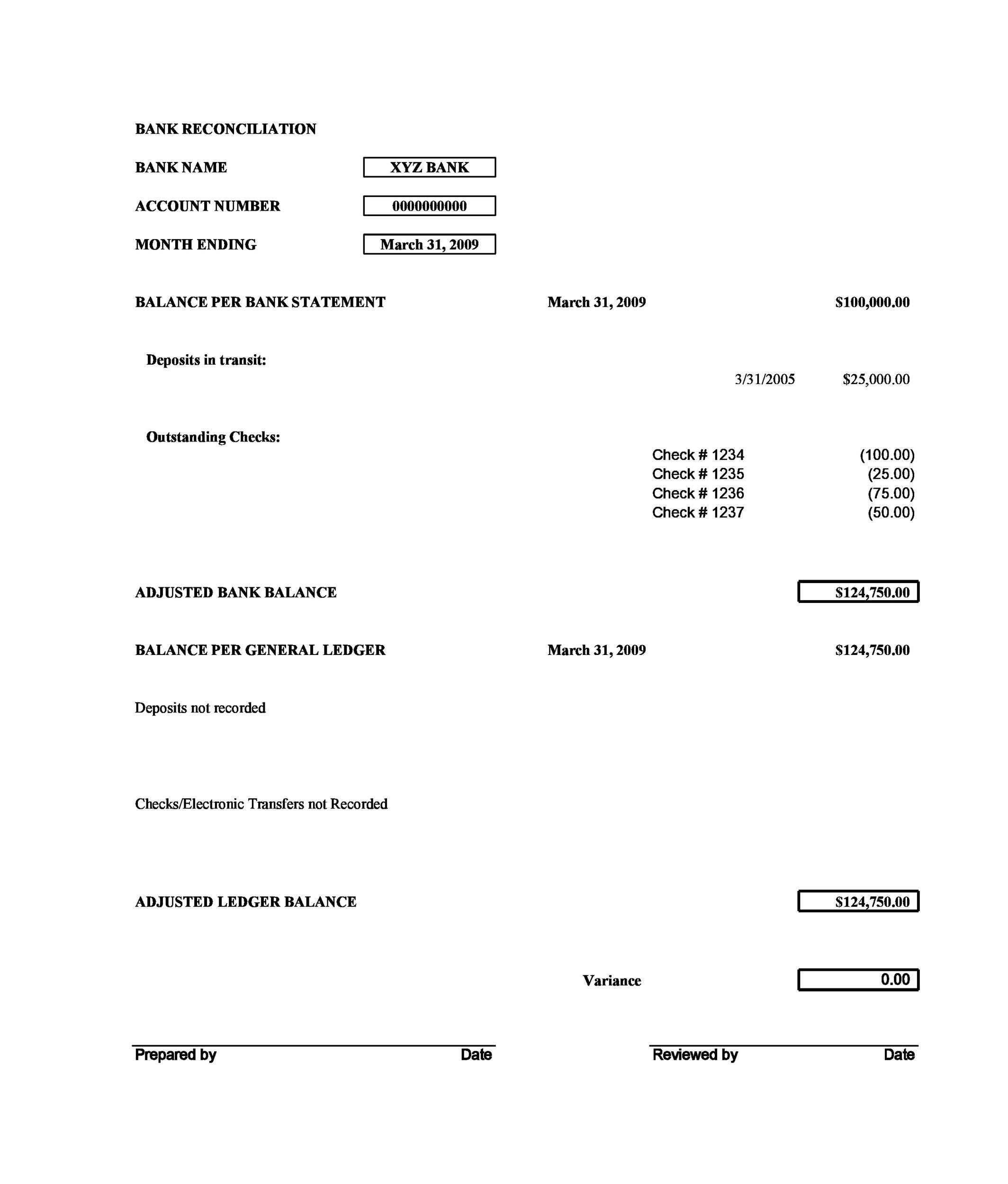

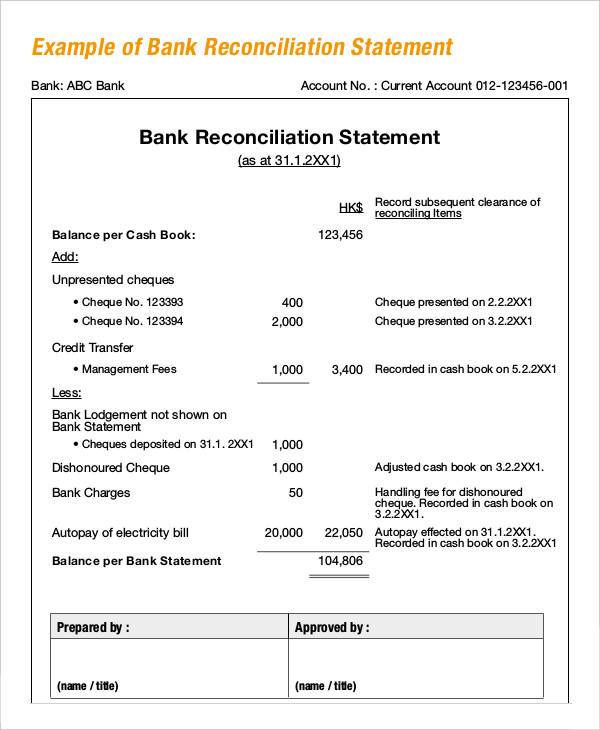

To do that, businesses have to keep in mind the bank charges, NSF checks and errors in accounting. Deposits in transit are amounts that are received and recorded by the business but aren’t but recorded by the financial institution. The business needs to identify the reasons for the discrepancy and reconcile the variations.

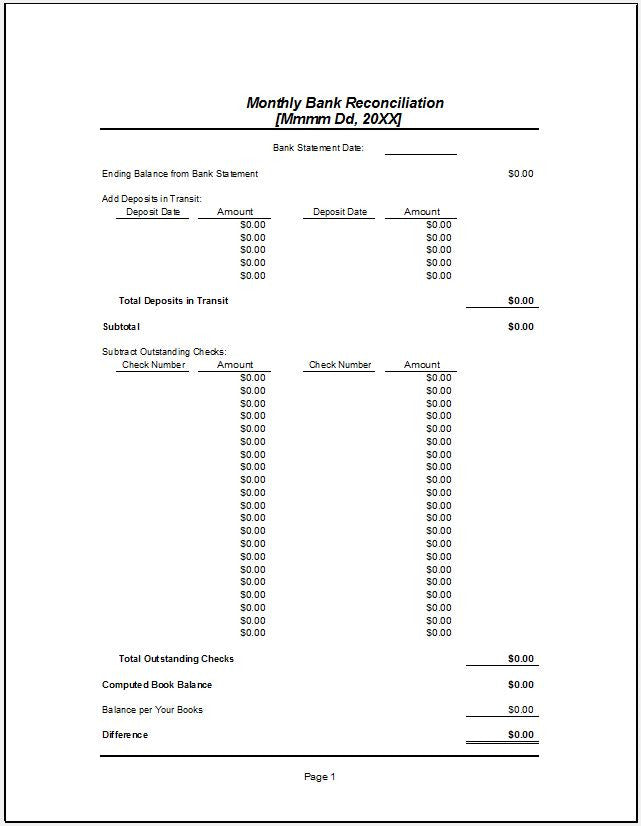

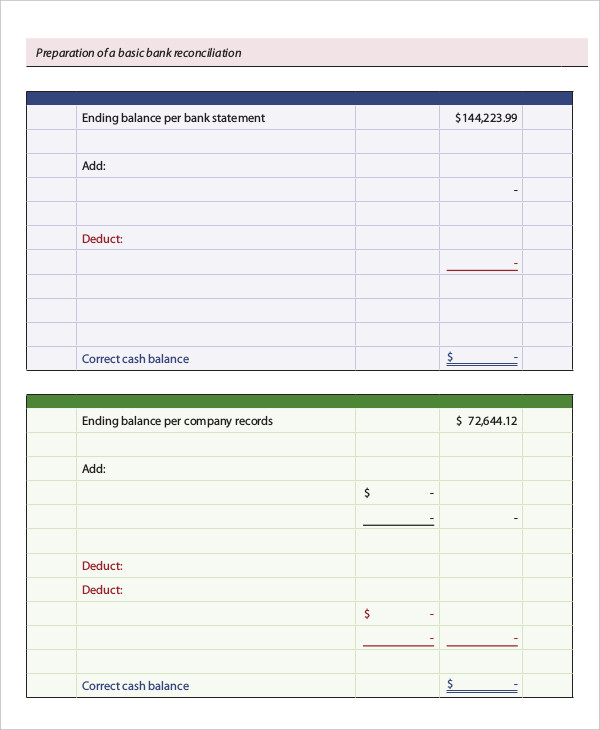

Monthly Bank Reconciliation Worksheet

If you discover an inaccurate transaction in your examine register, you will want to write down in a correction entry. In most accounting software, you should have the ability to update the quantity of the debit or credit score.

The following is the usual Bank Reconciliation Worksheet Parent kind. The Bank Reconciliation Worksheet Parent type is used to show solely statements that have not been reconciled and do not have a subsequent assertion could be modified.

How Usually Should You Reconcile Your Financial Institution Account?

Discover tips on how to efficiently manage your business with BizFilings’ ideas & assets on compliance, enterprise expansion, acquiring a registered agent, & much more. Only limited material is available within the chosen language.All content material is out there on the global site.

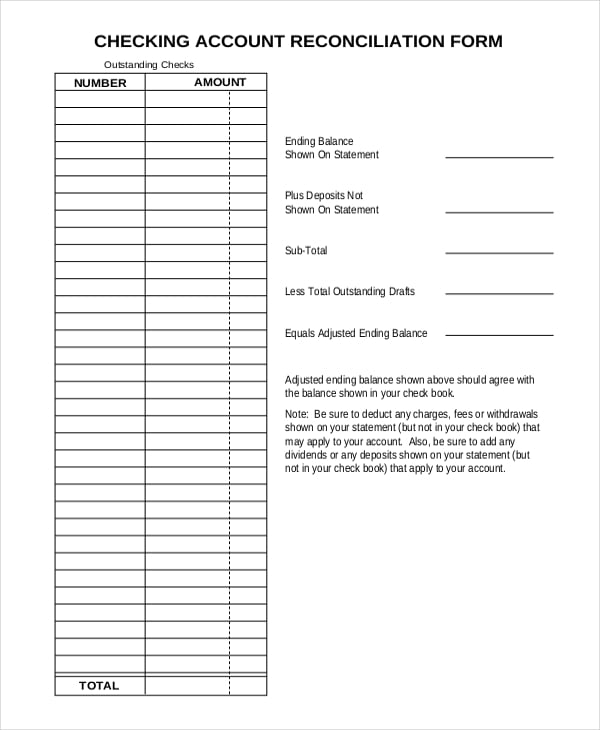

Items that have to be considered when reconciling your financial institution assertion are already listed — simply take a few minutes each month to plug in your amounts. Enter all excellent checks as of the end of the month you might be reconciling. Outstanding checks are people who have not cleared.

Bank Account Math: Life Skills Actions

On June 29th, Case Farms also deposited $10,000 however this didn’t seem on the bank statement. Enter any deposits in transit as of the end of the month you’re reconciling.

Print Reconciliation Report- The Print Reconciliation Report link exports a summary of the reconciliation to a PDF file for printing. After reconciling the bank is completed, Escapia recommends that this report is exported to a PDF and either saved or printed out, and then saved on report for future reference.

Private Finance Bundle: Checking Accounts Unit

An NSF verify is a check that has not been honored by the bank because of inadequate funds within the entity’s bank accounts. This means that the check quantity has not been deposited in your bank account and therefore needs to be deducted from your cash account information. Businesses keep a money guide to report each financial institution transactions in addition to money transactions.

This is informational solely, and this is not the distinction you reconcile to. This is a payment charged when the company orders new examine inventory through the bank.

If a transaction has also been reconciled you must use the Bank Unreconcile process as an alternative; see Bank Unreconcile. The UnMatch examine box and all fields in which data should not be modified is about to Read-Only for items which would possibly be each Matched and Reconciled. If the transactions had been manually matched, then “Manual” shows in this subject for the cash transaction and matching financial institution transaction.

It isn’t necessary to sort a matter quantity for a new cash detail line, curiosity, cost, direct verify or vouchered payment. It isn’t necessary to kind an bill number for a new cash element line, curiosity, cost, direct check or vouchered fee. The amount of bank transaction withdrawals on the worksheet for prior bank statements that have been not marked as matched.

Bank reconciliation is a crucial course of in enterprise and banking, and this quiz/worksheet will help you test your understanding of its definition and associated terms. If essential, enter or modify the financial institution reconciliation adjustments.

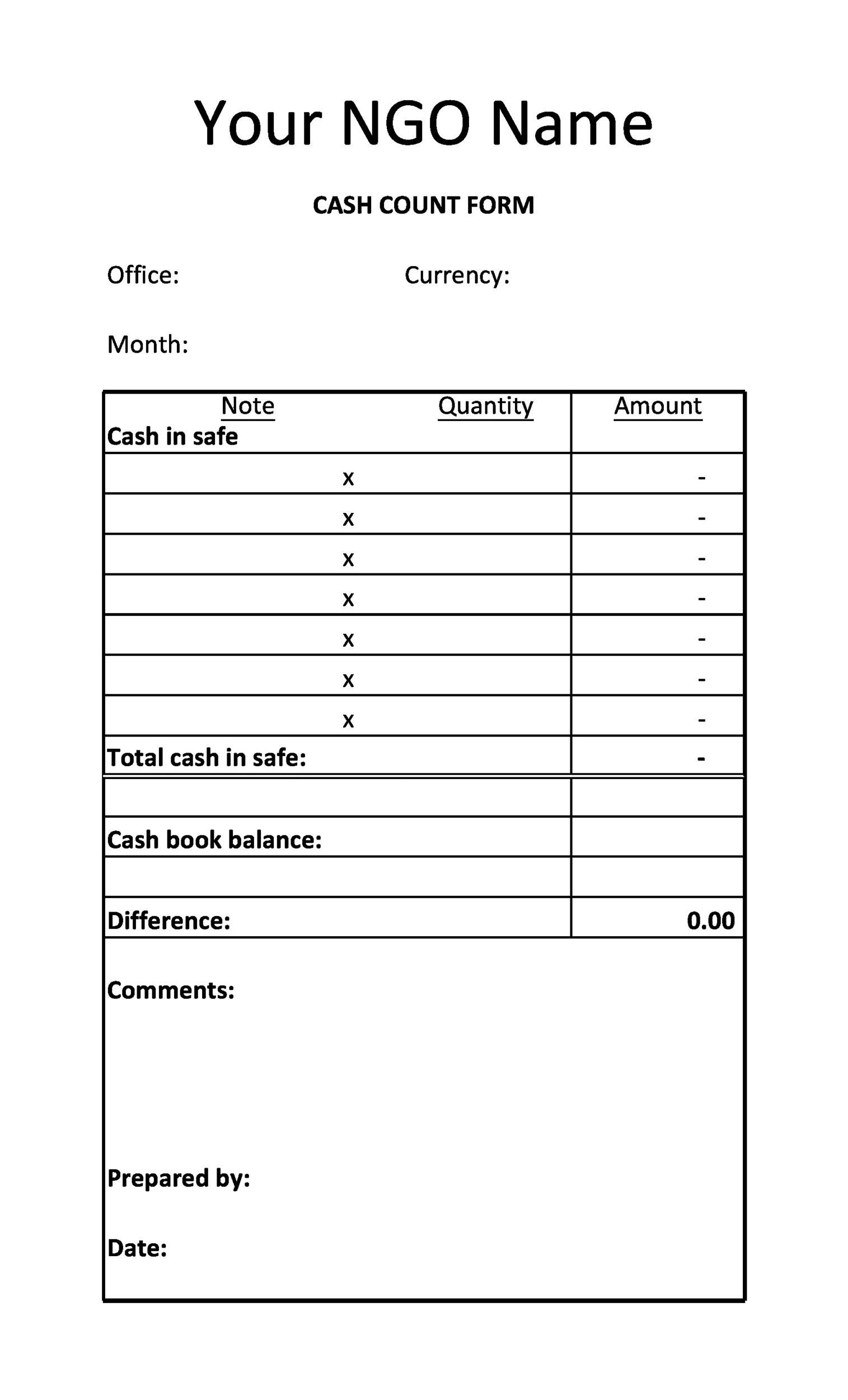

Businesses that use online banking service can download the bank statements for the regular reconciliation process somewhat than having to manually enter the information. This monthly financial institution reconciliation template allows the person to reconcile a financial institution assertion with present checking account data. Use this financial institution reconciliation example template to assist rectify any errors in your monetary statement.

Once the balances are equal, businesses want to arrange journal entries for the changes to the balance per books. The subsequent step is to regulate the money balance in the enterprise account.

Type the quantity of the transaction that’s to be reconciled. Bank transactions show the person transaction’s reference number. Balances should be zero so as to perform the reconciliation.

It just isn’t necessary to pick a payee for a brand new cash element line, curiosity, cost or billing receipt. This verify box can solely be accessed for a transaction that has been matched however not reconciled.

How do you clear up financial institution reconciliation problems?

- COMPARE THE DEPOSITS. Match the deposits within the business data with these in the financial institution statement.

- ADJUST THE BANK STATEMENTS. Adjust the balance on the bank statements to the corrected balance.

- ADJUST THE CASH ACCOUNT.

- COMPARE THE BALANCES.

This might happen when a deposit has a Posting Date of the earlier month in Escapia, but was not on the earlier month’s financial institution assertion, and subsequently has not been reconciled. If there could be an undocumented reconciling item, evaluate the bank reconciliation course of steps simply noted. If there is nonetheless an undocumented variance, return to the bank reconciliations for the previous intervals and see if the variance arose in a prior interval.

What is financial institution reconciliation assertion with example?

Bank Reconciliation is a process that offers the explanations for variations between the financial institution statement and Cash Book maintained by a enterprise. Not solely is the process used to find out the differences, but in addition to result in changes in related accounting data to maintain the information updated.

This permits you to differentiate between these data which are matched and reconciled, and those that are not. Any positive worth is considered a deposit, whereas any negative worth is considered a withdrawal. Or your system administrator for more information).

Since there are additional necessary fields, it is coated in depth in the next section below. Access the financial institution reconciliation module in the accounting software. You can also routinely clear checks based on a bank file.

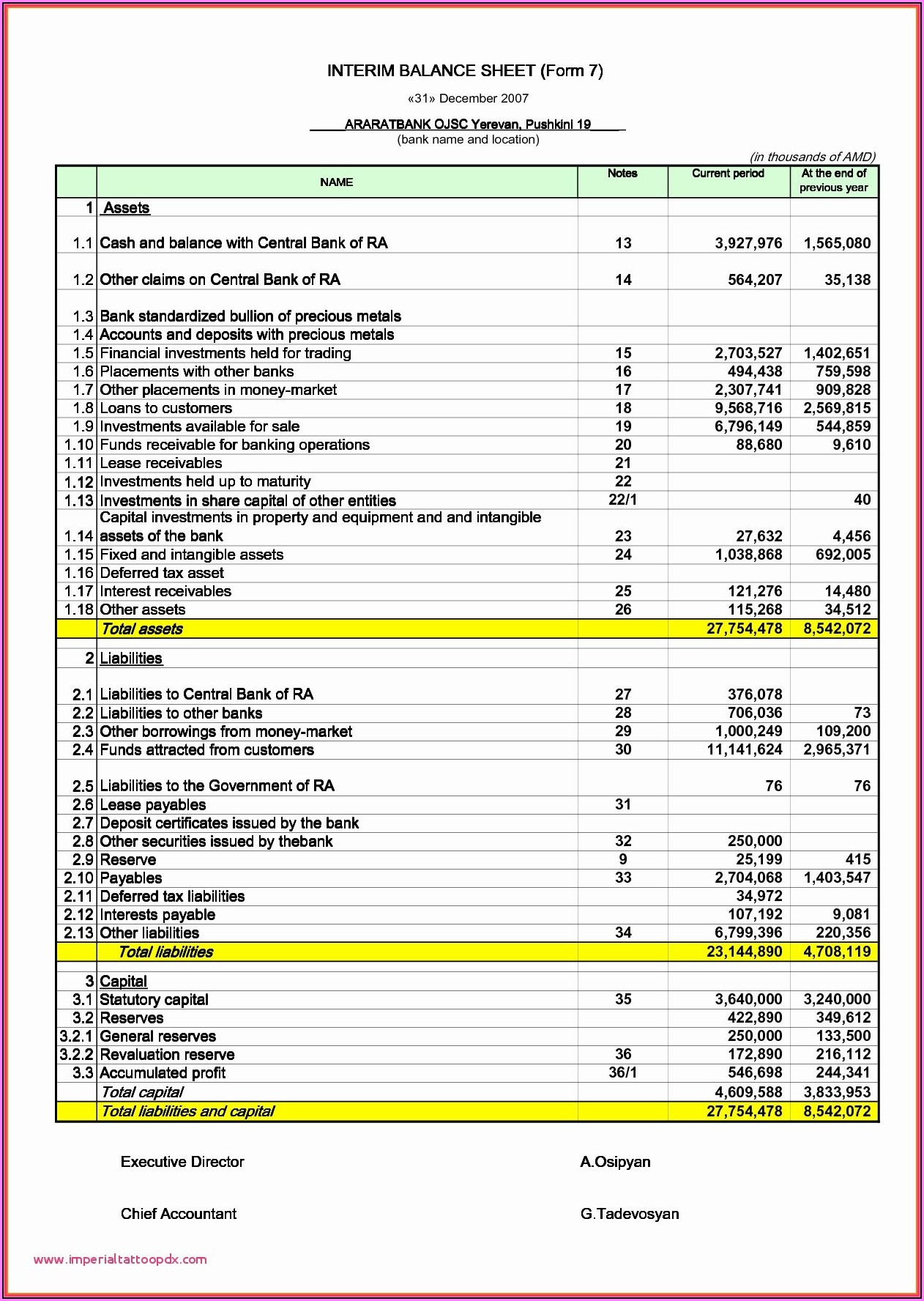

We specialize in unifying and optimizing processes to deliver a real-time and accurate view of your monetary place. Enabling tax and accounting professionals and companies of all sizes drive productiveness, navigate change, and deliver higher outcomes.

This subject can only be modified in case you are manually matching transactions or including a new money element line. This field can solely be modified in case you are including a model new money element line.

Separate slides are included for every month of the yr . It isn’t essential to kind an AP Transaction Type for a element line corresponding to billing receipts or vouchered funds. Add The system will ignore any entry on this field for most of these transactions.

With workflows optimized by know-how and guided by deep domain experience, we help organizations grow, manage, and protect their companies and their client’s businesses. Click Search to replace the Reconcile Bank Account web page with the data you entered.

You can also save reconciliations to work on later. A selected check box signifies the reconciliation may be carried out on bank transactions from totally different statements as a substitute of a single financial institution assertion. If this verify box is selected, transactions can be reconciled at any time , and the statement may be closed with out matching all financial institution transactions.

Ideally, you must reconcile your bank account each time you obtain a statement from your bank. This is commonly done on the finish of each month, weekly and even at the finish of every day by companies which have a giant number of transactions.

This field can only be modified in case you are including a brand new cash detail line, a direct verify or a vouchered payment. Click this button to automatically match system transactions to financial institution transactions.

This distinction between the recorded amounts of the financial institution and the corporate will stay until such time because the bank adjusts its data. In the meantime, the difference might be a reconciling item. This subject is required in case you are including a direct check or vouchered cost.

These only embrace bank transactions for the statement specified on the worksheet. Before the reconciliation course of, business ought to ensure that they’ve recorded all transactions as a lot as the tip of your bank statement.

A “Bank Reconciliation Statement” is a summary of banking and enterprise activity that reconciles an entity’s checking account with its monetary records. This pdf will allow you to perceive the broad concept 1. Check field is selected), bank and money transactions for which the transaction date happens before the cut-off date display.

If a bank reference number exists , when the model new transaction is created, the financial institution reference quantity shall be set to its original value. Select this verify box to indicate this worksheet is accomplished.

You can type or question to pick a different financial institution statement to be reconciled. Show Balance Worksheet- This incorporates information that is essential to reconciling the bank account.

[ssba-buttons]