Bill Of Rights Worksheet. To make this election, you have to verify the box on line 18 of Schedule A. If neither you nor anybody else has but been appointed as executor or administrator, you can sign the return for your partner and enter “Filing as surviving spouse” within the area where you sign the return. Music makes an excellent enrichment activity, and our assortment of music worksheets and printables assist you to easily introduce your youngster to new musical concepts. Eventually, the need for particular person rights turned the popular position.

After you complete your return, you should send it to the IRS. You can mail it otherwise you could possibly file it electronically. If your address is outdoors the United States or its possessions or territories, enter the city name on the suitable line of your Form 1040 or 1040-SR.

Special rules for eligible gains invested in Qualified Opportunity Funds. If you may have an eligible acquire, you probably can make investments that acquire into a Qualified Opportunity Fund and elect to defer half or the entire achieve that is otherwise includible in income.

The AMT exemption amount is elevated to $73,600 ($114,600 if married submitting jointly or qualifying widow; $57,300 if married submitting separately). The earnings ranges at which the AMT exemption begins to part out have elevated to $523,600 ($1,047,200 if married submitting jointly or qualifying widow).

Mortgage Loan Basics

This applies whether or not you employ the cash method or an accrual method of accounting. Certain loans to or from a international person, until the curiosity income would be successfully linked with the conduct of a U.S. trade or enterprise and never exempt from U.S. tax under an income tax treaty. Compensation-related loans (below-market loans between an employer and an worker or between an unbiased contractor and an individual for whom the contractor supplies services).

However, if the usefulness of these things extends considerably past the yr they’re placed in service, you have to usually get well their prices through depreciation. For more info concerning depreciation, see Pub.

Due Process Of Legislation

You paid $15 to a local church for a half-page ad in a program for a live performance it’s sponsoring. The purpose of the ad was to encourage readers to buy your products.

Exclusion of employer-provided adoption benefits shown on Form 8839, Qualified Adoption Expenses. Your accrued retirement advantages at the beginning of the year will not present more than $1,800 per 12 months at retirement. Didn’t perform the minimal service required to accrue a benefit for the 12 months.

Refunds

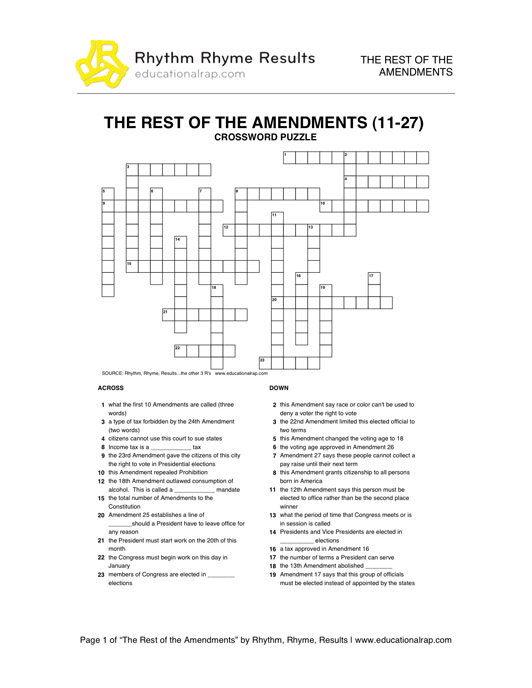

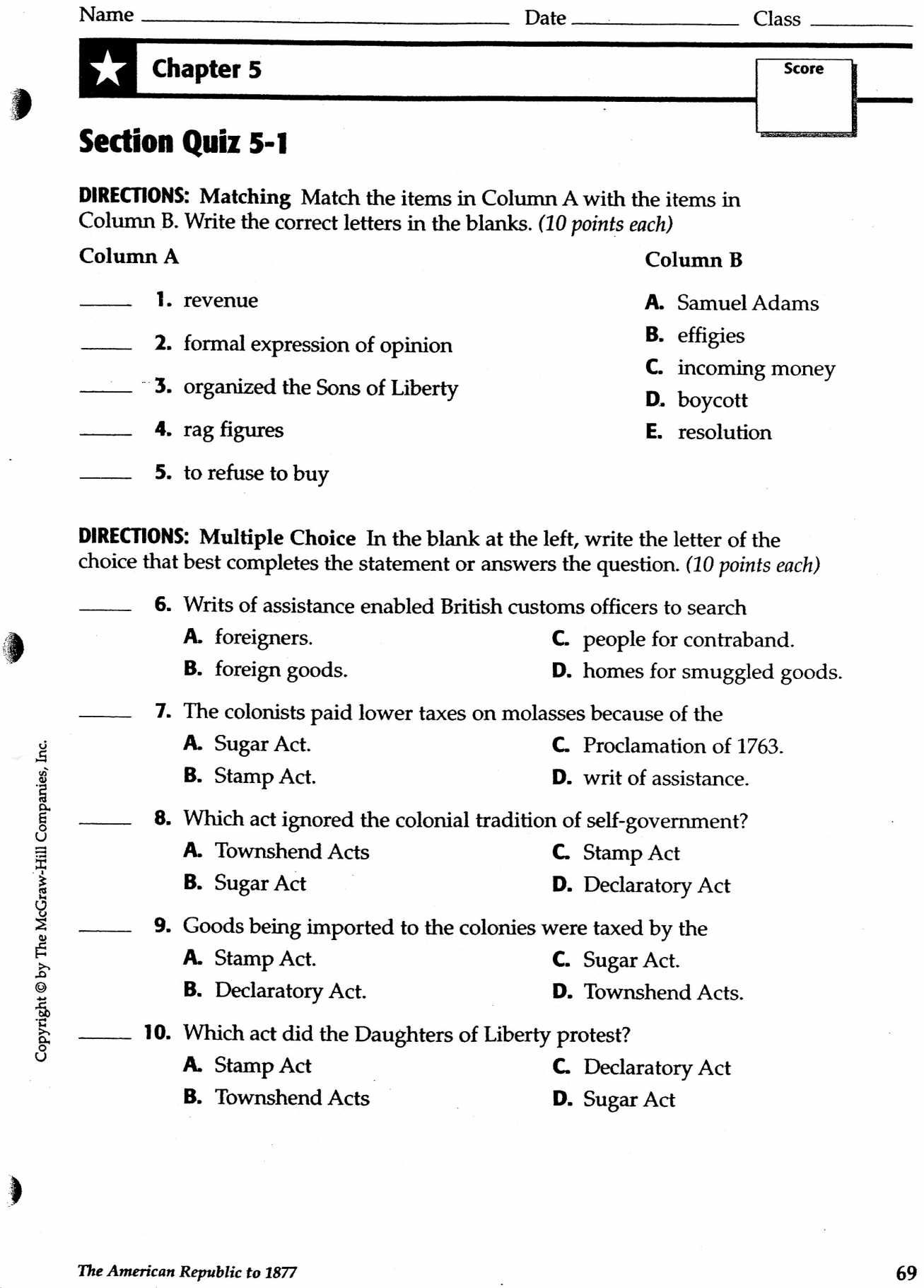

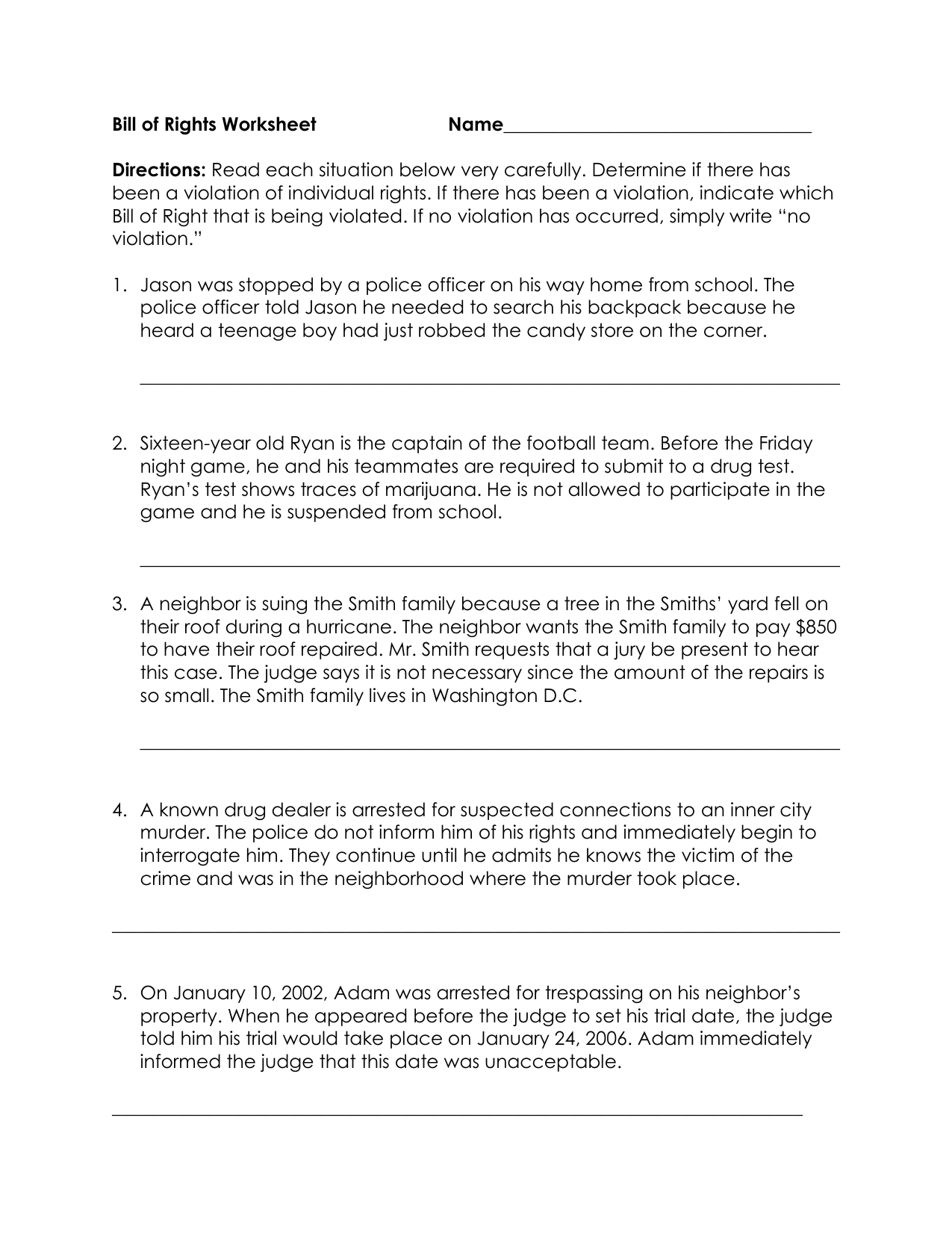

You might choose any 5 of the ten amendments to the Constitution generally recognized as the Bill of Rights. Bill of rights reply key displaying top 8 worksheets found for this concept.

No regulation, varying the compensation for the providers of the Senators and Representatives, shall take effect, till an election of Representatives shall have intervened. Health coverage tax credit , Health coverage tax credit.Health plan, More than one health plan and enterprise.Heating equipment, Heating equipment.Home, business use of, Business use of your home. TAS also has a website, Tax Reform Changes, which shows you how the new tax legislation might change your future tax filings and helps you propose for these changes.

Taxes

Citizens are free from self-incrimination and double jeopardy. This first means that everyone is handled the same by the police, the courts, and the government.

This section summarizes necessary tax modifications that took effect in 2021. Most of these modifications are mentioned in additional detail all through this publication.

Click on the “order now” button to visit the order web page. Fill the order type together with your task instructions making certain all important details about your order is included.

If your SSN has been lost or stolen or you suspect you’re a victim of tax-related identification theft, you’ll find a way to be taught what steps you should take. This tool lets your tax professional submit an authorization request to entry your particular person taxpayer IRS on-line account. OPI Service is accessible in additional than 350 languages.

If you don’t have enough tax withheld, you may have to pay estimated tax, as explained underneath Estimated Tax for 2022, later. During the 12 months, modifications may happen to your marital standing, adjustments, deductions, or credits you count on to assert on your tax return.

Any nontaxable amounts that you just roll over into your conventional IRA turn out to be part of your basis in your IRAs. To recuperate your foundation when you take distributions from your IRA, you should full Form 8606 for the 12 months of the distribution. See Form 8606 under Distributions Fully or Partly Taxable, later..

Those agencies might use the complaints to analyze cross-border points, uncover new scams, pursue regulatory or enforcement actions, and spot consumer tendencies. If you want a photocopy of your authentic return, full and mail Form 4506, Request for Copy of Tax Return, obtainable at IRS.gov/Pub/irs-pdf/F4506.pdf, together with the applicable payment. The IRS by no means sends e-mail requesting that you simply get hold of or access your transcripts.

However, with respect to partly worthless unhealthy money owed, your deduction is proscribed to the amount you charged off in your books through the 12 months. She can claim a enterprise bad debt deduction only for the quantity she paid as a end result of her guarantee was made in the midst of her commerce or business for an excellent religion business objective. She was motivated by the desire to retain one of her better shoppers and maintain a sales outlet.

If you aren’t in the business of renting private property, report your rental earnings on Schedule 1 , line 8k. If the refund or other recovery and the expense happen in the same 12 months, the recovery reduces the deduction or credit and isn’t reported as income.

You may be billed for a call you positioned or a service you used, however the description listed on your phone bill for the call or service may be unclear. If you do not know what was provided for a charge listed on your invoice, ask your telephone company to explain it earlier than paying it. In the event of repossession, banks, traders, and so forth. should resort to selling the property to recoup their original investment and are able to get rid of hard belongings extra shortly by reductions in worth.

The assertion ought to include the form number of the return you’re submitting, the tax year, and the rationale your partner can’t sign; it also wants to state that your spouse has agreed to your signing for him or her. You don’t want to be answerable for any taxes due if your spouse does not have enough tax withheld or doesn’t pay enough estimated tax. If you’re divorced beneath a final decree by the final day of the yr, you are thought of single for the whole 12 months and also you can’t select married submitting collectively as your submitting standing.

In the us a partial amortization or balloon mortgage is one where the amount of monthly funds due are calculated over a certain time period, however the excellent steadiness on the principal is due at some point wanting that term. In the UK, a partial reimbursement mortgage is sort of common, particularly the place the unique mortgage was investment-backed.

The price of constructing a private road on your small business property and the worth of replacing a gravel driveway with a concrete one are capital expenses you may find a way to depreciate. The value of maintaining a non-public street on your small business property is a deductible expense. For tax year 2021, the usual mileage price for the value of working your automobile, van, pickup, or panel truck for every mile of enterprise use is 56 cents per mile.

Your work clearly requires the expense so that you can satisfactorily carry out that work. When determining the time period of the switch settlement, embody all renewal options and some other period for which you and the transferor reasonably expect the agreement to be renewed. 463 for an in depth dialogue of individuals subject to the Department of Transportation’s “hours of service” limits.

The $5,000 deduction is lowered by the quantity your complete start-up or organizational prices exceed $50,000. For details about amortizing start-up and organizational prices, see chapter eight. A writer can deduct as a current enterprise expense the prices of establishing, maintaining, or rising the circulation of a newspaper, magazine, or different periodical.

You must first decide whether or not your settlement is a lease or a conditional gross sales contract. Payments made beneath a conditional gross sales contract are not deductible as lease expense. You are either a money or accrual calendar 12 months taxpayer.

This contains the unique cost or different foundation of the property and any improvements you made. You could make a contribution to reduce back debt held by the common public.

Taxpayers have the best to pay only the quantity of tax legally due, together with curiosity and penalties, and to have the IRS apply all tax payments correctly. This section explains your rights as a taxpayer and the processes for examination, appeal, assortment, and refunds. Section of your tax return and verify the Credit for other dependents field in column .

Business dangerous money owed are mainly the outcomes of credit gross sales to customers. Goods which have been sold, but not yet paid for, and services which were performed, however not but paid for, are recorded in your books as either accounts receivable or notes receivable. After a reasonable period of time, in case you have tried to gather the quantity due, but are unable to take action, the uncollectible part becomes a enterprise bad debt.

If the entire of these values is more than your basis within the IRA, you’ll have a taxable gain that’s includible in your earnings. For info on figuring your acquire and reporting it in earnings, see Are Distributions Taxable, earlier.

The unit also examines the evolution of the definitions of protected expression in speech, petition, assembly, art, and demonstration. No soldier shall, in time of peace be quartered in any house, with out the consent of the owner, nor in time of warfare, however in a fashion to be prescribed by legislation. Presented by the Library of Congress, Congress.gov is the official website for U.S. federal legislative info.

Cash reimbursement by your employer for these bills under a bona fide reimbursement arrangement can be excludable. However, cash reimbursement for a transit move is excludable provided that a voucher or similar item that may be exchanged just for a transit move isn’t available for direct distribution to you.

The cash and adjusted foundation of property you contribute to the activity. If you carry on your small business activity without the intention of constructing a revenue, you can not use a loss from it to offset different earnings.

For instance, you’ll be able to deduct one hundred pc of the price of meals on your corporation books and information. However, solely 50% of those prices are allowed by legislation as a tax deduction.

If a baby meets the five checks to be the qualifying baby of a couple of individual, there are rules you should use to determine which particular person can actually deal with the kid as a qualifying youngster. See Qualifying Child of More Than One Person, later..

[ssba-buttons]