chief man sitting at table and artful affairs Getty Images

The United States assets tax arrangement operates on a pay-as-you-go basis, with taxes due periodically throughout the year as you accept income, alike admitting you book a tax acknowledgment alone already anniversary year. Back you’re working, your employer withholds assets taxes from your paycheck and sends it to the IRS on your behalf. For best people, that takes affliction of the alternate acquittal requirement. But back you retire, it’s about up to you to accomplish abiding Uncle Sam gets his cut from your Social Security allowances and taxable retirement annual distributions.

You accept two means to amuse the year-round tax acquittal obligation for retirement income. Taxes can be withheld from your allowances and distributions, or you can accomplish estimated tax payments to the IRS. You can mix and bout if you want, but aloof accomplish abiding you pay abundant during the year to abstain an IRS underpayment penalty. There’s no amends if you owe beneath than $1,000 in tax back you book your return. You’ll additionally abstain the amends if your denial and estimated tax payments according at atomic 90% of your tax accountability for the year, 100% of the tax apparent on your tax acknowledgment for the antecedent year, or 110% of the tax apparent on the antecedent year’s acknowledgment if your adapted gross assets for that year was added than $150,000.

If you accept alternate payments from a 401(k) plan, alimony or acceptable IRA, assets taxes are automatically withheld from those payments as if they were wages. (Periodic payments are fabricated at approved intervals for at atomic one year.) You can, however, acclimatize the bulk of tax that is withheld, or cut off denial altogether, by commutual IRS Anatomy W-4P and giving it to the payer. But you about can’t appeal aught denial for payments beatific alfresco the U.S. and its territories.

For nonperiodic payments from pensions or retirement accounts, 10% is automatically withheld from the taxable allocation of the acquittal unless you appeal a altered allotment application Anatomy W-4R. (Again, accord it to the plan, alimony or IRA custodian.) Denial about can’t dip beneath 10% for nonperiodic payments beatific abroad.

Story continues

There’s a appropriate aphorism for 401(k) or alimony plan distributions paid anon to you if the acquittal is acceptable for a tax-free rollover to an IRA or added acceptable retirement plan. In that case, the plan ambassador charge abstain a collapsed 20% for taxes. You can abstain the 20% denial by accepting the money beatific anon to the rollover IRA or addition acceptable account. Taxes won’t be withheld from Roth annual distributions because those payments aren’t taxable.

When it comes to Social Security benefits, there’s no automated withholding. Instead, you charge appeal denial at a bulk of 7%, 10%, 12% or 22% by filing Anatomy W-4V if you appetite taxes paid upfront. But, again, don’t accelerate the anatomy to the IRS. Instead, mail it to your bounded Social Security office.

You can additionally pay estimated taxes anon to the IRS on a annual base application Anatomy 1040-ES. For the 2022 tax year, the aboriginal three payments are due April 18, June 15 and Sept. 15 of this year. The fourth acquittal is due Jan. 17, 2023. No final acquittal is bare if you book your 2022 tax acknowledgment by Jan. 31, 2023, and pay the absolute antithesis due with your return.

A worksheet in the instructions for Anatomy 1040-ES can advice you account the bulk of your estimated payments. If your aboriginal appraisal is too aerial or too low, artlessly abide addition Anatomy 1040-ES to acclimate after payments. You should additionally recalculate the acquittal bulk if your banking bearings changes — or the tax law does — and it affects your tax accountability for the year.

The IRS gives you abounding means to pay estimated taxes: check, cash, money order, acclaim agenda or debit card. There are several online acquittal options, too. For details, analysis the instructions for Anatomy 1040-ES.

Your accompaniment may appetite to aggregate taxes throughout the year, too. Analysis with your state’s tax bureau to apprentice about its denial and estimated tax acquittal requirements. Although some plan administrators and IRA custodians may be able to abstain accompaniment taxes for you, Social Security won’t accord you that option.

Why Now Might Be a Good Time to Sell Your Investment Real Estate

Your Guide to Roth Conversions

SECURE Act 2.0: 14 Means the Proposed Law Could Change Retirement Savings

There is a fundamental formula for estimating the taxes that have to be paid, however numerous tax components may trigger it to be incorrect, similar to dependents, tax deductions, or earnings from different sources. If you favor the previous model of the worksheets, you possibly can download them beneath. Once students have turn out to be acquainted with utilizing the worksheets, direct them to investigate documents as a category or in teams with out the worksheets, vocalizing the four steps as they go. These worksheets, together with all supporting documentation, ought to be submitted to the Responsible Entity or HUD Office that’s responsible for finishing the environmental review. These worksheets ought to be used provided that the Partner doesn’t have access to HEROS. View information on whether or not you might be eligible for HEROS entry.

If revenue varies a lot from month to month, use a median of the last twelve months, if out there, or final 12 months’s earnings tax return. When you load a workbook from a spreadsheet file, it goes to be loaded with all its existing worksheets . Move on to actions during which students use the primary sources as historical evidence, like on DocsTeach.org.

Past and present tips, stories, forms, instructions, worksheets, and different related assets. This interactive worksheet is offered for informational purposes solely. The person should independently verify that all entries and calculations generated by the interactive worksheet are appropriate before counting on its results or submitting it with a court docket. Resizing the current warehouse to dynamically improve or decrease the compute sources utilized for executing your queries and other DML statements.

If you’re in the center of operating queries, they may resume operating when the refresh is completed. Note that when you sign off of Snowflake, any active queries stop running. Specifying a different role for every worksheet and switching roles without dropping your work. You can execute particular statements in a worksheet, then switch roles before continuing your work in the same worksheet. Snowflake retains the static contents of each worksheet, so you can log in once more later and resume working the place you left off. Snowflake shows the worksheets that have been open when you logged out.

In the classroom setting, worksheets usually check with a loose sheet of paper with questions or workouts for school kids to finish and document solutions. They are used, to a point, in most topics, and have widespread use in the math curriculum where there are two main sorts. The first kind of math worksheet contains a group of comparable math issues or exercises. These are meant to assist a scholar become proficient in a specific mathematical talent that was taught to them in school.

The worksheet may be integrated into the filing package, or could solely be a device for the filer to figure out the value, but with out requiring the worksheet to be filed. Overall, research in early childhood training shows that worksheets are really helpful mainly for assessment purposes. Worksheets should not be used for instructing as this isn’t developmentally applicable for the education of young students. Worksheets are necessary as a outcome of these are individual activities and oldsters additionally need it. With evolving curricula, mother and father could not have the necessary education to guide their college students via homework or present further help at residence.

These are often known as columnar pads, and usually green-tinted. A worksheet, in the word’s authentic meaning, is a sheet of paper on which one performs work. They are obtainable in many varieties, most commonly related to children’s college work assignments, tax forms, and accounting or other enterprise environments. Software is increasingly taking up the paper-based worksheet.

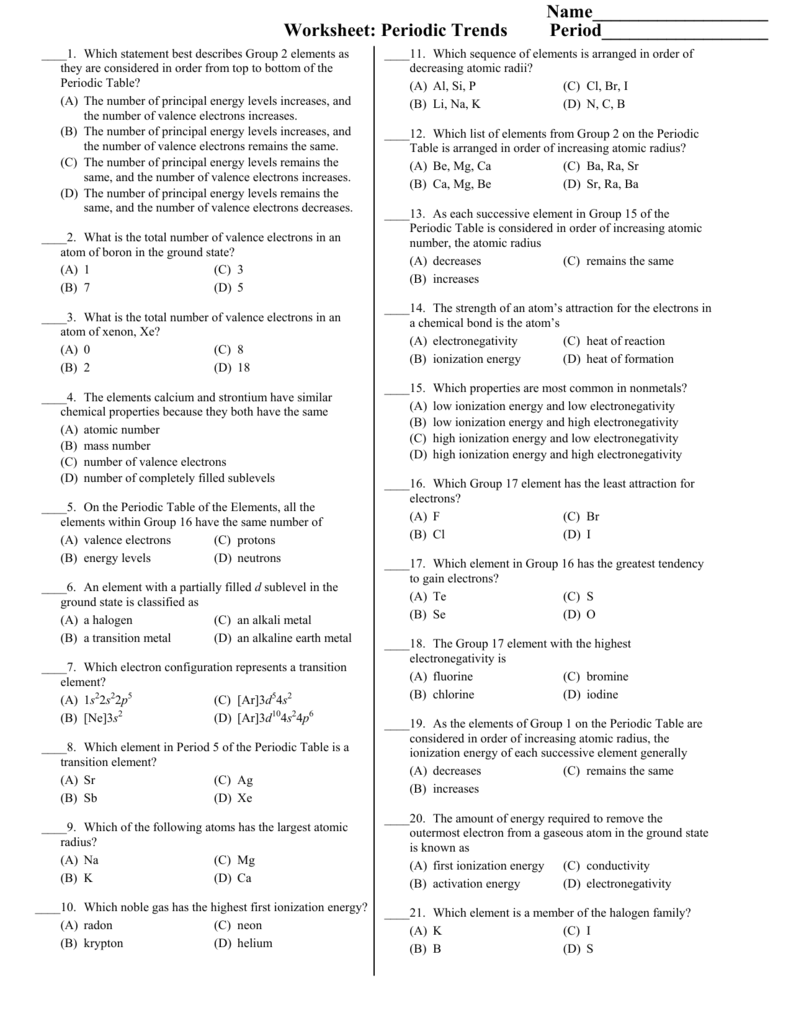

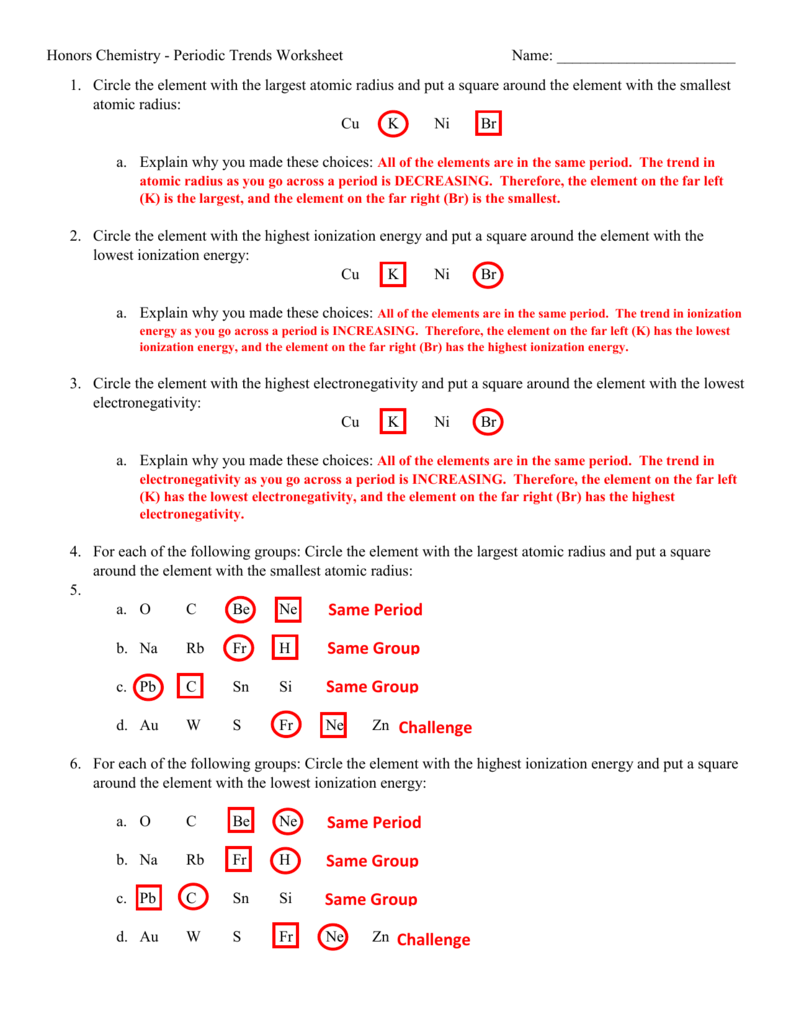

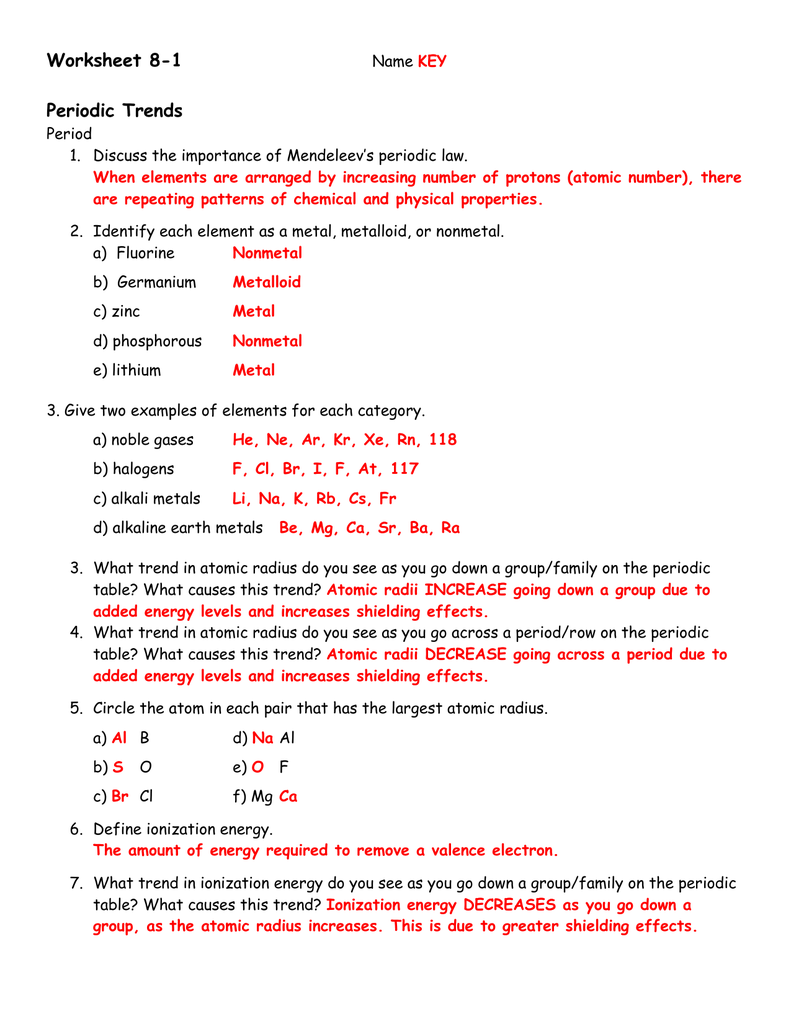

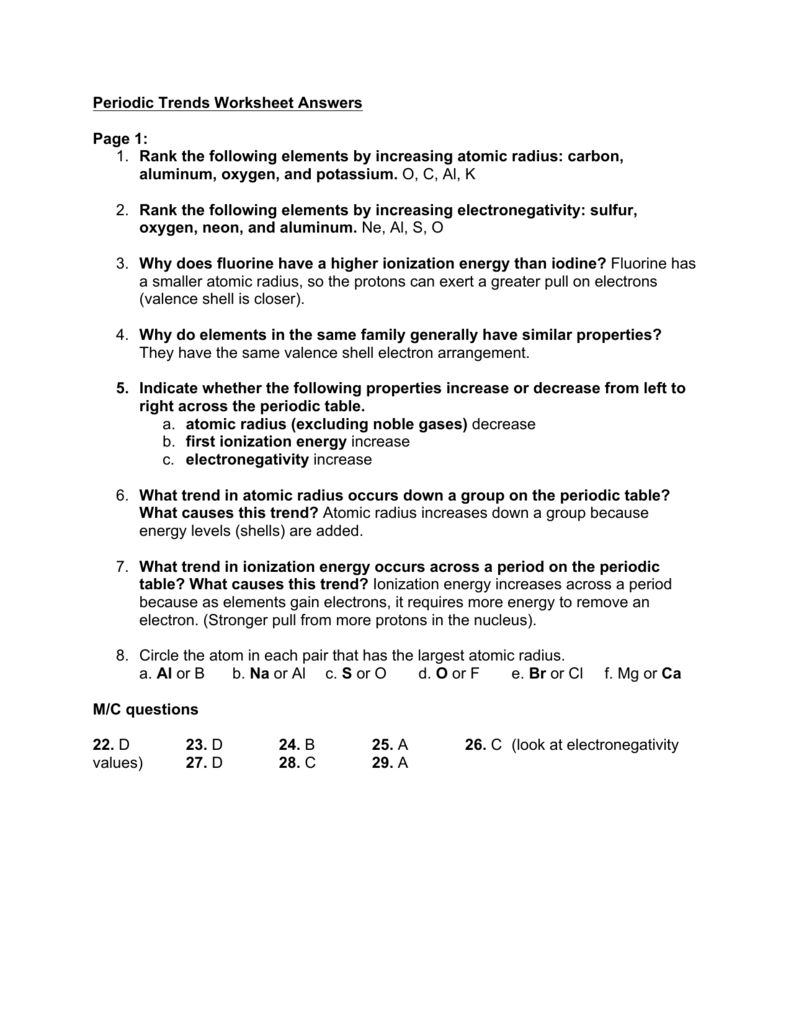

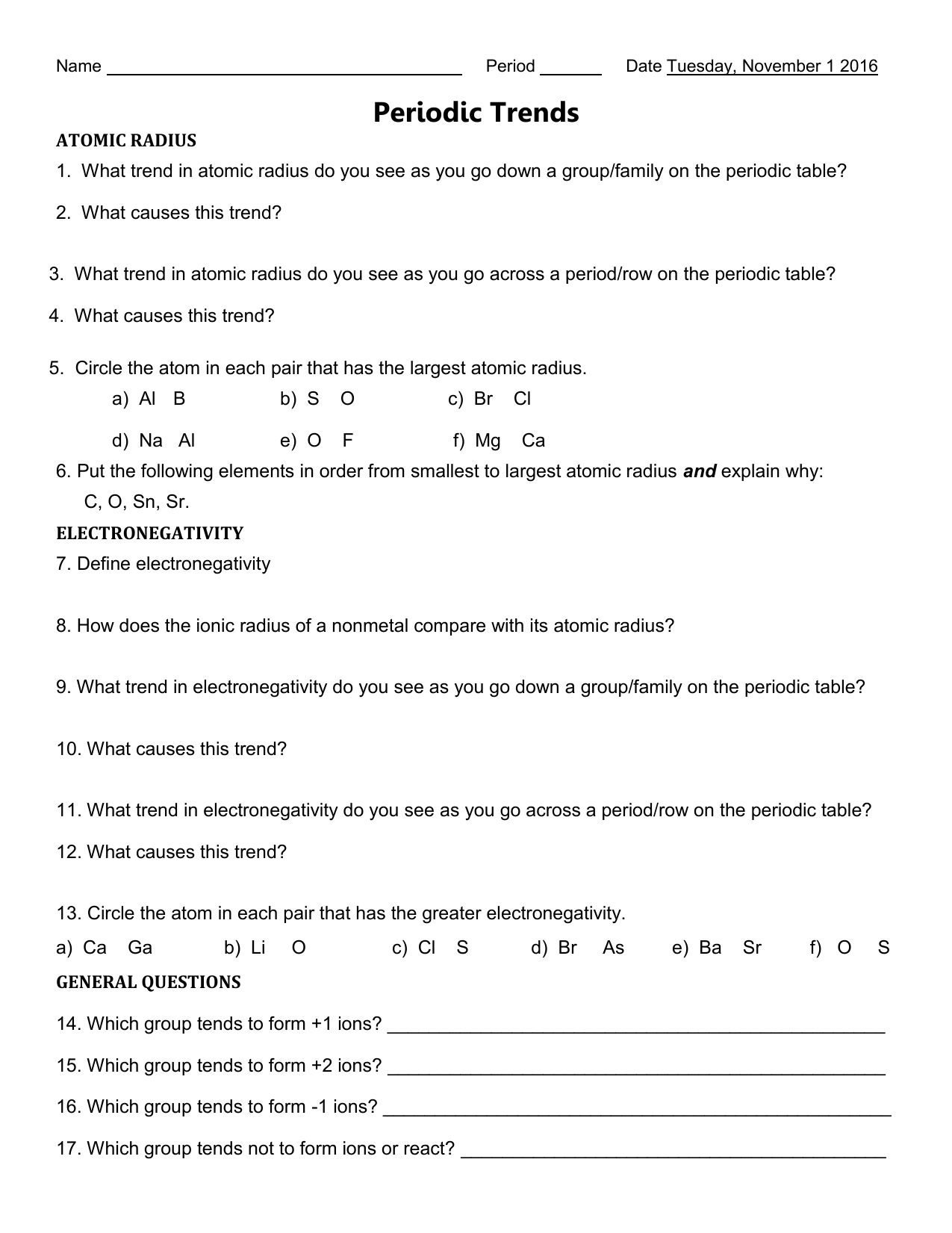

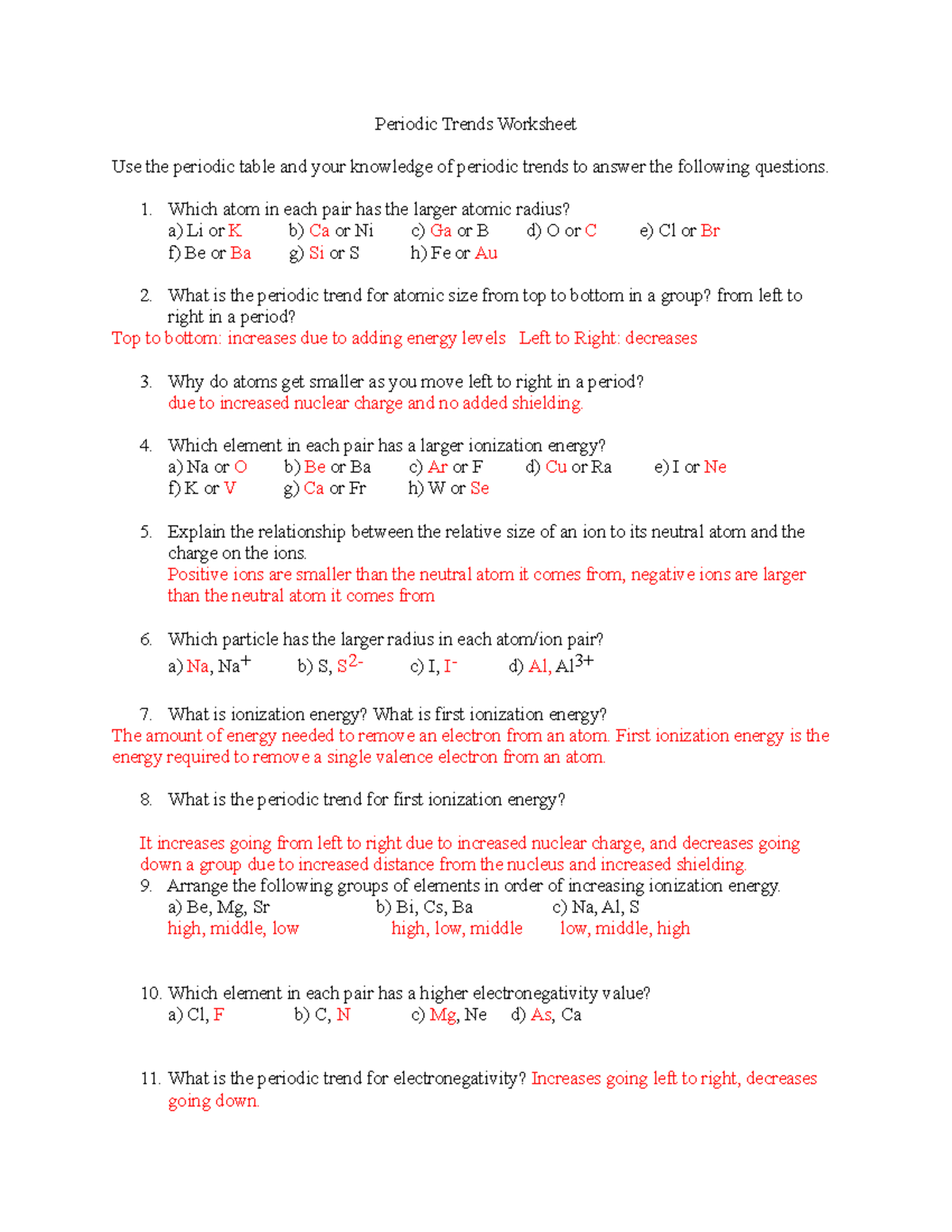

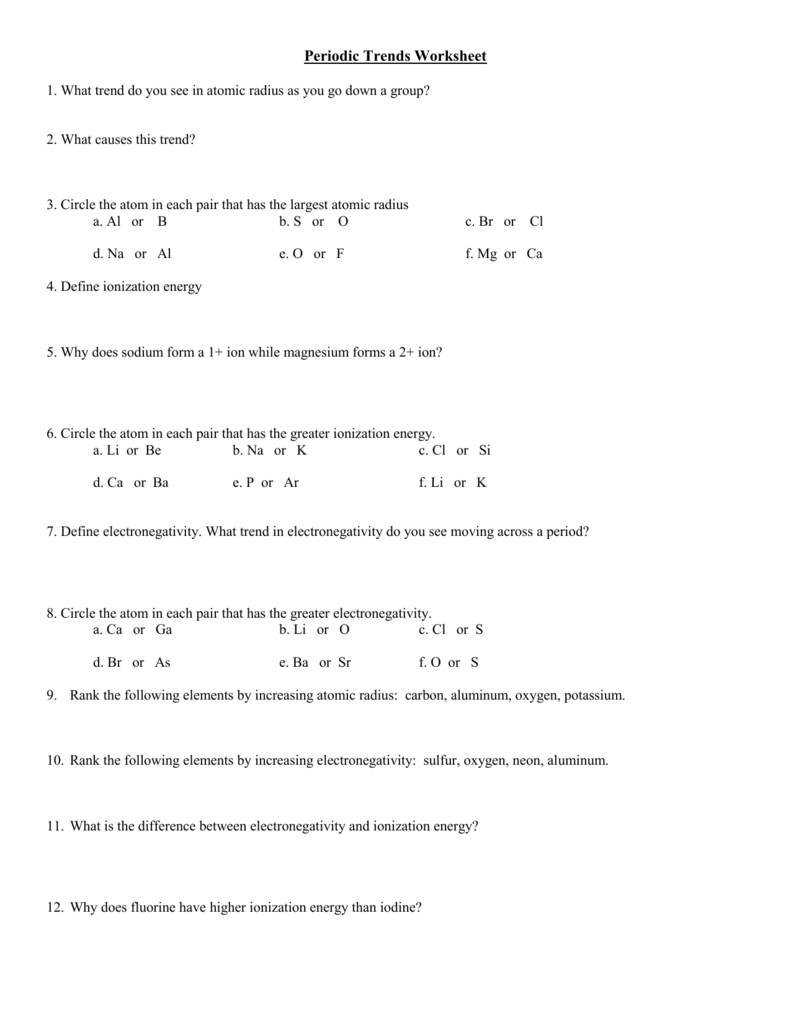

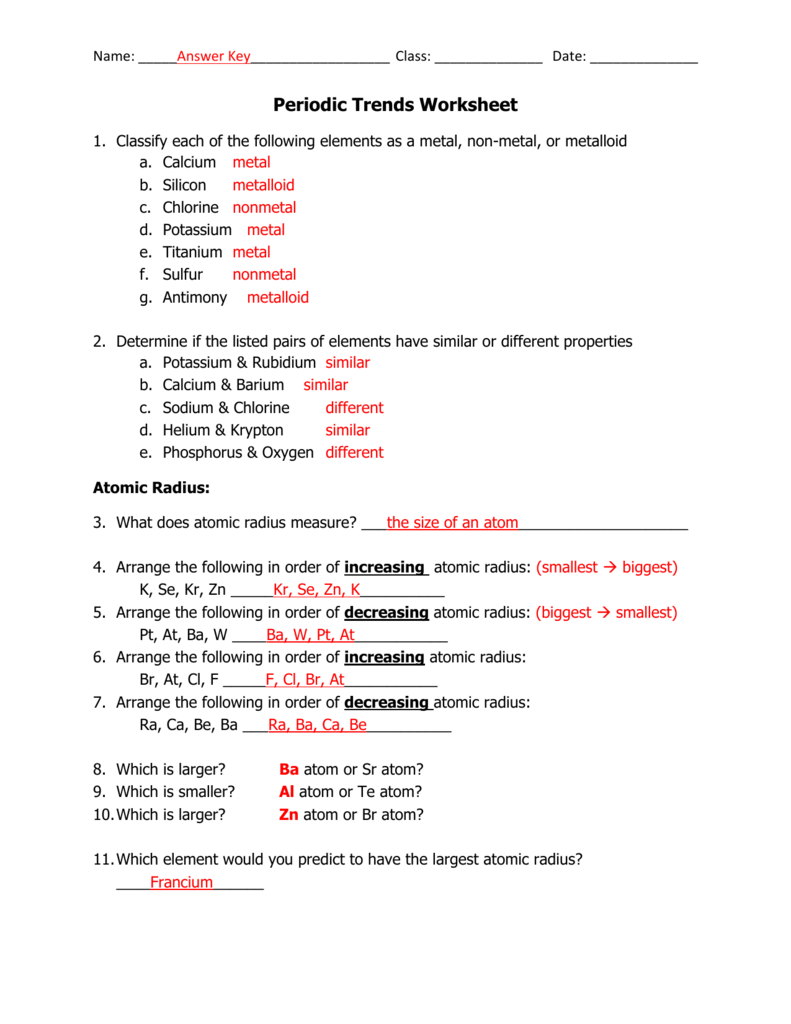

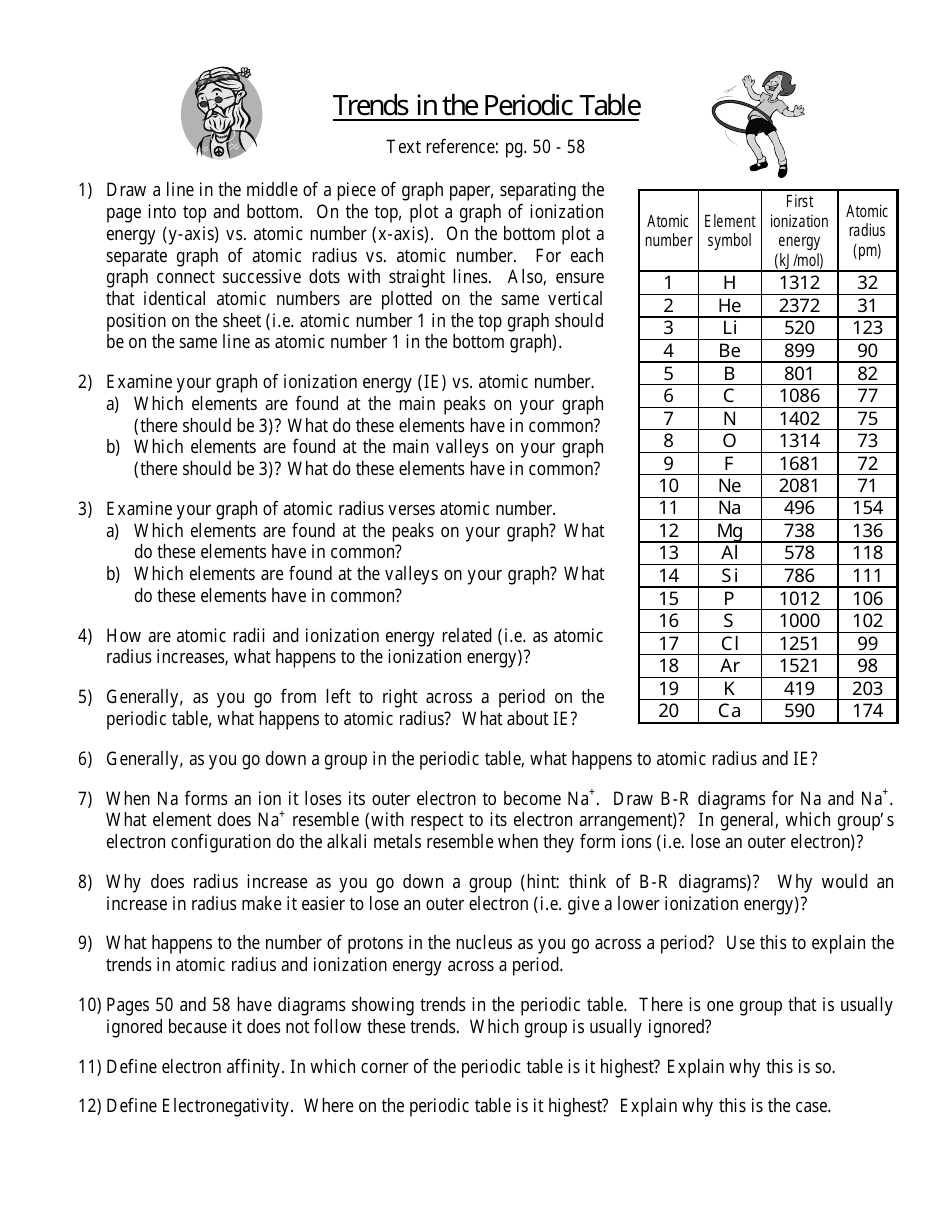

Diy Worksheet Periodic Trends Answers

Sample Worksheet Periodic Trends Answers. If you want to get all of these incredible photos about Worksheet Periodic Trends Answers, just click save link to download the shots in your computer. These are prepared for transfer, If you love and wish to get it, just click keep symbol on the page, and it will be instantly saved in your desktop computer. Finally If you wish to obtain unique and recent picture related to Worksheet Periodic Trends Answers, occupy follow us on google benefit or bookmark this website, we attempt our best to come up with the money for you regular up grade next fresh and new pics. Hope you enjoy staying right here. For many updates and latest news more or less Worksheet Periodic Trends Answers shots, divert lovingly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark area, We try to present you up grade regularly next fresh and new graphics, love your browsing, and locate the right for you.

This article will help you get conversant in the concept of a worksheet and its options. It’s easy to add extra aptitude and character to your projects with Adobe Spark’s unique design assets. Add animated stickers from GIPHY or apply a text animation for short-form graphic movies in a single tap.

Cick and drag using the mouse left button or the touchpad. Click the context menu to pick a special lively warehouse for the worksheet. You can resume or suspend the selected warehouse, or resize the warehouse. The object browser enables users to explore all databases, schemas, tables, and views accessible by the position chosen for a worksheet.If you are looking for Worksheet Periodic Trends Answers, you’ve come to the right place. We have some images practically Worksheet Periodic Trends Answers including images, pictures, photos, wallpapers, and more. In these page, we after that have variety of images available. Such as png, jpg, vivacious gifs, pic art, logo, black and white, transparent, etc.

[ssba-buttons]