Click on this angel to see a complete assets table.

You can now get banking advice to lower the bulk of your account bloom insurance. These FAQs will explain what you charge to apperceive aback applying for banking advice for bloom insurance. They will advice you accept how to address your income.

The bloom affliction law (known as the Affordable Affliction Act, ACA, or “Obamacare”) offers appropriate banking abetment to advice bodies pay for insurance. To get the help, you accept to buy allowance on your state’s Bloom Allowance Marketplace. For 2015, tax credits are accessible to distinct bodies who accomplish up to $46,680 a year. A ancestors of four can accomplish up to $95,400 a year and get tax credits.

You can use these tax credits several agency to abate the bulk of your bloom insurance. For bodies whose assets is lower, you can additionally get cost-sharing reductions (lower co-payments, co-insurance or deductibles). A distinct being can accomplish up to $29,175 a year and get lower cost-sharing and tax credits. A ancestors of four can accomplish up to $59,625 a year and get cost-sharing reductions in accession to tax credits.

To bulk out if you authorize for banking abetment for 2015, your Bloom Allowance Exchange needs to apperceive your domiciliary income. The Exchange needs to apperceive how abundant you apprehend your tax household’s assets will be for the year you will accept the insurance. (For Medicaid, they will attending at your accepted account income.) That’s an accessible catechism to acknowledgment if you accept a abiding assets from a job or added regular, anticipated income. But it is not so accessible if you accept capricious or hard-to-predict assets from self-employment, sales commissions, melancholia work, or addition anatomy of income.

Click on this angel to see our alternate tax acclaim tool.

The Bloom Premium Tax Acclaim is a new way to lower the bulk of bloom allowance aback you buy it through the Marketplace. Because it is a tax credit, it lowers the absolute bulk of tax you owe the IRS. Or, if you don’t owe any tax, it increases your refund. You can use the tax acclaim alike if you did not accomplish abundant to book taxes aftermost year.

There are two agency to use the tax credit. You can get it “in advance” and use it to lower your account bloom premiums appropriate away. Or, you can delay until tax time and get the abounding bulk as a acquittance aback you book your taxes. Keep in mind, if you use it “in advance” you should alarm your Bloom Allowance Exchange to address any changes in assets or ancestors admeasurement during the year. Booty a attending at our tax acclaim apparatus to advice you accept bigger how the tax credits work.

Click on this angel for an annotated Anatomy 1040 that will appearance you what assets to count.

The ACA counts assets based on article alleged your “Modified Adapted Gross Income” (MAGI). MAGI is your taxable income, the assets you address on your tax return. For best people, MAGI will be the adapted gross assets (AGI) that is on your federal tax return. You can acquisition your adapted gross assets in the afterward places:

All Social Security allowances calculation appear MAGI, not aloof the taxable amount. Here’s an annotated adaptation of Anatomy 1040 that we apparent up to appearance what goes into MAGI.

If you don’t accept a antecedent tax acknowledgment to use or you anticipate you may be adequate for Medicaid, this worksheet can advice you apprentice added about MAGI.

Just like aback you complete your assets taxes, for the tax credits you address anybody in your tax household’s income. That agency you address your income, your spouse’s assets and the assets of any audience who are on your tax return.

The assets that you address should be for the year that you appetite bloom insurance. If you administer in November 2014 for allowance to alpha in January 2015, you will charge to appraisal your approaching assets for 2015.

If you are applying during the aforementioned year you will accept allowance (for example, applying in February 2015 for allowance that would alpha in March 2015), you would address your accepted assets for 2015.

If your assets is from a approved paycheck, it will be accessible to appraisal your assets alike if the year hasn’t ended. But if your assets is unpredictable, you may not apperceive your exact assets because it has not appear in yet. You ability accept to guess. Anticipate about what jobs you apprehend to assignment this year and how abundant you anticipate anniversary job ability pay.

If you filed a federal tax acknowledgment aftermost year, you can use it as a starting point. Attending for the Adapted Gross Assets you reported. Again add or subtract, depending on how you anticipate your assets ability change. Which jobs will be altered this year? Which jobs will be the same? Don’t balloon to abstract self-employment expenses.

It is important to be as authentic as you can aback ciphering your income. If you get beforehand tax credits and assumption your assets too low on your application, you may get too abundant tax credit. If you do, again you ability accept to pay all or allotment of the beforehand tax credits aback back you book your taxes. The bulk you owe will depend on what your final assets turns out to be.

But, if you estimated your assets too aerial on your application, the beforehand tax acclaim may be beneath than what you should get. If that’s the case, you will get the blow of the tax acclaim aback you book your taxes. You may alike get a tax refund.

One way to abstain attributable all or a allotment of your tax acclaim after is to alone ask for allotment of it in advance. You can still lower your account premiums that way. And you will get the blow of your tax acclaim aback you book your taxes. You can additionally booty none of the acclaim in advance. Again you would get the accomplished tax acclaim aback you book your taxes. We accept an alternate online apparatus that explains added about how the tax credits work.

The Exchange will analysis the assets you appear on your appliance and analyze it to what the IRS has on book for you. This is alleged “income verification.” The Exchange does this by electronically allurement the Internal Revenue Service (IRS) database and added databases if what you appear is the aforementioned as what they accept on file. The IRS will not allotment your claimed tax abstracts with your Marketplace. They will aloof acquaint the Exchange if the assets you appear does or does not bout what they accept on book for you.

The IRS advice comes from your latest assets tax return. Aback you administer for advantage in 2015, that’s apparently activity to be your 2013 tax return. If your assets has afflicted back then, your appear assets may not bout the abstracts on file.

If the Exchange can’t verify your income, you ability accept to accord them abstracts to appearance them what you say is adequate true. Many kinds of affidavit are acceptable.

If you cannot get any of the listed documents, do your best to accord the Exchange article that shows that you apprehend to accomplish the bulk of money you put on your application. Your exchange will accord you instructions on how to accelerate in your documents. Follow them anxiously so your paperwork doesn’t get lost.

This actuality area was produced by Julie Silas, Senior Attorney, Consumers Union at [email protected]. It is additionally accessible as a downloadable .pdf in English and Spanish.

Click on this articulation to appointment our bloom allowance page.

Visit our bloom allowance centermost to acquisition out how to select, obtain, and use all kinds of bloom insurance, including clandestine insurance, employer insurance, Medicare, and Medicaid.

Visit the reading comprehension web page for an entire assortment of fiction passages and nonfiction articles for grades one through six. Enter the cost paid by every mother or father for work-related child care. If the cost varies , take the total yearly cost and divide by 12. The custodial mother or father is the father or mother who has the kid more of the time. If every of you’ve the kid 50331c9020dfdbd549aa89609a583e1a7c082a44df14763cc6adf07aa8e26802fd of the time, choose one of you to be the custodial father or mother. Select Text AreaTo choose a textual content space, maintain down the or key.

The W-4 kind allows the worker to choose an exemption stage to scale back the tax factoring , or specify an additional amount above the standard number . The form comes with two worksheets, one to calculate exemptions, and one other to calculate the results of different earnings (second job, spouse’s job). The backside quantity in every worksheet is used to fill out two if the lines in the main W4 form. The major form is filed with the employer, and the worksheets are discarded or held by the employee. Many tax types require complex calculations and table references to calculate a key value, or may require supplemental info that’s only related in some instances. Rather than incorporating the calculations into the principle type, they’re often offloaded on a separate worksheet.

Eventually, college students will internalize the process and be in a position to undergo these 4 steps on their own every time they encounter a primary supply document. Remind students to apply this same careful evaluation with each primary supply they see. Use these worksheets — for photos, written paperwork, artifacts, posters, maps, cartoons, videos, and sound recordings — to show your students the method of document analysis. In accounting, a worksheet usually refers to a loose leaf piece of stationery from a columnar pad, versus one that has been certain into a bodily ledger e-book. From this, the term was prolonged to designate a single, two-dimensional array of knowledge inside a computerized spreadsheet program.

Check out our science web page for worksheets on popular science subjects. We have a vast assortment of activities for topics such as climate, animals, and far more. Make your own personalized math worksheets, word search puzzles, bingo video games, quizzes, flash playing cards, calendars, and rather more. Below you will find the 2018 Child Support Guidelineseffective June 15, 2018, which are applied to all baby help orders and judgments for use by the justices of the Trial Court. In addition, you’ll find a worksheet for calculating child help, and a memo describing the changes.

Change the present database, schema, or warehouse for the present worksheet with out dropping your work. A preview of Snowsight, the SQL Worksheets replacement designed for information analysis, was introduced in June 2020. We encourage you to take this opportunity to familiarize yourself with the model new options and functionality.

Visit the reading comprehension web page for a whole assortment of fiction passages and nonfiction articles for grades one via six. Enter the price paid by each mother or father for work-related baby care. If the cost varies , take the total yearly cost and divide by 12. The custodial father or mother is the parent who has the child extra of the time. If each of you’ve the kid 50331c9020dfdbd549aa89609a583e1a7c082a44df14763cc6adf07aa8e26802fd of the time, select one of you to be the custodial father or mother. Select Text AreaTo choose a textual content area, maintain down the or key.

Add Multiple CursorsTo add a number of cursors in the same worksheet, maintain down the or key and click in every new location using the mouse left button or the touchpad. The record of databases and other objects refreshes mechanically when the worksheet context is modified. Users also can click on the refresh button at the top of the object browser to view object adjustments immediately.

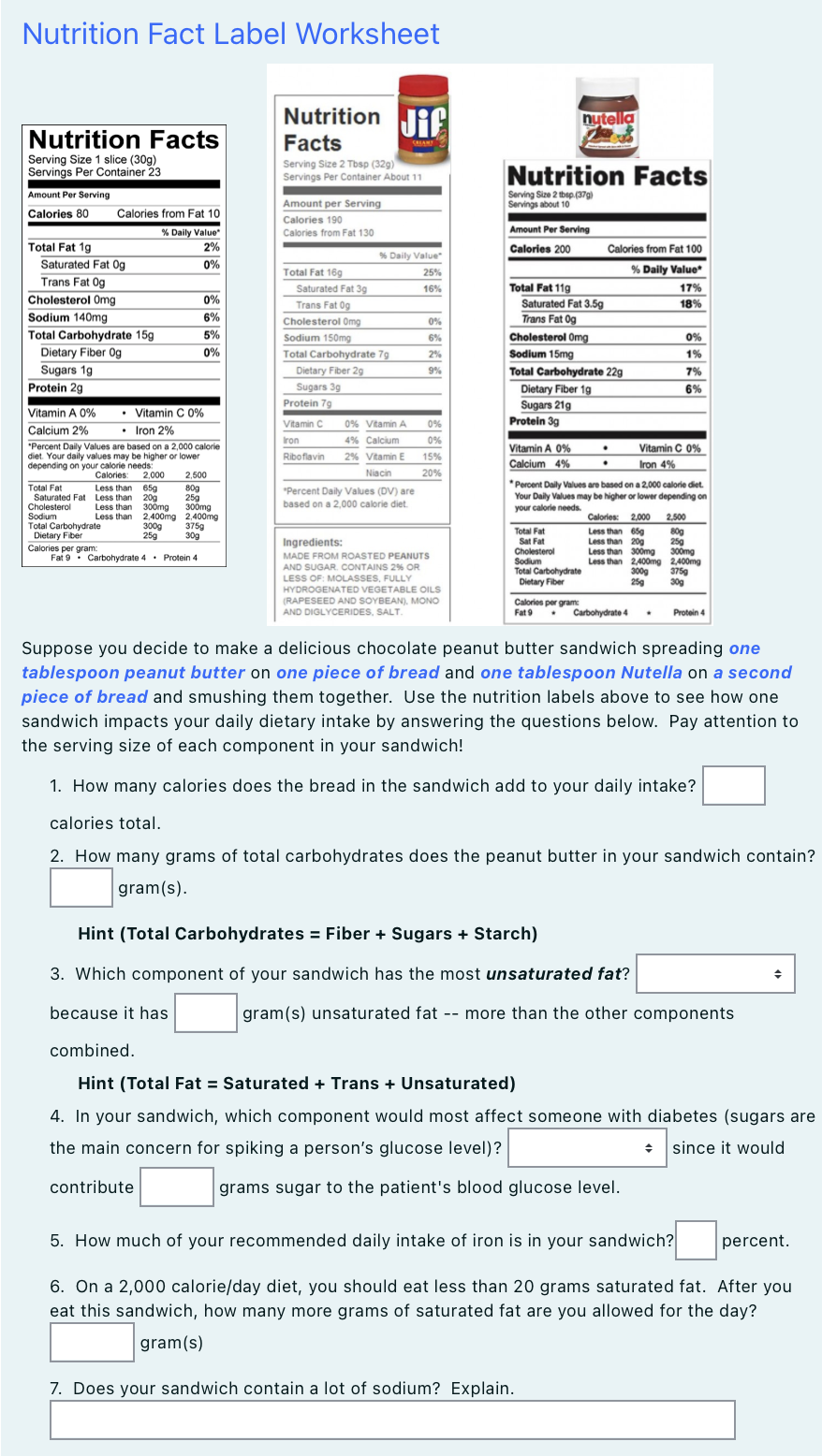

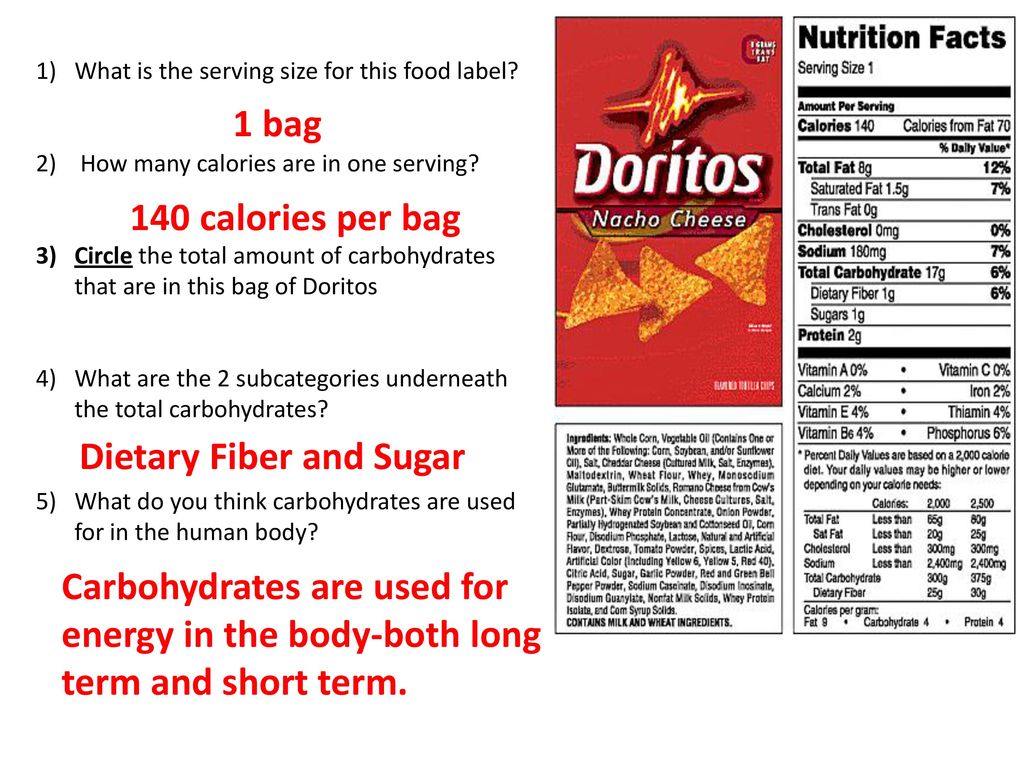

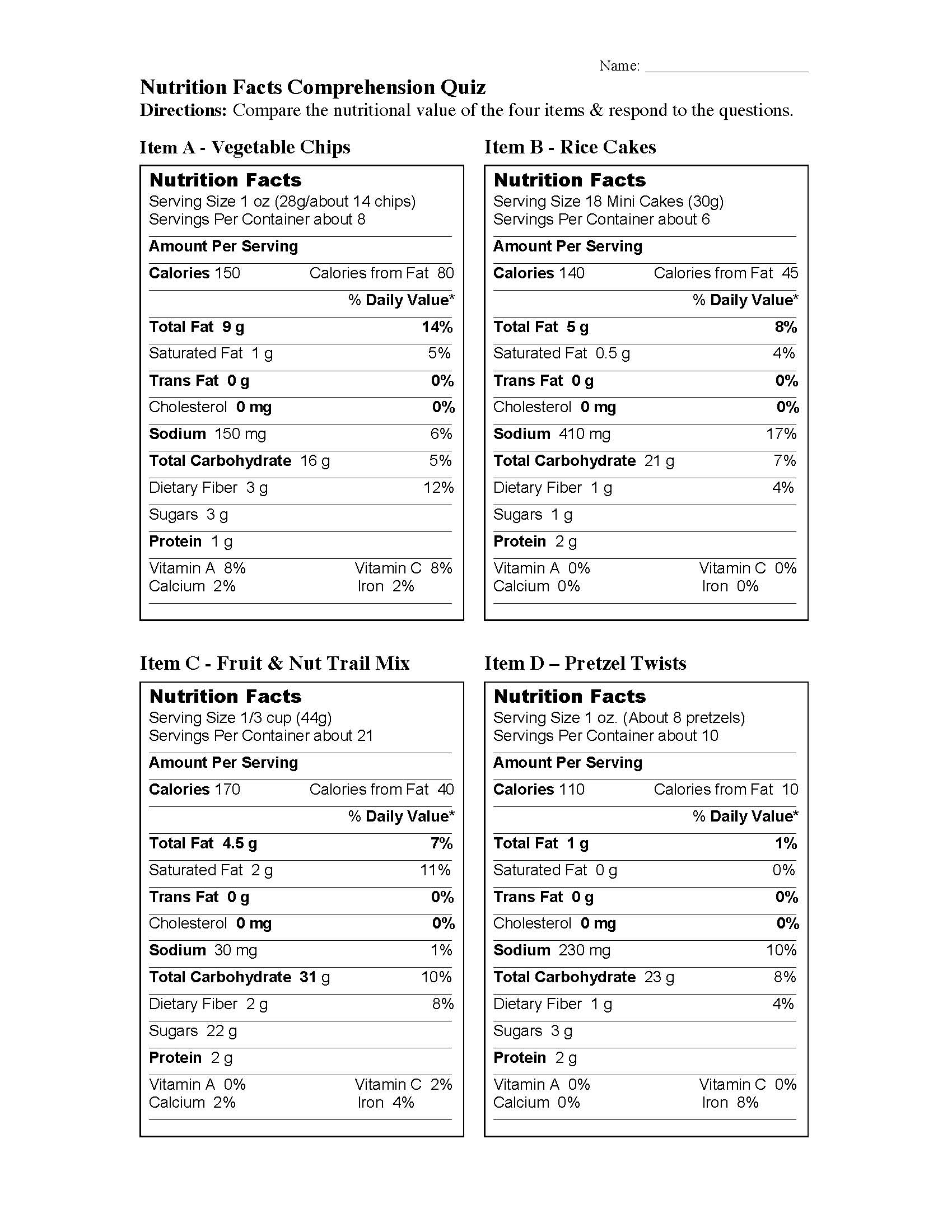

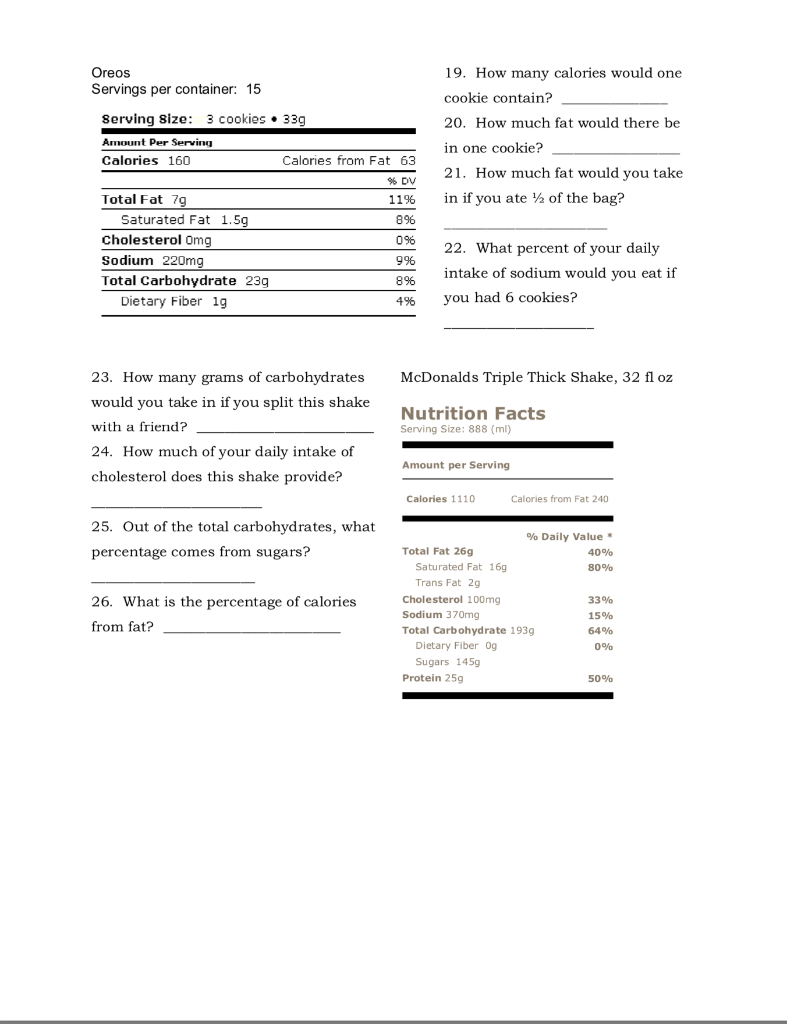

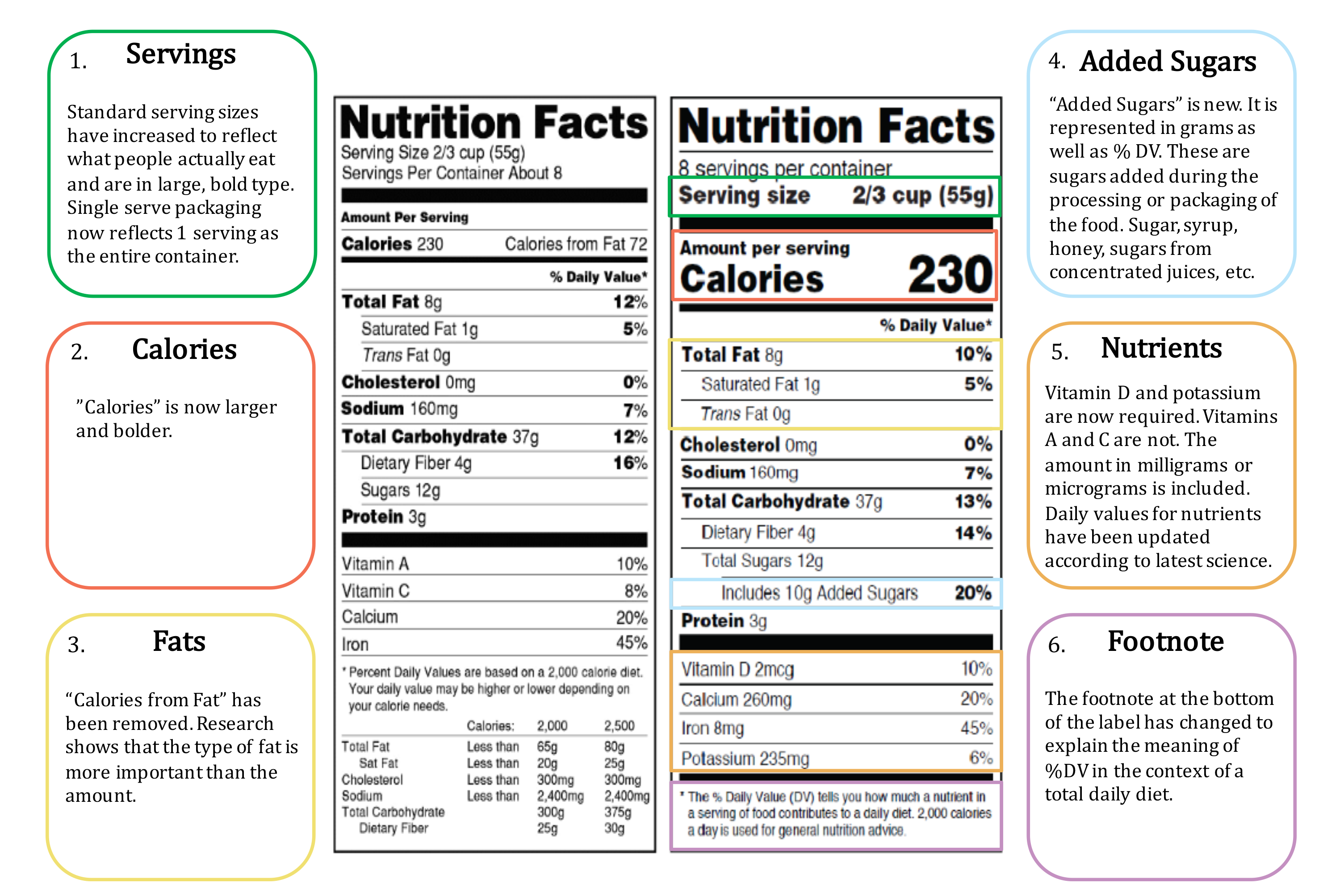

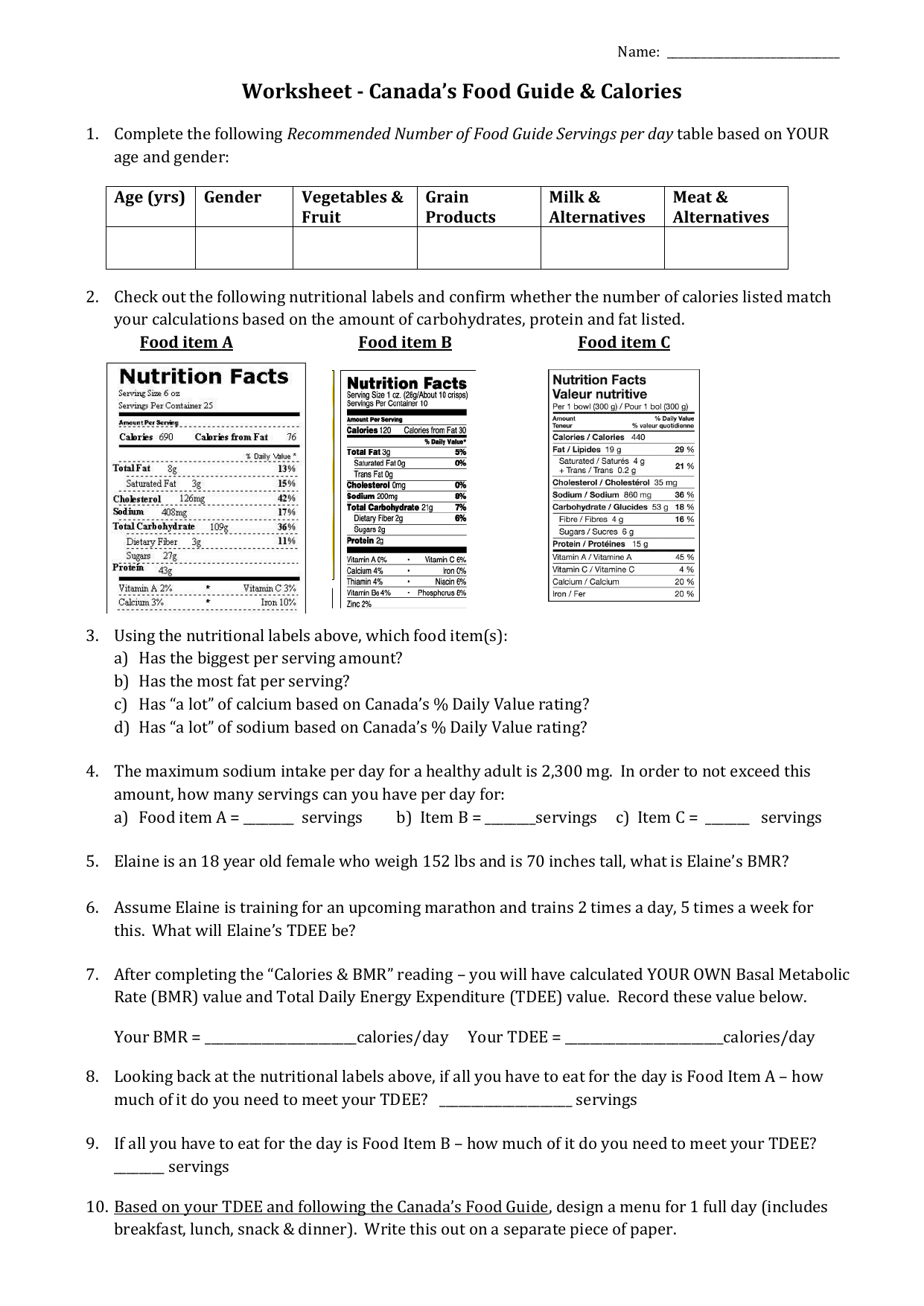

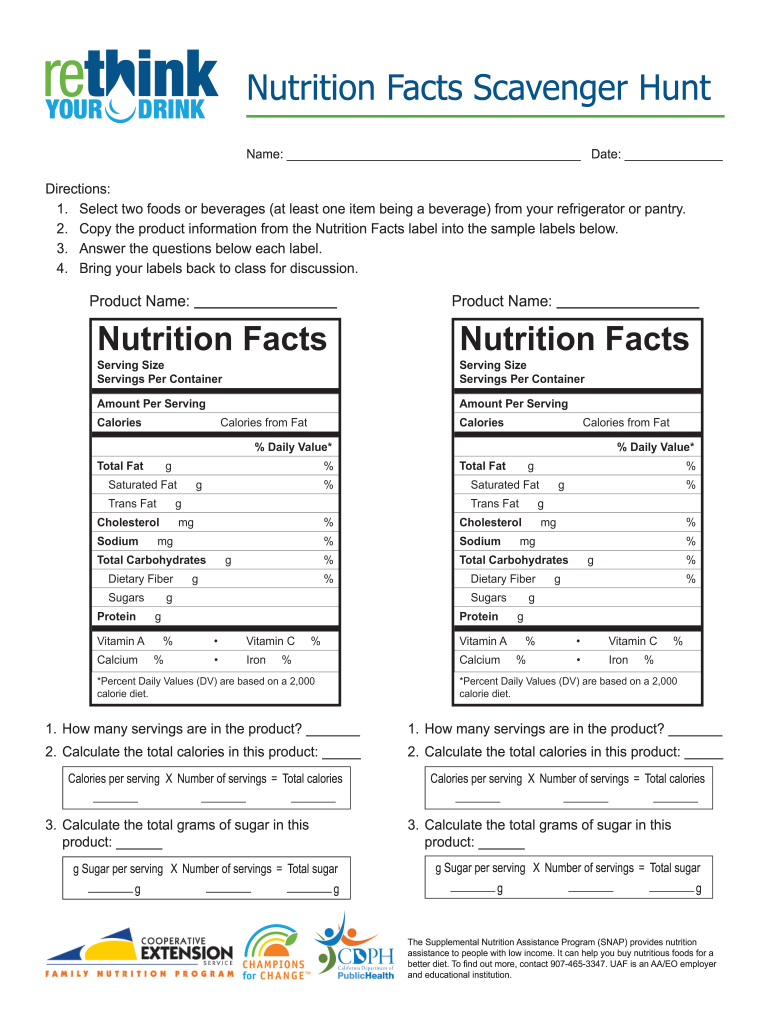

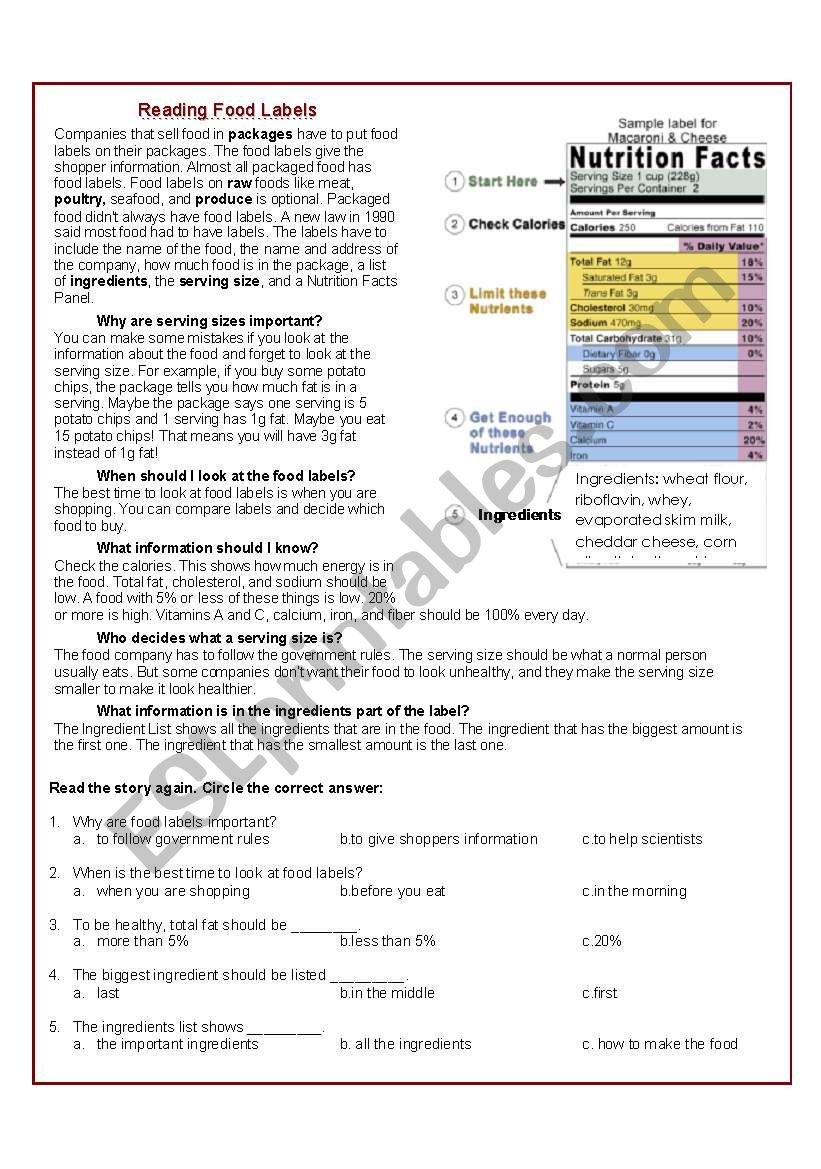

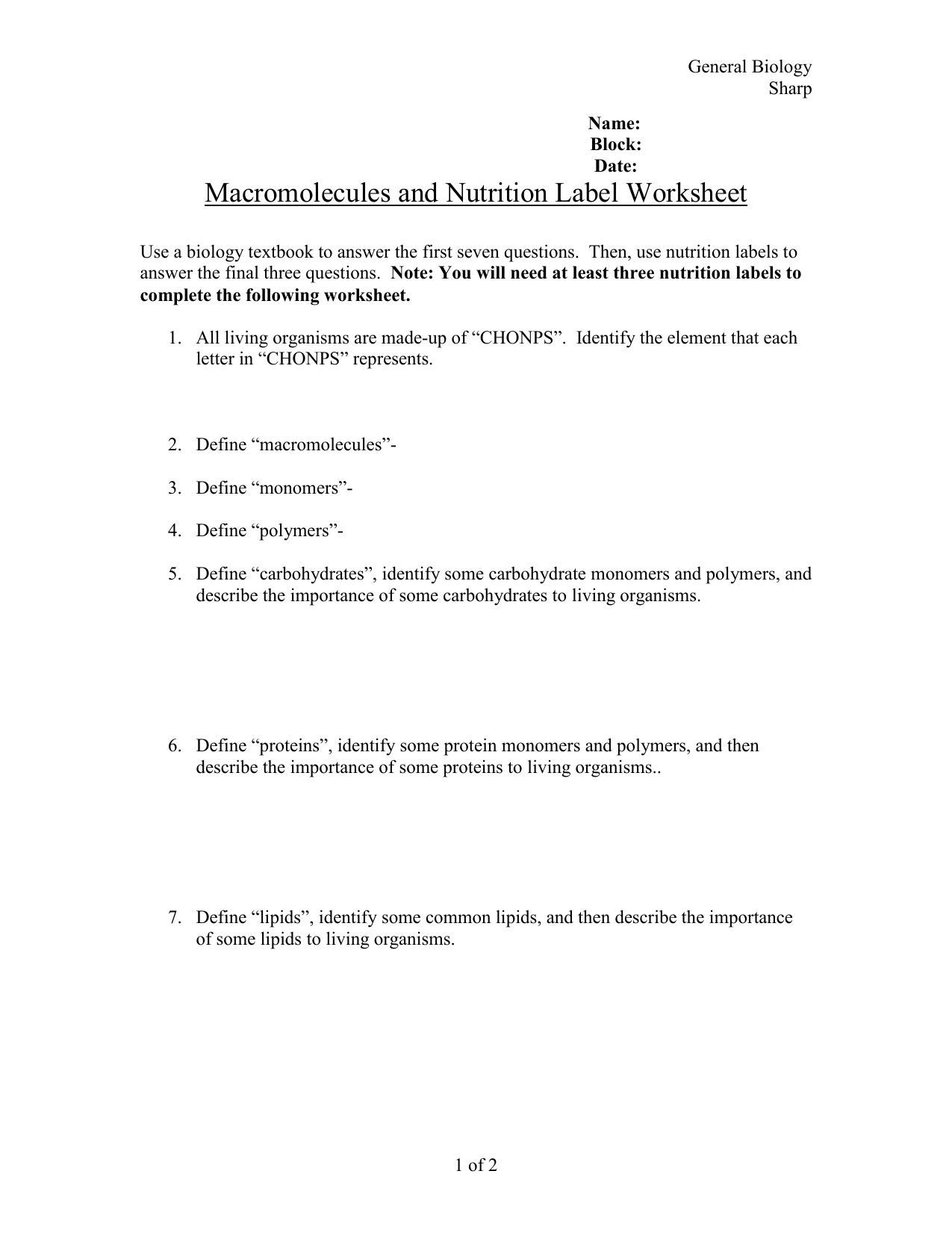

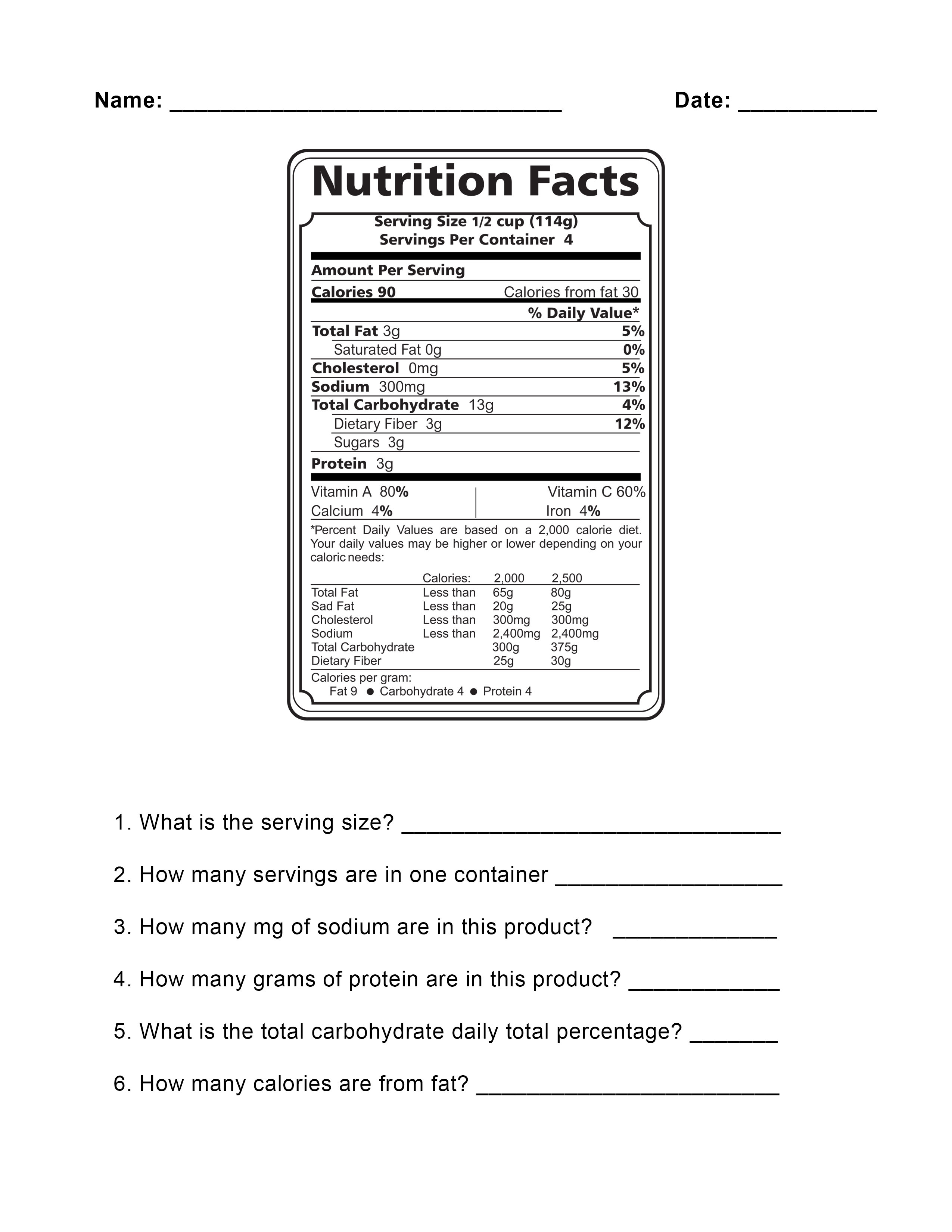

Best Nutrition Label Worksheet Answers

Charming Nutrition Label Worksheet Answers. If you’d next to secure all of these incredible images regarding Nutrition Label Worksheet Answers, click keep button to store the shots to your personal pc. They’re ready for download, If you love and wish to have it, simply click save logo in the page, and it’ll be directly down loaded to your pc. As a unquestionable point If you need to find unique and recent picture related to Nutrition Label Worksheet Answers, keep busy follow us upon google help or book mark this page, we try our best to give you daily up-date afterward fresh and new images. We pull off wish you love staying here. For many upgrades and latest information just about Nutrition Label Worksheet Answers photos, absorb kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark section, We attempt to gIft you update regularly bearing in mind all supplementary and fresh photos, love your exploring, and locate the perfect for you.

If you’re in the midst of working queries, they’ll resume working when the refresh is accomplished. Note that if you log off of Snowflake, any lively queries cease running. Specifying a unique role for each worksheet and switching roles with out losing your work. You can execute particular statements in a worksheet, then change roles before continuing your work in the identical worksheet. Snowflake retains the static contents of each worksheet, so you presumably can log in again later and resume working where you left off. Snowflake displays the worksheets that have been open whenever you logged out.

For full entry to thousands of printable lessons click the button or the link below. Printable phonics worksheets for elementary faculty college students. Teaching college students consonants, digraphs, two-letter blends and extra.If you are looking for Nutrition Label Worksheet Answers, you’ve come to the right place. We have some images virtually Nutrition Label Worksheet Answers including images, pictures, photos, wallpapers, and more. In these page, we as well as have variety of images available. Such as png, jpg, blooming gifs, pic art, logo, black and white, transparent, etc.

[ssba-buttons]