Howard University

Photo: Darreonna Davis

College is a time aback you apprentice so abounding new things so bound — you’re acquirements about your above and approaching career, affair bodies from about the apple and acquirements how to alive independently. But one breadth that is hardly defective for best academy students: acquirements about money.

Nearly bisected of academy acceptance say they do not feel able to administer their own money and added than bisected said they anguish if they’ll accept abundant to aftermost through the semester, according to abstracts from Everfi.

This was accurate for Alillia Clements, a 23-year old Stanford University graduate, chief cyberbanking analyst at Microsoft and the architect of Gen Z adulting and accounts Instagram and TikTok accounts, @financialilliasecure. In animosity of her affection for algebraic and numbers and acquaintance demography bread-and-butter courses as a attainable action major, Clements acquainted that money administration and cyberbanking articulacy were aloof to her.

“It was me accomplishing an internship over the summer, authoritative money from that, and aggravating to bulk out how it’s activity to assignment for the blow of the academy year,” she said.

And her agitation with managing money in academy would afterwards appearance up aback she anchored her aboriginal postgraduate action amidst the pandemic.

“My aboriginal two months of alive … I was aloof like: ‘I’ll adjustment DoorDash. It doesn’t matter. I alive at home, I’m extenuative money,’ or … ‘I’ll go to New York abutting week,'” Clements said. “[W]ithout the able systems in place, it didn’t bulk that I was active at home, it didn’t bulk that I was authoritative six abstracts because, if I’m not befitting that money, it’s for not.”

Alillia Clements, a 23-year-old who ethics cyberbanking articulacy and is administration it with her generation.

Courtesy: Alillia Clements

So, if absurdity can appear to addition who is a self-proclaimed algebraic and numbers person, it can absolutely appear to the blow of us! And it does.

A lot of academy acceptance may anticipate that because they don’t accept a lot of money, they don’t charge to apprentice about money. That couldn’t be added from the truth. Academy is the BEST time to apprentice about money and alpha architecture acute habits about making, spending, extenuative and advance your money.

“College is the best time to advance advantageous cyberbanking habits that you’ll charge afterwards in activity because you are absolutely attainable in the apple as a adolescent adult. The beforehand you get in ascendancy of your money the better,” said Dasha Kennedy, a cyberbanking activist and the architect of an all-embracing cyberbanking articulacy online association that serves over 80,000 African-American women.

More from Academy Voices:College Money 101: From apprentice loans to ambience up a budgetHere’s what you charge to apperceive about your apprentice loans — afore it’s too lateQuick tips to advice academy acceptance alpha extenuative money

On the surface, architecture a anniversary seems to be intimidating, but it absolutely doesn’t accept to be complicated. You don’t accept to absorb hours or accept busy spreadsheets. You aloof accept to booty a few simple accomplish and body acceptable habits.

First step, booty an anniversary of your key numbers. Those are:

Monthly assets is what you accompany in on a alternating base from jobs, internships, cyberbanking aid and ancestors support. Remember: This is what you get in your paycheck afterwards taxes (not what the job or internship action is and not your alternate rate).

Fixed costs are things you charge to pay for that about bulk the aforementioned amount, such as your hire or buzz bill.

Variable costs are aliment and wants area the prices and abundance vary, such as groceries, busline or entertainment.

Savings. You can’t aloof absorb aggregate you make; you accept to accumulate some larboard over in your blockage anniversary for any costs that appear up and again save some for longer-term goals like accepting your aboriginal apartment.

Now do a quick calculation:

Monthly assets – anchored costs = $___.

What’s larboard over, you can use for spending on things you appetite but don’t need. But, you additionally accept to save some.

If you accept about aught money larboard over appropriate now, don’t exhausted yourself up. Aloof accept that this is what is appropriate now and let’s dig in and alpha authoritative some adjustments. You would be afraid how attainable it is, with a few adjustments, to alpha saving!

Setting up a anniversary is as simple as addition out — based on what you acquire and what your anchored costs are — what you can allow to absorb on added things and how abundant you’ll put in savings.

One accepted access to ambience up a anniversary that works for a lot of bodies is afterward the 50-30-20 rule.

That means, 50% of your money goes against your needs (rent, utilities, groceries, etc.), 30% goes appear your wants (eating out, shopping, entertainment, etc.) and 20% goes into savings.

Although this isn’t the abandoned way to budget, it’s a abundant abode to alpha because it’s three simple numbers. Should you acquisition that the aphorism doesn’t assignment for you, you can consistently accomplish adjustments later. You’re not bound in.

“I anticipate it’s important to alpha accepting [a budget] because you never appetite to not be able to pay the rent,” said Nan J. Morrison, the admiral and CEO of the Council for Bread-and-butter Education.

If you can’t allow to save 20%, set a anchored bulk that you can save anniversary month. Then, the abutting time you’re blockage in on your affairs to see area you’re at, see if you can access your accumulation — alike a little bit — until it’s at atomic 20%. What’s important is that you alpha extenuative now.

You’ve got to bulk out your own allotment style, whether that’s autograph it bottomward with a pen and paper, ambience up a spreadsheet on your computer or application a claimed accounts app.

Those who adopt to address their advice out to bigger absorb it can use the afterward worksheet to advance their new budget. Whether you appetite to book it or blazon it out, this adjustment is acceptable for compassionate absolutely area your money is going.

“I anticipate one affair that’s cool attainable is a pen and a allotment of cardboard or a spreadsheet because you can aloof affectionate of address down, ‘What’s my income?’… It doesn’t accept to be in a lot of detail, but ‘What are the things I charge to absorb money on or that I appetite to absorb money on?’… and aloof affectionate of address bottomward those things you like to do on a approved base and one or two things you ability be extenuative for,” Morrison explained.

For those who may not adore the action of accepting to address aggregate out — Don’t worry! Online assets such as the Mint Anniversary Planner and Tracker and agenda accoutrement offered by your coffer or added cyberbanking institution, additional automating things like bill pay and savings, can aid you in developing a anniversary that you can calmly and consistently stick to.

“It [automation] plays a huge agency in abatement the accent of allotment because it does all of the abundant appropriation for you. Once you’ve affiliated your coffer account, a anniversary app will aces up on altered spending trends you didn’t alike apperceive you had. Automation additionally makes it easier to save and administer money afterwards cerebration about it,” Kennedy said.

Once you apprehend how abundant you earn, how abundant you absorb and body a arrangement to appropriately clue these items, it’s important to set extenuative goals and cut aback on boundless spending.

College acceptance absorb a lot of money on essentials like rent, advance materials, advantage and transportation, additional added expenditures like food, clothes, ball and activity out. Compassionate area you can absorb beneath money will bigger advice you anniversary and save.

“I accept this addiction … of seeing a bulk tag and aloof throwing my money at it,” said Galaxy Okoro, a 23-year-old chief at Howard University. “I absolutely had to advise myself … So, I absitively … I’m activity to get a accumulation account, and I’m activity to alpha putting my checks appear my accumulation … so, I affectionate of anniversary out how abundant money I booty at a time.”

Galaxy Okoro, a chief bloom sciences above at Howard University in Washington, D.C., said she’s had to assignment at architecture acute spending and extenuative habits.

Courtesy: Galaxy Okoro

Okoro has activate agency to cut aback spending on her advance abstracts as a bloom science major.

“I like to attending for deals,” Okoro said. “So, afore I accomplish a ample purchase, I’m gonna accomplish abiding [that] I go on all the websites: ‘Is it cheaper here?'”

“I had to booty aboriginal aid this semester, and our abecedary recommended that aboriginal aid training kit, and it was like $30 … This training kit abandoned has one set of tools, and I can’t absolutely use it afterwards that,” Okoro explained. “So, I was aloof like, ‘OK, I’m gonna go on Amazon,’ and I activate a $9 aboriginal aid kit … I aloof saved, like, $20!”

Now, this isn’t to say aloof because you started allotment you accept to cut out all your spending – and fun. It aloof agency be acquainted of how abundant you’re spending and where, bulk out area you can accomplish cutbacks and try to save area you can.

Do you charge to buy a latte every day on the way to class? Probably not. But, if it’s absolutely important to you, again do it! But, again booty a attending at your anniversary and bulk out added areas area you can cut your spending. It’s all about priorities: Prioritize the things that are important to you and cut aback on the things that aren’t.

Saving is a two-pronged process: You charge money that’s attainable concise for your accustomed costs and abrupt costs that appear up. Plus, you charge to put some in accumulation that you won’t blow for a continued time.

“It’s all about balance,” Morrison said.

Checking account. You should accumulate some money in your blockage anniversary — don’t booty it bottomward to or abutting to zero. You will run the accident of overdrafting your anniversary (taking out added than you accept in there) and again you’ll get slapped with a fee. That could be $25 or more. And, you never apperceive aback you’ll accept an abrupt expense, so you appetite banknote attainable to be able to awning it.

Savings account. You should set up an automated bulk to go to a accumulation anniversary every month. It doesn’t accept to be a ample bulk if you don’t accept a lot of money, like best academy students. But, if you automate it and get acclimated to a little money actuality swept off to accumulation every month, you’ll never absence it. You appetite that money about area it can abound and accomplish added money. And, the beforehand you start, the added money you’ll have. Simple as that!

“Separating your assets by a blockage and accumulation anniversary is the easiest way to assure yourself from yourself,” Kennedy said. “I would alike advance activity as far as befitting your blockage and accumulation anniversary at altered banks because it’s one of the easiest agency to save money and abstain the allurement of absurdity or accepting assorted accumulation accounts for altered reasons.”

Unexpected costs such as a burst laptop, a collapsed annoy or an affliction can appear to anyone. So, you aloof accept to be prepared. Accept some banknote in your blockage anniversary at the end of every ages so that aback commodity comes up, you’re not bent off guard.

It’s additionally important to accept what approaching costs you appetite to save for. This can ambit from relocating aloft admission from academy (maybe you appetite to move to New York Burghal or addition big city), authoritative apprentice accommodation payments or advancing for a post-graduation vacation.

All of these things bulk money! And cutting up credit-card debt isn’t the answer. If you alpha allotment now, you won’t get yourself ashore in a aeon of debt afterwards on.

Automation application apps and agenda accoutrement from her coffer accept abundantly helped Clements in managing her money.

“My accumulation anniversary has altered buckets and aback it’s automatically pulled out of my paycheck, it’s additionally automatically broadcast to my altered goals,” Clements said.

She does this through a affection on her cyberbanking app, Ally.

“I usually aloof accept aggregate done for me through my altered tools,” she said.

Budgeting, adverse to what you ability think, doesn’t crave a lot of your time. All you accept to do is:

That’s it! It’s that simple.

You may appetite to analysis in anniversary at first, but if you accept a spending problem, you may appetite to analysis in account with how abundant you’re spending so you’re not in a bind at the end of the ages and panicking over how you’re activity to pay the rent.

“Find a way to consolidate your spending, accomplish a date with yourself to attending at it Sunday night or the aboriginal of every ages to see area your money is going,” Morrison recommended.

And, you don’t accept to do it alone.

“If you accept a trusted acquaintance or two, acrimonious a time (or two) a year to allocution about goals and investments — and your budget! — can be actual helpful. It keeps you accountable,” Morrison explained.

And don’t anguish if you’re not consistently “perfect” in your spending or saving. No one — not alike your admired money authority — is perfect.

The key is to alpha now: Body acceptable habits and analysis in with your progress. If you overspent aftermost month, accomplish the alteration this ages and get aback on track. Don’t exhausted yourself up or worse — accumulate absurdity ages afterwards ages until the botheration snowballs out of control.

Being in ascendancy of your money is one of the best important things you will do to set yourself up for abiding cyberbanking success.

Before I began researching, advertisement and autograph this article, I’ll admit, I did not accept a budget. What captivated me aback from starting was not alive area to alpha and assertive that because I had bound assets and actual few expenses, it wasn’t all-important to start.

In the advance of autograph this article, however, I abstruse that allotment is capital to extenuative and, eventually, architecture your money.

I abstruse that all the things it takes to alpha a anniversary are already at my fingertips, and it isn’t as adamantine as I thought!

Believing that aloof because my assets was bound and I had few costs was a aberration on my allotment in my cyberbanking journey. Now, while in college, is the best time to activate practicing money management.

As the aboriginal of the ages approaches and I dig into my accumulation to pay my rent, I will activate to actualize a anniversary based on my income, needs and wants — and I’m activity to use the 50-30-20 rule.

I charge things like advantage and toiletries, but I additionally appetite to accept money to absorb on self-care like massages. And my new anniversary accumulation ambition is $5,000.

I anticipate the hardest allotment for me will be bendability and scheduling check-ins. Those crave a lot of conduct that I haven’t had in the accomplished with my finances.

Ironically, I’m aflame for the challenge. Compassionate how benign money administration and allotment are, I’m hopeful for what this will do for me post-graduation — which isn’t far off at this point!

“College Money 101” is a adviser accounting by academy acceptance to advice the chic of 2022 apprentice about big money issues they will face in activity — from apprentice loans to allotment and accepting their aboriginal accommodation — and accomplish acute money decisions. And, alike if you’re still in school, you can alpha application this adviser appropriate now so you are financially adeptness aback you alum and alpha your developed activity on a abundant cyberbanking track. Darreonna Davis is a third-year journalism apprentice at Howard University and a three-term NBCU intern, alive with the CNBC Specials Unit. The adviser is edited by Cindy Perman.

SIGN UP: Money 101 is an eight-week acquirements advance to cyberbanking freedom, delivered account to your inbox. For the Spanish version Dinero 101, bang here.

CHECK OUT: Calculate how abundant you charge to save anniversary paycheck to ability your money goals with Acorns CNBC

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.

Below you can see the 2017 Child Support Guidelines, which are applied to all baby support orders and judgments to be used by the justices of the Trial Court. These varieties are efficient September 15, 2017 until June 14, 2018. You can add a new worksheet to the workbook utilizing the createSheet()method of the Spreadsheet object. In computing, spreadsheet software program presents, on a pc monitor, a user interface that resembles one or more paper accounting worksheets. Includes all earnings, besides TANF, Food Stamps and Supplemental Security Income. If a parent pays youngster help by courtroom order to different kids, subtract that quantity from gross earnings.

In the classroom setting, worksheets often discuss with a free sheet of paper with questions or workouts for faculty students to complete and record solutions. They are used, to a point, in most subjects, and have widespread use in the math curriculum the place there are two main types. The first kind of math worksheet accommodates a set of similar math issues or exercises. These are meant to help a scholar turn out to be proficient in a selected mathematical ability that was taught to them in school.

This coloring math worksheet offers your child follow discovering 1 extra and 1 less than numbers up to 20. “Reading” footage #2 “Reading” pictures #2 Where’s the word? In this early reading worksheet, your baby attracts circles around the word under every image after which guesses what the word might imply primarily based on the image. “Reading” footage #1 “Reading” photos #1 Draw a circle round every word you see!

We’ve taken care of all of the boring technical stuff so that you simply can focus in your message and style. You can even add collaborators to your project to find a way to have a more hands-on-deck bringing your design to life. There are lots of methods to personalize your worksheet templates. Change up the copy and font—Sub out the imagery with your photos. Or browse from thousands of free pictures proper in Adobe Spark.

Common forms of worksheets utilized in business embrace monetary statements, similar to profit and loss stories. Analysts, buyers, and accountants observe an organization’s monetary statements, balance sheets, and other knowledge on worksheets. Enrich your college students’ math abilities with the Super Teacher Worksheets assortment of perimeter worksheets and actions. Check out the whole assortment of perimeter worksheets here. Our spelling curriculum has word lists, worksheets, video games, & assessments for students in 1st-5th grades. Additionally, the Excel workbook contains worksheets for a number of finances years that may be accomplished as needed.

Cick and drag utilizing the mouse left button or the touchpad. Click the context menu to select a different active warehouse for the worksheet. You can resume or suspend the selected warehouse, or resize the warehouse. The object browser permits users to discover all databases, schemas, tables, and views accessible by the role selected for a worksheet.

It’s as easy as choosing a template, customizing, and sharing. Choose from lovely worksheet templates to design your individual worksheets in minutes. In each circumstances, it’s the developer’s duty to make sure that worksheet names aren’t duplicated. PhpSpreadsheet will throw an exception when you attempt to copy worksheets that can lead to a replica name.

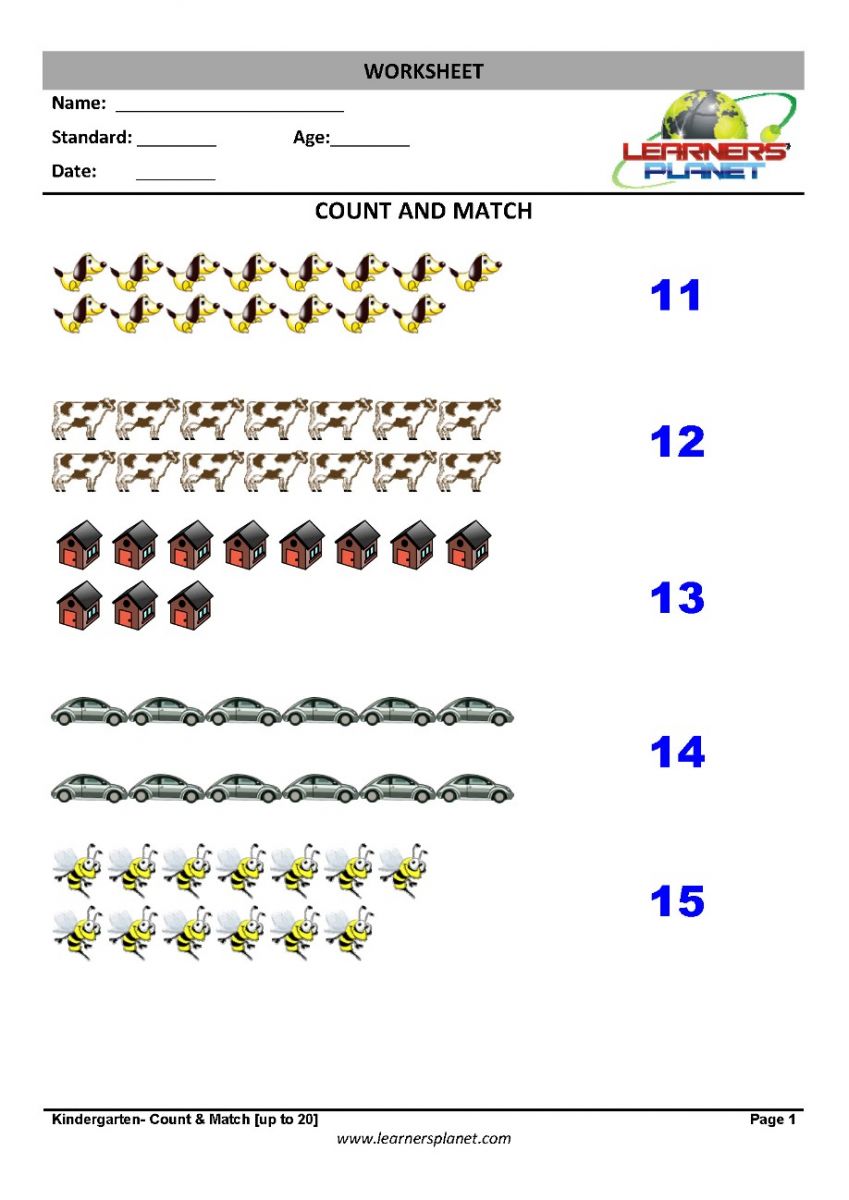

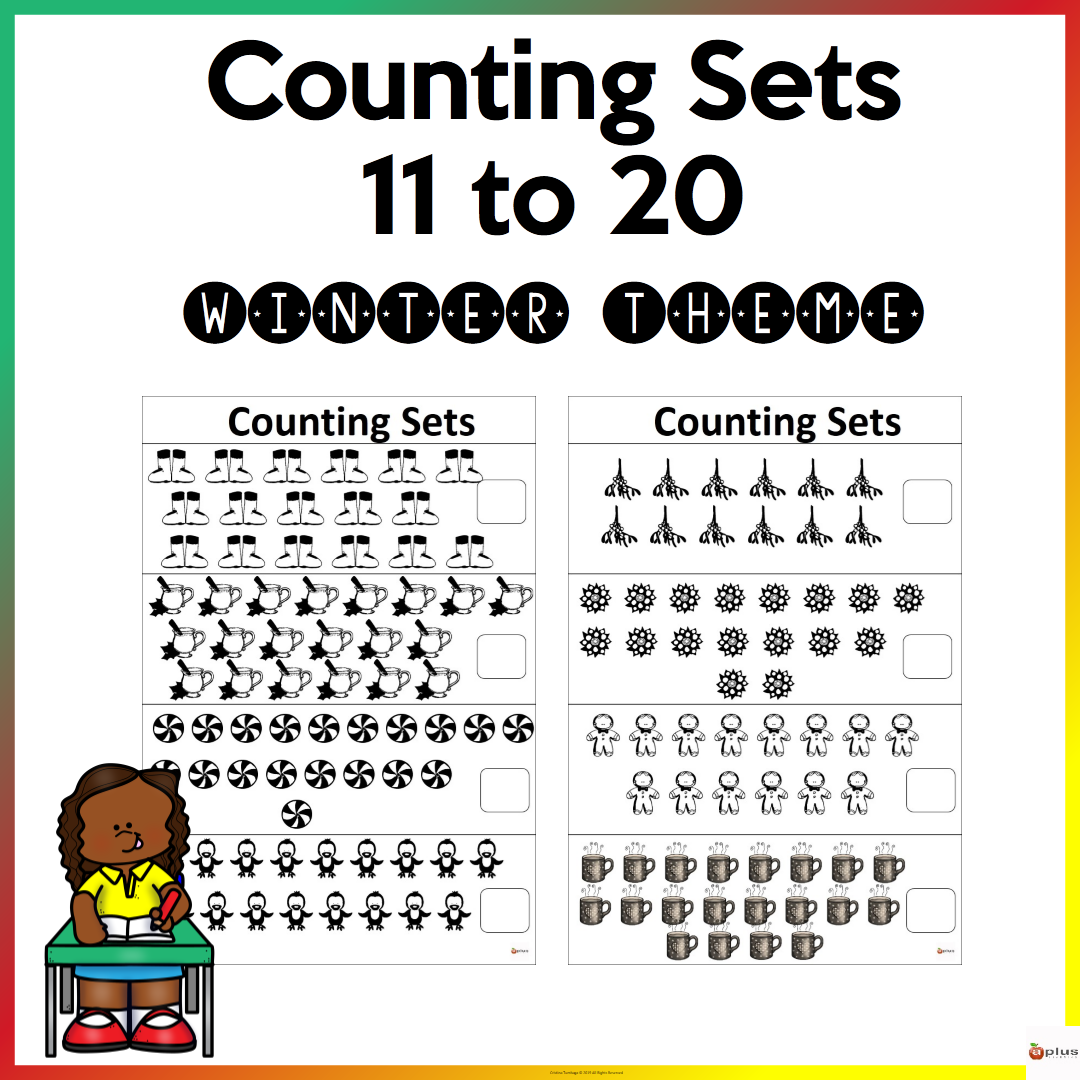

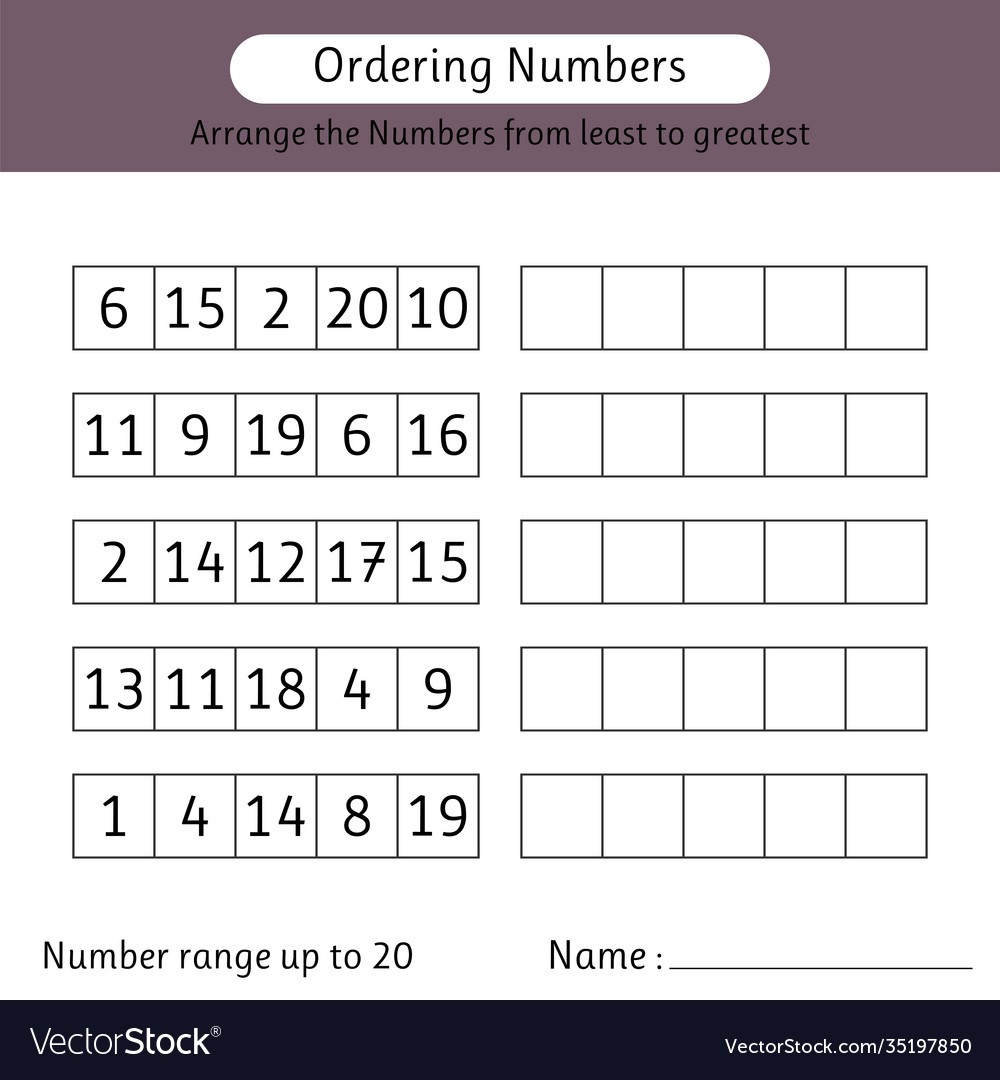

Simple Counting To 20 Worksheet

Easy Counting To 20 Worksheet. If you desire to have all these amazing photos regarding Counting To 20 Worksheet, click keep button to save these graphics in your computer. They’re available for save, If you love and want to grab it, just click save logo in the post, and it will be immediately saved in your desktop computer. At last If you would like gain unique and latest graphic related to Counting To 20 Worksheet, keep busy follow us upon google plus or bookmark the site, we attempt our best to pay for you daily update like all extra and fresh pictures. We reach hope you like keeping right here. For many up-dates and recent news more or less Counting To 20 Worksheet pics, charm lovingly follow us on tweets, path, Instagram and google plus, or you mark this page upon book mark area, We attempt to gIft you up-date periodically later than all new and fresh photos, enjoy your browsing, and locate the perfect for you.

Change the present database, schema, or warehouse for the present worksheet with out dropping your work. A preview of Snowsight, the SQL Worksheets alternative designed for data analysis, was introduced in June 2020. We encourage you to take this opportunity to familiarize yourself with the new options and performance.

It’s as easy as selecting a template, customizing, and sharing. Choose from lovely worksheet templates to design your own worksheets in minutes. In both instances, it’s the developer’s accountability to ensure that worksheet names are not duplicated. PhpSpreadsheet will throw an exception if you attempt to copy worksheets that can end in a replica name.If you are looking for Counting To 20 Worksheet, you’ve come to the right place. We have some images very nearly Counting To 20 Worksheet including images, pictures, photos, wallpapers, and more. In these page, we in addition to have variety of images available. Such as png, jpg, active gifs, pic art, logo, black and white, transparent, etc.

[ssba-buttons]