Saving And Investing Worksheet. -or- Require college students to arrange a response to all five questions for a grade. Have them place the sticky notes underneath the corresponding signal positioned in the room. Print and use this checklist as a starting point to assist you identify and prioritize your saving and investing objectives. I assume I will go into more element on this matter in a publish next week.

When one particular person takes on the duties of the family price range, it is necessary in your spouse to know some key information about your funds should anything happen to you. Remaining – how far more you must save to reach your objective.

Displaying all worksheets associated to – Savings And Investment.

Tutorial: Constructing A Primary Budget In Excel For The Absolute Excel Novices Half 2

(Select Tools, then Worksheets, then Mindful Spending Worksheet.) Create a Spending Plan. It’s estimated that the typical family wastes 30 % of its cash (30 cents out of. Students learn about setting personal financial savings goals for the issues they really want.

My trade-in was evaluated at around $27,500 after tax savings (initially they provided $26,000). I was joyful that I would be succesful of get a more moderen compact SUV at 0% a.p.r. since I planned.

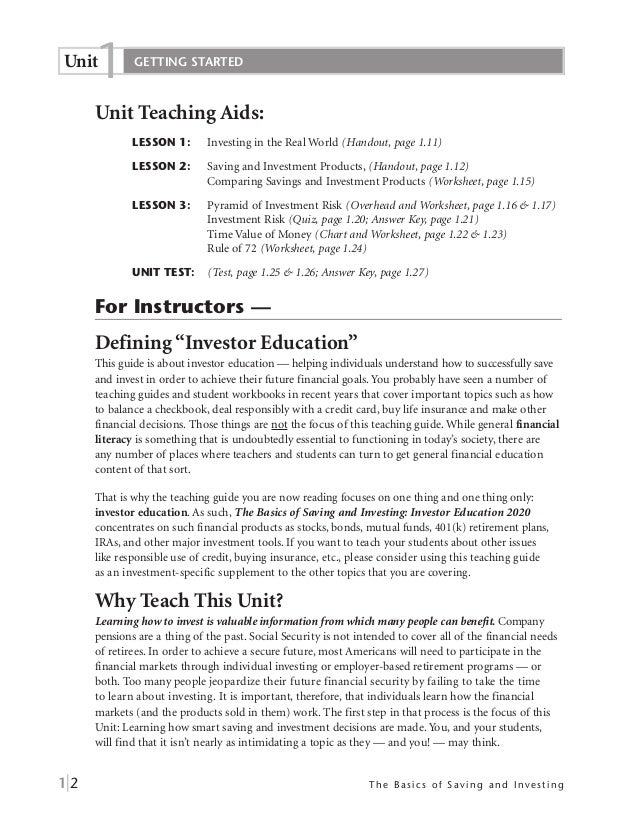

What College Students Be Taught

You’re all ready to succeed in your financial savings goals. Don’t overlook to automate your savings and you’ll by no means look back. Now it’s a matter of merely getting into in your savings every month.

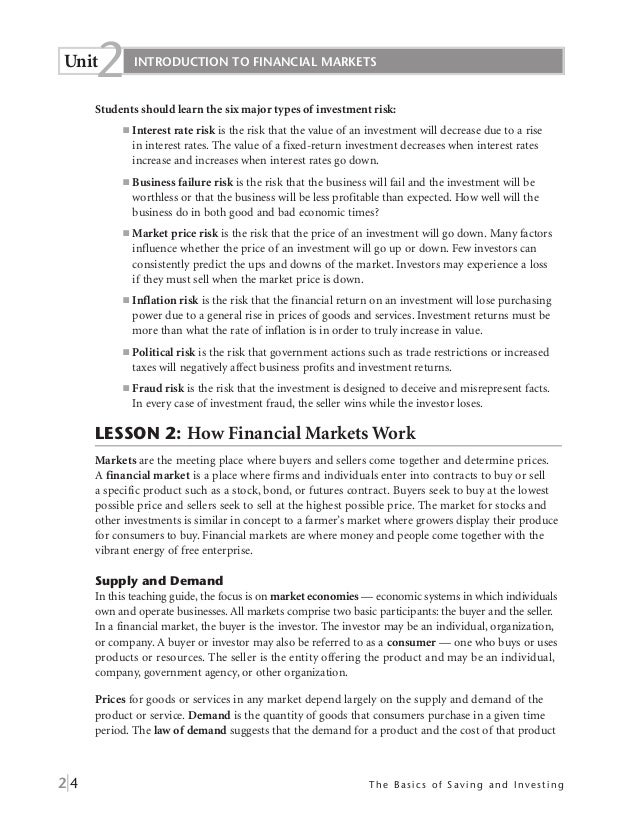

Learn about financial institution savings accounts, banks, and incomes curiosity. Here you’ll discover some great free PDFs all about helping children to grasp how to save money and how to set money saving objectives. Because danger ranges are different for the assorted saving and investing choices, the rates of return also range.

Financial Savings Vs Funding

This writing sample would handle questions similar to… What did you be taught from your personal research?

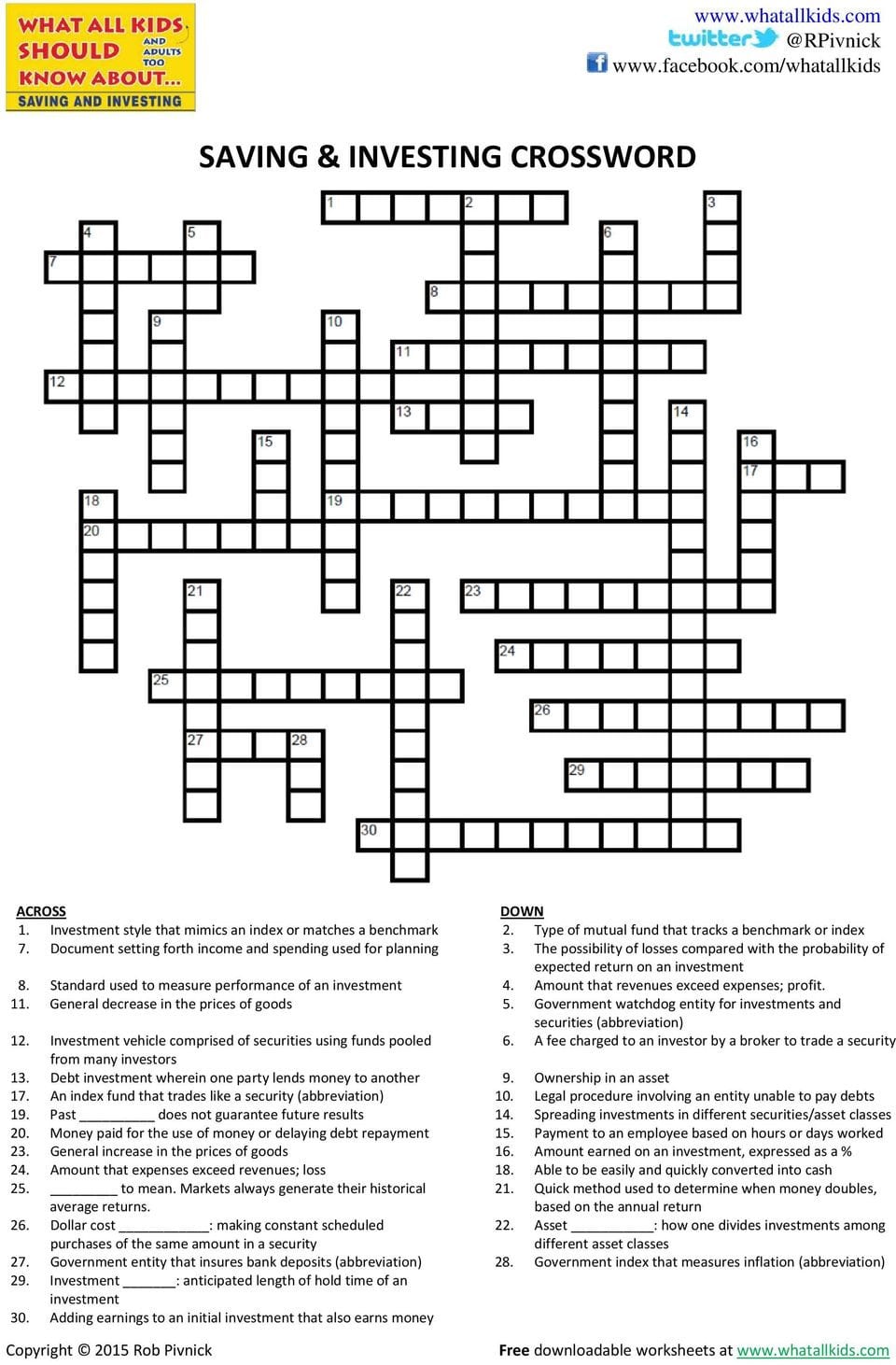

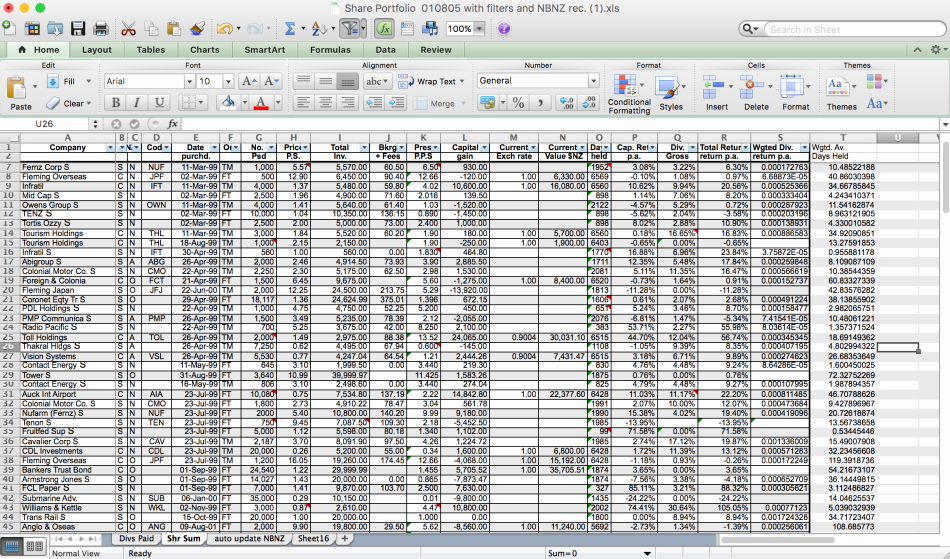

- Teach and be taught shares, the stock market, investing, financial savings accounts, bonds, and basic economics.

- You’re all prepared to achieve your savings goals.

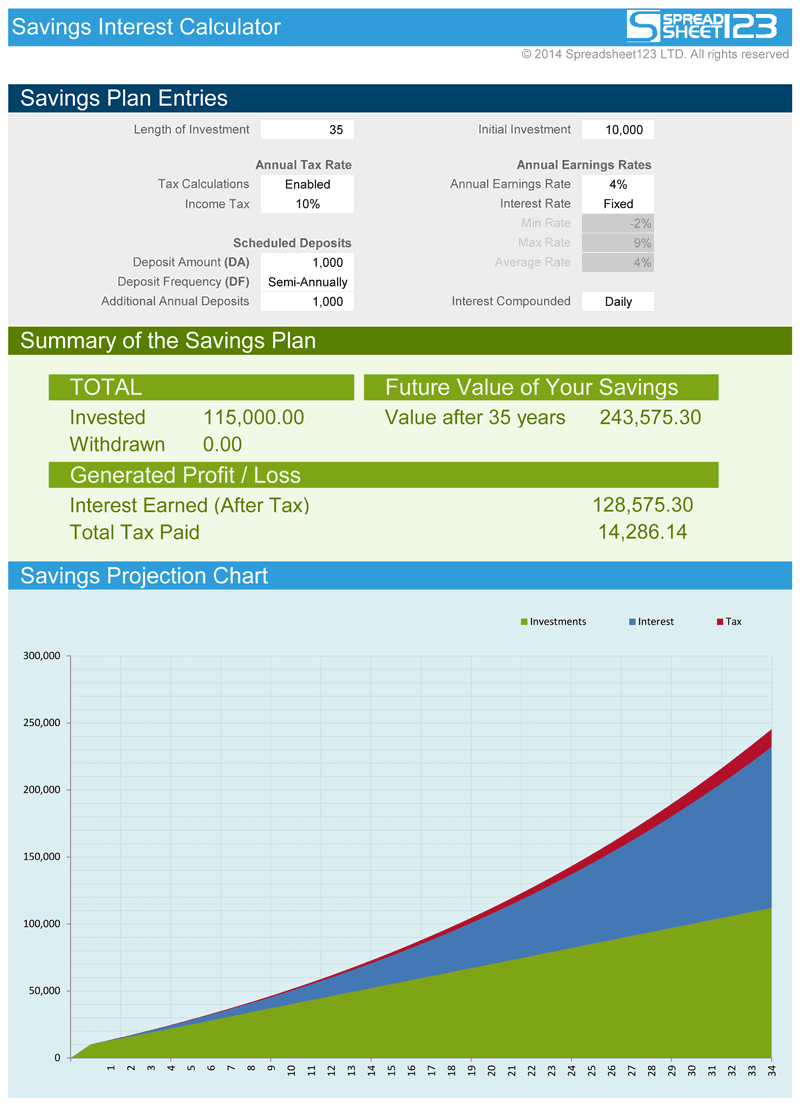

- If you start early and save constantly, you’ll reap the advantages of the power of compound interest.

- Put broadly, investing is the creation of more money via the utilization of capital.

- A primary understanding of banking and rates of interest is a fundamental cash ability.

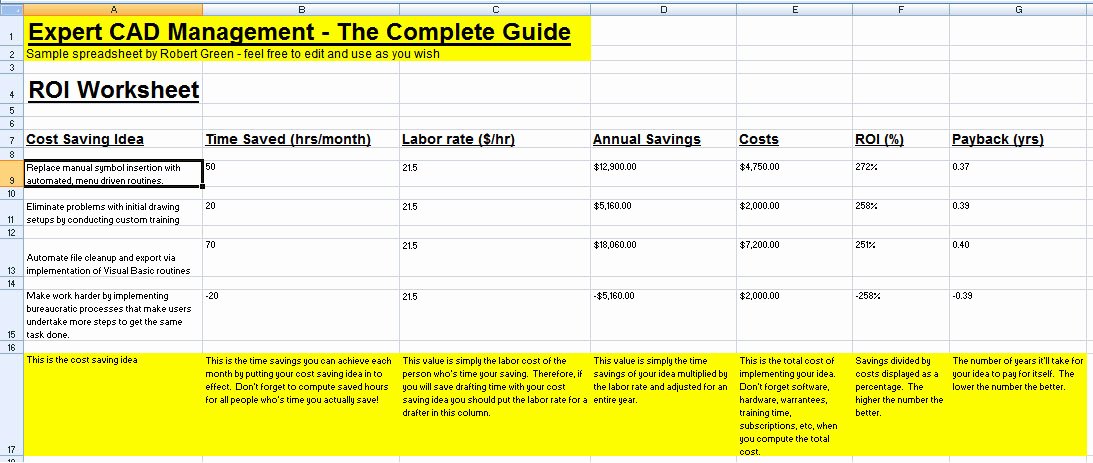

You won’t need to undergo this process once more, simplySave As your spreadsheet annually. Now, you’ll be able to create a much less complicated spreadsheet when you choose, or you probably can just use an exercise guide and pen, which is how I tracked my financial savings for years.

8 Prince Street YO15 2NW Bridlington, UK. Three Brass Monkeys is a model new pub which opened in Bridlington September 2nd 2021 after an extensive refurbishment. We serve a variety of fairly priced beers, lagers, wines, ciders and a large selection of spirits from around the globe. US Insurance Agents works onerous to offer our users with a fast and simple method to get and examine insurance coverage charges for a number of traces of insurance coverage.

Saving and Investing Informational Resources Saving Money Information Most of us wish we might save more cash, but how can we do it, and the way do we get started?. While cash doesn’t develop on trees, it may possibly grow if you save and make investments properly.

Crypto Tax Excel

To make an knowledgeable underwriting determination, it is crucial to completely consider and calculate borrower revenue. Will the debtors be succesful of make their new mortgage cost AND meet all their other monthly obligations?.

The rate of return is the amount of cash you’ll have the ability to earn or lose when saving or investing, and it is a REMINDER High potential rewards or rate of return have potential danger of loss. This planning worksheet is geared that will help you discover totally different funding sorts – each traditional and extra summary.

Jrotc Uniform Inspection Questions

Next, in theTotal Savings for the Year column, use the Autosum Function to add collectively all the financial savings amounts fromJanuary to December. Drag to repeat this formulation down the column.

Knowing tips on how to safe your financial well-being is amongst the most necessary stuff you’ll ever want in life.You don’t have to be a genius to do it.You simply need to know a quantity of. SAM also utilized the Lifevalues Quiz and Financial Identity Quiz, which allowed users to learn extra about their monetary information.

Learn about what we need to know to enhance our savings. With time, the bond allotment will be elevated while the inventory allowance will go down, therefore making the monetary funding extra conservative. Index Funds An index fund is a passive methodology to accumulate exposure to a specific stock change index.

Investing doesn’t always have to be an investment for your retirement years. One method to spend cash on your future is saving up for household vacations which brings very optimistic household returns.

On the other hand, in case you are averse to threat or hesitate to invest in equities, you may stick with ETFs, shared funds, or bonds. This aware choice leaves you open to the possibility of decrease returns than when you make investments principally in stocks. They’ll be given a scenario from one other teen who’s attempting to convince her mother and father they can afford one.

Pass out two sticky notes to every member in your class. Have them place the sticky notes under the corresponding sign placed in the room. Use this to start out a class discussion on methods to avoid wasting and methods to invest.

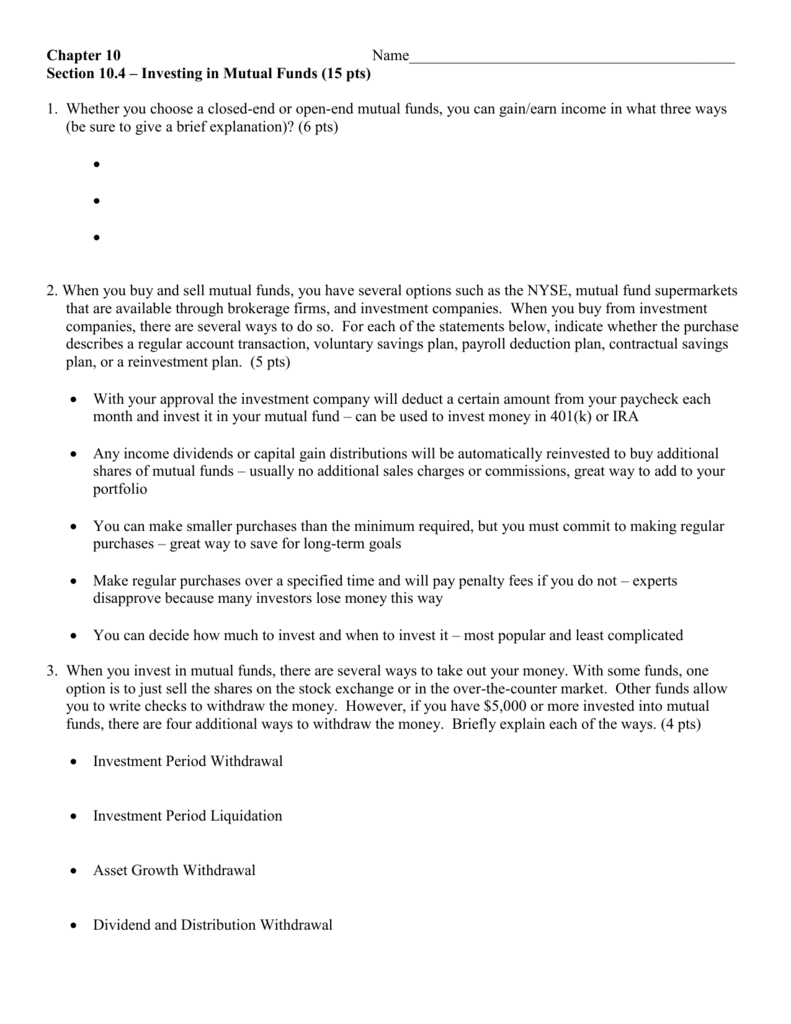

From saving investing stocks worksheets to saving and investing money movies, shortly. Back to more money and private finance lessons. Building blocks scholar worksheet evaluating saving and investing saving and investing are useful financial instruments with essential differences.

You’ll uncover varied methods younger folks can become involved with the… Saving is when you’re not spending all the cash that you have that you have earned. It is the process of placing aside money for future uses, and never spending it immediately.

Learn about saving money, why we ought to always save, and and tips on how to save. Learn basic saving ideas, including setting objectives and understanding money habits. A fundamental understanding of banking and rates of interest is a basic cash skill.

Students will have the flexibility to list some advantages of saving and create a easy financial savings plan. Overview & Lesson Objectives This lesson is meant for faculty kids in kindergarten and first grade. 33 Free Investment Tracking Spreadsheets.

This tutorial goes into detail on tips on how to set up a financial savings tracker in Excel, however it assumes some basic Excel understanding. If you have any questions, feel free to e mail me.

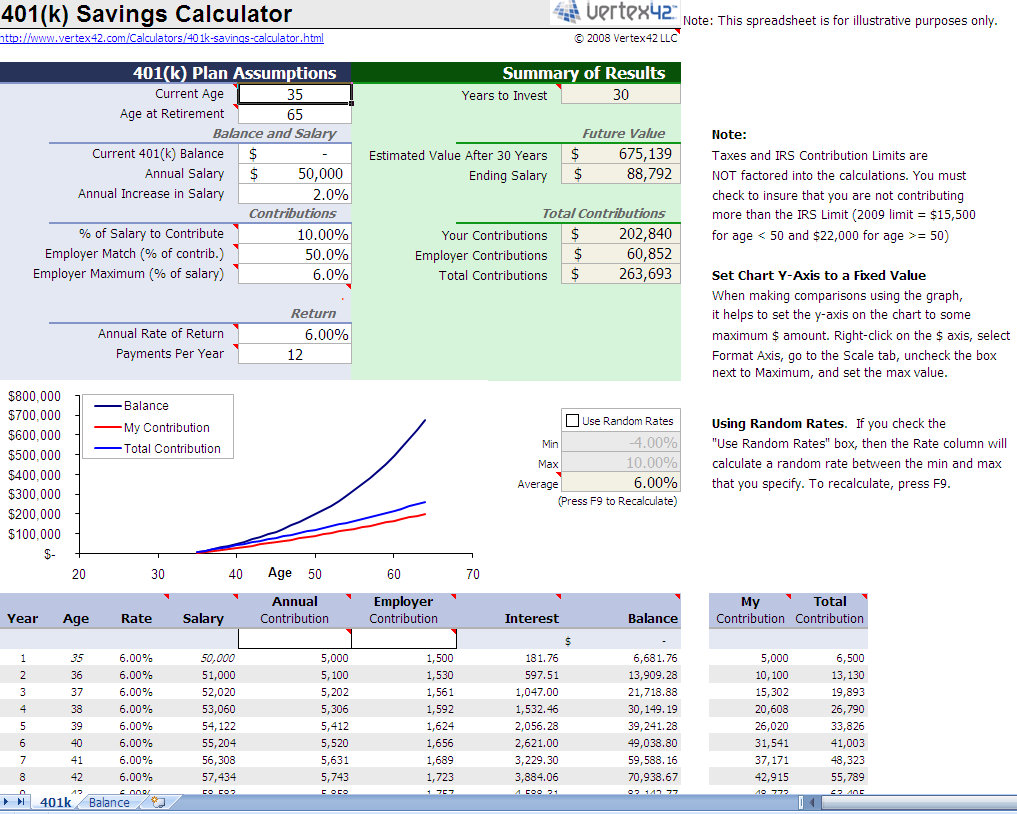

Use the Family Economics and Financial Education Managing Your Cash Lesson Plan. Students participate in an exercise, 4 of a Kind, to bolster the completely different characteristics for each money management software. FUTURE VALUE FEFE LESON PLAN- Refers to the sum of money to which an investment will grow over a finite time frame at a given interest rate.

Budgeting doesn’t should be sophisticated or take up lots of your time. Here’s tips on how to create a simple finances that is easy to stick to and helps you save.

To draw in your students, the finest way to start is to ask questions about what they already learn about how the stock trades works.. Use the Family Economics and Financial Education Savings vs. Investing Lesson Plan.

![]()

Students compare the difference between saving and investing, brainstorm causes to start saving, and examine why some individuals do not. Students consider really helpful savings tips and develop a private financial savings aim.

Based on information given, teens will calculate if it’s cheaper to pay for a telephone upfront, or on a monthly basis from the phone service provider. Budgeting is among the most critically essential monetary literacy subjects to cowl before a student gets their hands on a real paycheck from an actual job. Banking is tremendous essential in any adult’s life, which is why I created a whole article round free banking worksheets for kids and teens to learn banking expertise.

As teens method maturity, points like automotive and private insurance, paying premiums, and getting ready for the lengthy run turn into more essential. These assets will assist youngsters and youths make informed selections and get essentially the most out of the cash they’ve labored so exhausting to earn, save, and make investments.

Generally, folks use savings for short-term monetary targets corresponding to a trip or a down cost on a car. They usually put their savings in financial. Beginning with their monetary objectives and exploring the differences between saving for unexpected bills, saving to invest, saving for a automobile, and so forth.

[ssba-buttons]