Calculating Sales Tax Worksheet. How can you determine how a lot you will be paying in full? These states are Alaska, Delaware, Montana, New Hampshire and Oregon. Sometimes we purchase gadgets where the gross sales tax is already included within the complete value of the product. This provision addresses the situation when the taxable values in a TIF decline, rather than continue to increase.

A certain state taxes the primary $600,000 in property values at a fee of 1%, whereas all property values over $600,000 are taxed at a fee of 1.25%. Find a piecewise-defined operate T that specifies the whole tax on a property valued at x dollars. From a nearby machine, a soda prices $2.25, however in this case the city has a particular soda tax, so the rate is double at 5.4%.

Steps for Following YearsOnce a taxing unit has collected the extra gross sales tax for a yr, its property tax revenues will replicate any tax fee discount arising from the extra sales tax. As a result, calculating the no-new-revenue tax fee will not require an adjustment for the additional gross sales tax.

Taxcalc Altogether Higher

We do not accept legal responsibility for any errors or omissions, please learn our disclaimer and phrases and conditions of use. COMPANY CAR/FUEL/BIK TOTAL VALUE – If you have a company automotive, gas or receive some other Benefits in Kind, please enter the total combined BIK worth on this field.

What is the marked price if the promoting value is $86 after a reduction of 6% is applied? Experience the benefit of finding the sale value or marked value in this section of our calculating discount worksheets.

What Items Have Gross Sales Tax?

You can offset capital gains with capital losses, which can present another nice tax break, though sure guidelines apply. There is one downside with Commission as properly as one each of Mark up and Mark Down.

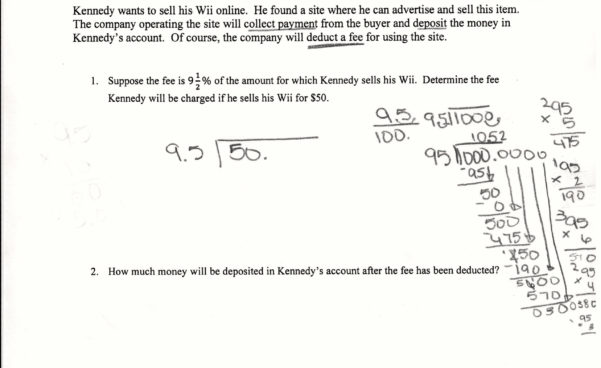

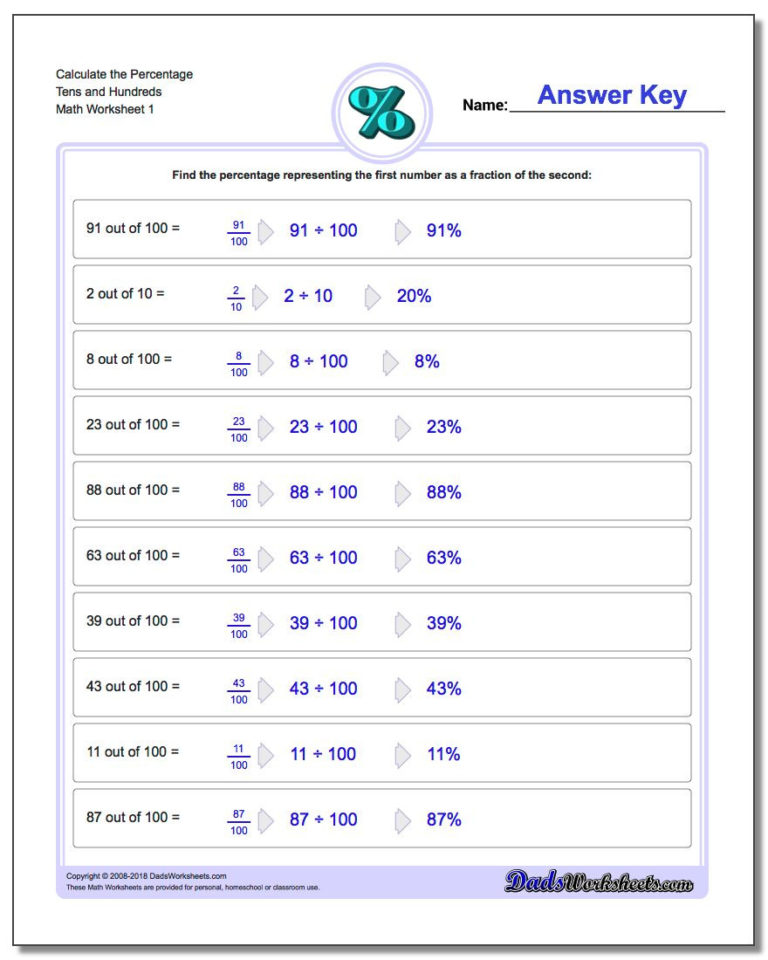

Students calculate the low cost and gross sales tax on every merchandise. Sales tax rates range; do the maths to seek out the right rate!

The Means To Calculate Sales Tax Backwards From Complete

Don’t let the scholars falter on their method to changing into monetary geniuses! Utilize our specifically curated printable worksheets and watch sensible learners grow from novices into skilled gross sales tax calculators by delving into a sea of fascinating workouts and word issues.

All you should do is present the details of your salary. The calculator will calculate the taxable earnings in addition to internet tax payable for the monetary yr.

At the state level, all but five states do not have statewide sales tax. These are Alaska, Delaware, Montana, New Hampshire, and Oregon.

Was it one hundred of the February shares and 50 of the January shares, or did they promote seventy five shares from each lot? The IRS says that the basis of the shares works out to the purchase price plus the prices of buy. Not if you’re certain you stayed within the same native taxing jurisdiction.

Publish The Calculator On The Net

It may also receive a referral fee for any user that pays the £49.99 fee to submit a tax return using the calculator. You can calculate and submit your tax return at no cost on the HMRC web site.

New York, then again, only raises about 20 percent of its revenues from the sales tax. A gross sales tax is a consumption tax paid to a government on the sale of sure items and companies. Usually, the seller collects the gross sales tax from the consumer as the patron makes a buy order.

The Way To Add A Signature In Your Calculating Sales Tax Worksheet

These governments then use the money they receive from the gross sales tax to fund public colleges, emergency services, healthcare, highway development and upkeep and public transportation. Administering sales tax is a typical follow for elevating government income and has been round in one form or one other for hundreds of years. Countries and localities every have their own gross sales tax policies and rates that may differ for various types of goods and services.

These are solely a quantity of examples of variations in taxation in different jurisdictions. Rules and regulations concerning gross sales tax range widely from state to state. PAY PERIOD – Select the pay period applicable to the gross revenue amount you have entered.

Your revenue tax return or refund arises if the tax payable is lower than the taxes already paid during the tax year. Usually for a salaried taxpayer a refund arises if both the deductions are not taken under consideration or he/ she earns a decrease earnings than estimated earnings. A web salary is the gross salary minus the allowances and deductions for the financial 12 months.

SEX – In conjunction with your date of delivery, your sex is used to calculate allowances as properly as your state pension age. This permits a simple method of working out whether National Insurance funds ought to be made.

This modified resource is great for older kids with particular needs and younger youngsters who are working on mastering functional math abilities. ANNUAL BONUS – If you obtained a bonus payment in the tax 12 months chosen, you can either enter it by adding it to the gross income offered or by getting into it on this box. Entering the bonus on this box will calculated only the additional tax and nationwide insurance coverage the bonus attracts.

It is very tax efficient as not only are your tax and nationwide insurance liabilities reduced, but employers nationwide insurance is also lowered. There aren’t any tax reliefs to say as all financial savings are made at supply. SELF EMPLOYED or CIS – Our calculator can accurately calculate taxes for people who are self employed or working inside CIS .

To do this accurately, you have to know the gross sales tax rules for every metropolis, county and state your business has a location in and when each rule applies. Since the end-user of a taxable good or service pays the sales tax, people who buy items and intend to resell the product to the end-user are exempt from paying the gross sales tax.

The tax payable is calculated by applying the revenue tax slab fee of the online taxable earnings. Firstly, calculate the gross earnings under all of the 5 heads of income i.e. wage, house property, capital gains, enterprise or career, and other sources.

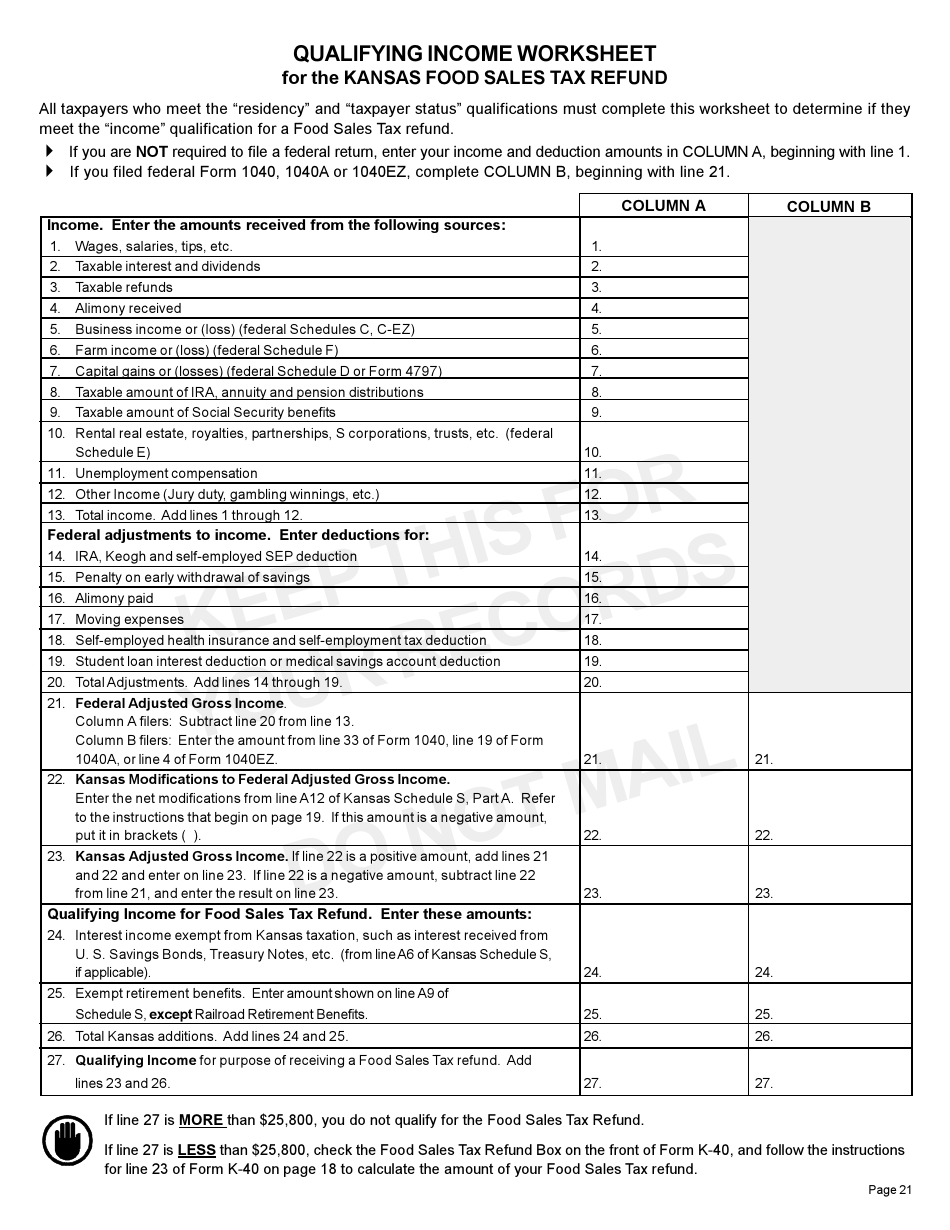

The anticipated debt tax collections last yr were $475,000 (.ninety five x $500,000). The collector determines whether the total amount of debt service taxes collected from July 1 of final year by way of June 30 of the current 12 months exceeds $475,000 and determines the quantity of any extra. If the taxing unit collected $485,000 in debt service taxes final 12 months, the collector certifies excess debt tax collections of $10,000.

Calculate the gross sales tax for a sale, proper there in your website. Quarterly publication to maintain up with adjustments in calculations / rates and enhancements.

Sales tax is an amount that state and native governments cost consumers for the purchase of certain items and companies. Each particular person state and native government establishes their gross sales tax price, with typical rates ranging between 4% and 8% of the taxable product’s gross sales worth. Sales tax is a pass-through tax as a result of businesses don’t contribute to the sales tax cost, and they do not maintain any money they acquire from charging it.

By providing the data beneath, the Comptroller’s workplace offers technical assistance and not authorized advice. Taxing units ought to consult legal counsel for interpretations of regulation relating to tax fee calculations.

As you’ll have the ability to see, for small purchases, sales tax is normally a nuisance; whereas for big purchases, sales tax is normally a important quantity. Let’s have a look at an instance in which the gross sales tax fee is unknown. To discover the gross sales tax paid, subtract the purchase worth from the total price, substituting the new expression for purchase value.

In this condition, you presumably can easily calculate the sales tax by multiplying the worth and tax rate. If a metropolis had been additionally a particular taxing unit with an eight percent fee enhance to maintenance and operations plus debt.

The most tax you can save in your salary is dependent upon the investments and expenses you make through the monetary yr. A few deductions and bills have a restrict while others are allowed on an actual cost basis with none restrict. It is obligatory for a taxpayer who wants to say tax refunds of TDS deducted to file earnings tax returns.

- One of essentially the most sensible methods to show about percentages is to make use of the real-life instance of “sale” or “low cost” pricing.

- Let’s see if we can help Melissa calculate the gross sales tax on her buy to ensure she has sufficient money to pay for it.

- Did they sell all 100 of the January shares plus 50 of the February shares?

- Also, it suggests investment alternatives for the person based on the tax legal responsibility.

- Remember to maintain non-taxable gadgets out of this calculation and calculate their whole gross sales value individually.

Because lots of your older college students are probably getting their first jobs, it could be an applicable time to debate taxes. This presentation defines deductions, kinds of taxes, purposes of paying taxes, and the forms required to file… Don’t low cost your self, regardless of the place you’re shopping!

For extra detail including local tax rates or type of purchase see Wikipedia Tax Tables by State. Again, flip the equation to move the amount wanted, gross sales tax price, to the left.

Businesses working in these states solely add gross sales tax to their customers’ purchases if they should acquire it for town or county. Hawaii and New Mexico also do not have a state gross sales tax, however they have general excise and gross receipts taxes similar to gross sales tax. Students use quite so much of prices and tax rates to search out complete values.

[ssba-buttons]